Last Updated:

The greatest concern with the non-public cryptocurrencies like Bitcoin and Ethereum is that they don’t have any underlying worth, says RBI governor Shaktikanta Das

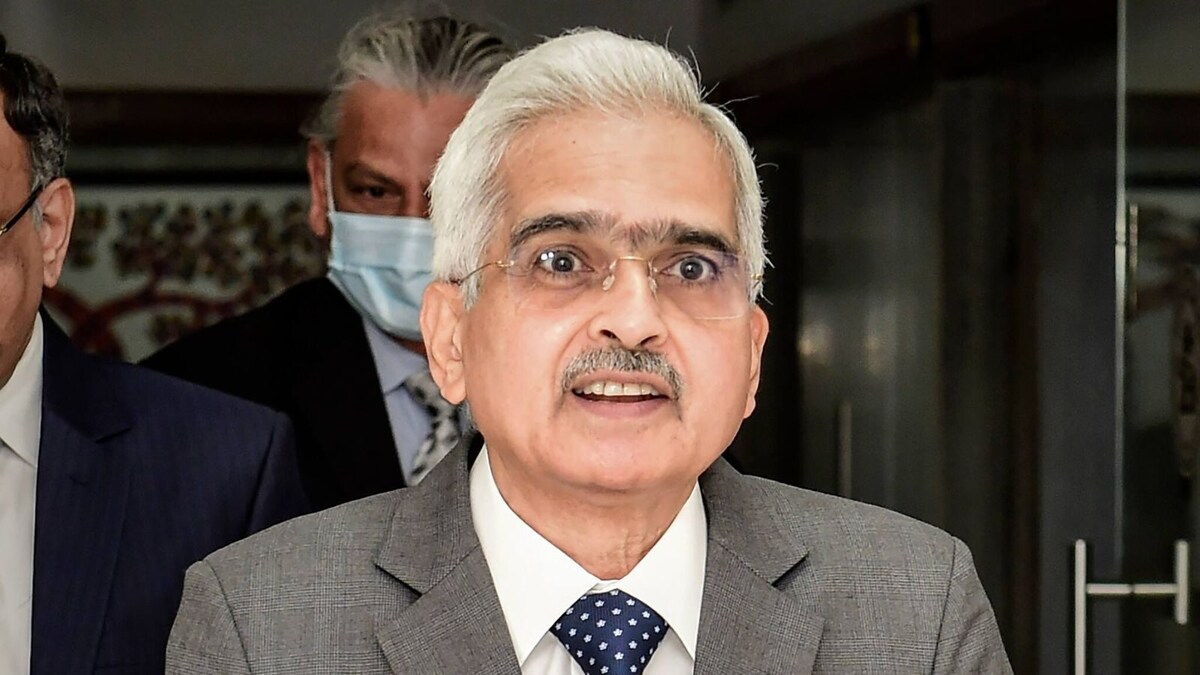

RBI Governor Shaktikanta Das. (File Photo: PTI)

RBI Governor Shaktikanta Das on Wednesday mentioned the most important concern with the non-public cryptocurrencies like Bitcoin and Ethereum is that they don’t have any underlying worth, and if they’re allowed to develop, the subsequent monetary disaster will come from them. He additionally mentioned these property needs to be prohibited.

Speaking on the BFSI Insight Summit 2022 hosted by Business Standard, he mentioned, “Cryptocurrencies owe their origin to bypass the system, break the system, and so they don’t consider in laws… I’m but to listen to any good argument about what good public function it serves. It’s a 100 per cent speculative exercise and needs to be prohibited. If you enable it to develop, the subsequent monetary disaster will come from non-public cryptocurrencies.”

Das has up to now additionally come down closely upon cryptocurrencies. He earlier additionally mentioned these digital property can create quite a lot of monetary instability when it comes to the flexibility of the central financial institution to find out financial coverage.

On requested how central financial institution digital foreign money (CBDC), or digital rupee, is completely different from present digital fee methods, Das on Wednesday mentioned UPI is a fee system whereas CBDC is a foreign money itself. He additionally mentioned UPI includes the intermediation of banks whereas CBDC is sort of a paper foreign money that will get settled between these doing transactions, and there’s an automated sweep-in and sweep-out facility. Digital rupee can even save prices on printing paper currencies. There can be prompt switch.

Earlier this month, the RBI launched India’s digital foreign money on a pilot foundation. CBDC is a digital type of fiat foreign money issued by the central financial institution and cryptocurrencies are digital property on a decentralized community, away from any authorities or central financial institution’s chains. The digital foreign money would be the identical as a sovereign foreign money and exchangeable at par with the present foreign money. On the opposite hand, cryptocurrency is a type of foreign money that has its personal denomination and makes use of cryptography to safe transactions.

“24 hours, you may draw CBDC. And if you’re carrying extra CBDC, you may deposit it within the financial institution,” the RBI governor mentioned.

On the impression of US Federal Reserve’s impression on India’s financial coverage, Das mentioned although the US is a significant participant, India’s financial coverage is primarily ruled by its home elements.

He additionally highlighted the accuracy of the GDP progress projection for the September 2022 quarter of 6.3 per cent and inflation for the November projection. Das mentioned the RBI is refining its inflation and progress projection fashions.

Read all of the Latest Business News right here