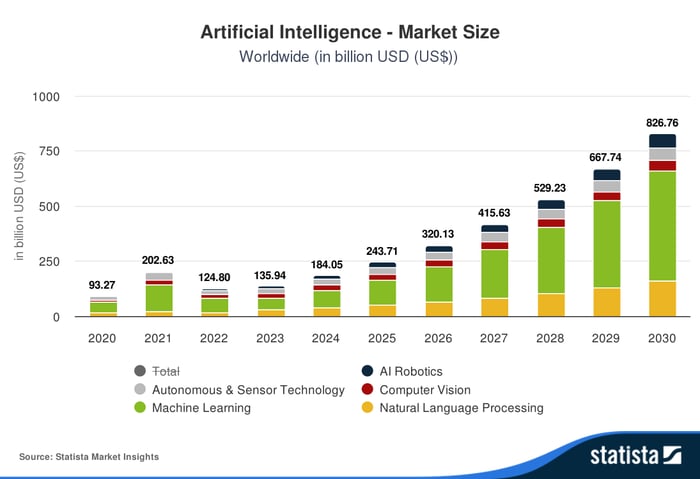

The bull market on Wall Street persists, aided by shares like Nvidia and Microsoft, that are posting super outcomes on the again of the substitute intelligence (AI) increase. Knowing when to take a position with the market close to all-time highs is tough. Many individuals really feel the bull market will proceed with a perceived business-friendly incoming administration and Big Tech investments in AI. These firms are forecast to pour $250 billion into capital expenditures subsequent yr alone. And, as proven beneath, income from AI may exceed $820 billion by 2030.

Chart by Statista.

This does not imply shares will proceed rising; there are all the time dangers. I’ll focus on shopping for methods in a bull market beneath. But first, listed here are two very totally different firms that might every present wonderful long-term returns.

Dell’s huge knowledge middle alternative

The variety of hyperscale knowledge facilities (these over 100,000 sq. ft) eclipsed 1,000 this yr, and the forecast is for a minimum of 120 to return on-line yearly for the foreseeable future. These huge facilities, some over 1 million sq. ft, want infrastructure like servers. Dell (DELL 2.58%) is a market chief on this space. Dell’s Infrastructure Solutions Group recorded document income final quarter, $11.6 billion, with 38% progress. The firm’s whole gross sales elevated 9% to $25 billion for the quarter.

Dell believes its addressable market in AI will likely be $124 billion and its whole infrastructure market $265 billion by 2027. Recent developments at its competitor Super Micro Computer doubtless imply Dell will seize much more of this market than beforehand anticipated. Supermicro is reeling from a brief report, delayed monetary filings, and the resignation of its auditors. Its public struggles ought to profit its competitors. As proof, analysts have been busy elevating their Dell value targets this month.

Wells Fargo raised its goal from $140 to $160 per share, whereas Morgan Stanley raised its goal from $136 to $154. The targets are 7% to 11% above the present value; nonetheless, if Dell continues to dominate the server market, analysts will doubtless elevate them once more. Shareholders additionally profit from a dividend and share buyback program that returned a mixed $1 billion final quarter. Dell expects to extend its dividend by 10% yearly by way of a minimum of fiscal 2028. The AI alternative, competitor struggles, and rising value targets make Dell a tempting inventory to personal for the following a number of years.

Amazon’s gigantic knowledge processing alternative

Moving from an organization that provides knowledge facilities to 1 that builds them results in Amazon (AMZN 1.04%). For occasion, development has begun on Amazon’s $11 billion knowledge middle in Indiana. These facilities are key to growing the processing and storage capability of Amazon Web Services (AWS).

Some individuals nonetheless consider Amazon as a product firm, however AWS is the straw that stirs Amazon’s drink. The section accounted for 60% of Amazon’s $60.5 billion working revenue during the last 12 months. It posted a particularly spectacular working margin of 38% final quarter in comparison with 5% for the opposite two segments mixed.

As proven beneath, Amazon’s working money stream exploded with lots of assist from AWS.

AMZN Cash from Operations (TTM) knowledge by YCharts

Amazon inventory trades beneath its five-year averages based mostly on gross sales, working money stream per share, and earnings, a rarity in right now’s record-setting market.

So, what’s the easiest way to put money into a raging bull market? Investing on the prime of a market is dangerous, but it surely’s vital to not attempt to time the market. Just as a result of the foremost indexes are close to all-time highs does not imply they cannot go increased. Here are two methods to mitigate danger.

First, think about dollar-cost averaging — accumulating shares over a number of months. This means that you can reap the benefits of declines within the inventory value and limits the chance of shopping for at a market prime. Or, think about a “buy-the-dip” technique. The market continuously experiences corrections (declines larger than 10%); nonetheless, we have not skilled one in 2024, though there was one in 2023, 4 in 2022, and 5 in 2020. However you select to take a position, think about Dell and Amazon for a chunk of the AI market.

Wells Fargo is an promoting companion of Motley Fool Money. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of administrators. Bradley Guichard has positions in Amazon and Dell Technologies. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure coverage.