Last Updated:

The rise of digital gold is creating new funding avenues.

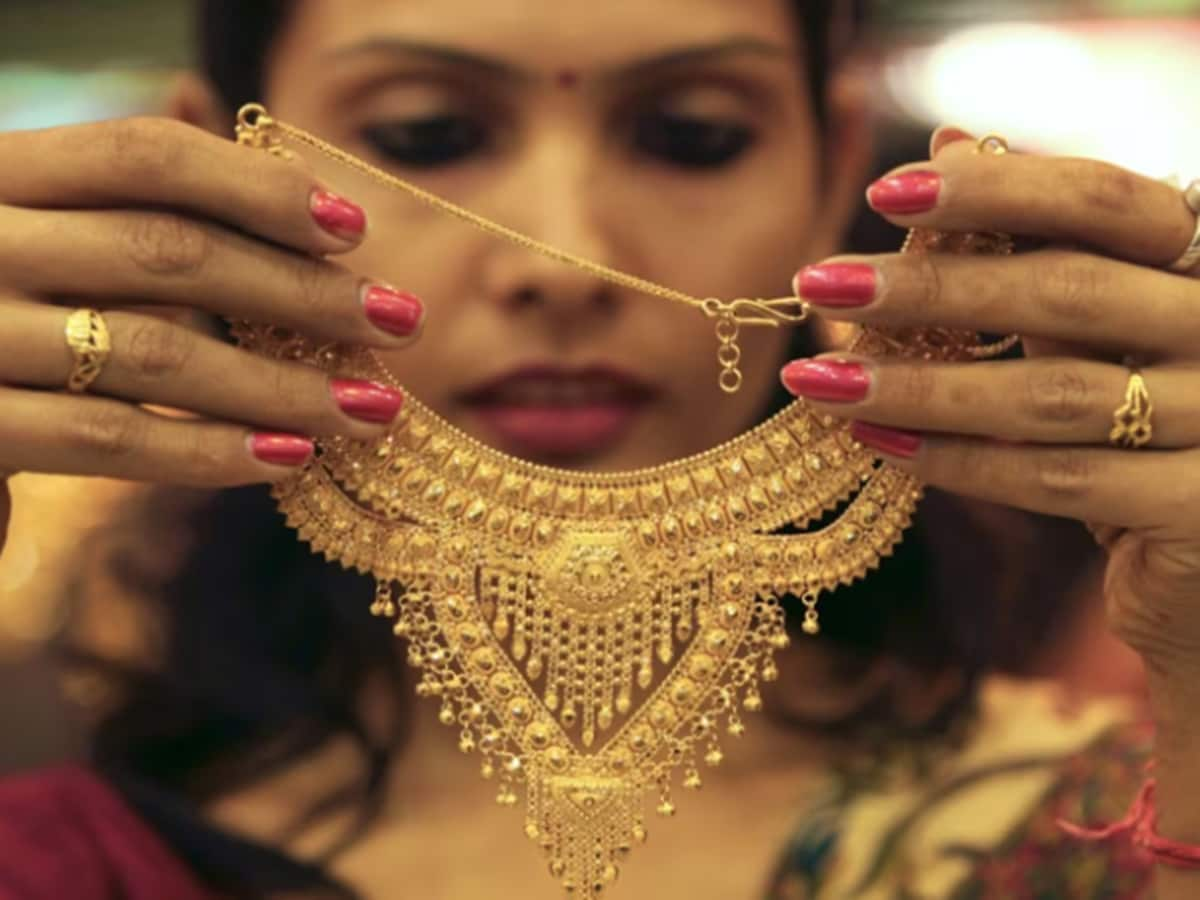

Dhanteras 2024: Physical Gold, ETFs, or Digital Gold, Know Which Is The Right Choice For Your Portfolio

In India, gold is excess of a commodity—it’s an emblem of wealth, safety, and custom. Amid international financial shifts and evolving funding landscapes, gold stays a well-liked alternative, however trendy traders now have options beyond physical gold. With selections like Gold ETFs and digital gold gaining traction, traders are actually evaluating which type aligns greatest with their monetary objectives and life. Mayank Bhatnagar, Co-founder and COO of FinEdge provides insights into the strengths and challenges of every choice, serving to traders make knowledgeable selections that stability custom with innovation.

(Dhanteras 2024 Best Time To Buy Gold)

Tangibility and Tradition of Physical Gold vs. the Efficiency of Gold ETFs

Bhatnagar emphasises that bodily gold holds important emotional and conventional worth for Indians, typically chosen for cultural causes and a way of tangible possession. However, these advantages include sensible drawbacks. Storage prices, restricted liquidity, and dangers of theft or loss make it much less enticing purely from an funding perspective.

In distinction, gold ETFs supply a digital strategy. Bhatnagar highlights their ease of liquidity, transparency, and tax effectivity. “ETFs get rid of storage issues and supply a seamless option to embody gold in an asset allocation technique,” he says.

Unlike bodily gold, nevertheless, ETFs lack conventional attraction and would possibly incur minor brokerage charges, although these prices are usually decrease than storage bills for bodily gold.

Digital Gold – A Modern Investment Frontier

Digital gold has change into an more and more well-liked different, providing quick access and adaptability by way of on-line platforms while not having a demat account.

Bhatnagar factors out that digital gold combines the accessibility of ETFs with decrease limitations to entry, making it supreme for brand spanking new traders. “Digital gold is secure attributable to regulatory oversight and doesn’t require a demat account, in contrast to ETFs. However, ETFs supply increased liquidity and are less expensive,” he notes.

While digital gold supplies distinctive benefits, Bhatnagar cautions that it’s important to do not forget that gold, as an asset class, won’t align with long-term monetary objectives. Instead, he advises a well-rounded funding plan to make sure returns that safe wealth over time.

The Future of Gold Investments: Can Digital Gold Compete?

According to Bhatnagar, the rise of digital gold is creating new funding avenues. However, bodily gold’s cultural and emotional significance in India is irreplaceable. ETFs, in the meantime, stay a trusted alternative for these looking for an economical, regulated option to incorporate gold into their portfolio. Bhatnagar believes that digital gold will complement quite than exchange conventional kinds, providing an accessible different for a extra diversified strategy.

Opportunities and Challenges for NRIs in Gold Investments

Gold investments present NRIs with a diversified hedge towards inflation, foreign money fluctuations, and international uncertainties. Bhatnagar factors out that NRIs can profit from the straightforward accessibility of gold ETFs for regulated market publicity or digital gold’s comfort with out the trouble of bodily storage. However, he emphasises the significance of aligning gold investments with monetary targets quite than market tendencies, noting that “gold is ideally suited as a hedge, however not as a major funding.”

Navigating Taxation Policies on Gold Investments

The 2024 Budget launched crucial modifications for gold investments. Bhatnagar highlights that the long-term capital beneficial properties (LTCG) holding interval for gold has been decreased from 36 to 24 months, with the LTCG tax fee revised to 12.5% (with out indexation advantages). For NRIs, taxation stays a key consideration, with a flat 30% TDS on capital beneficial properties. However, this may be reclaimed as a tax refund throughout annual filings, including some flexibility for non-resident traders.

The alternative between bodily gold, gold ETFs, and digital gold in the end relies on particular person priorities—whether or not it’s the emotional connection to bodily gold, the regulatory safety of ETFs, or the accessibility of digital gold. As Bhatnagar advises, a balanced funding technique is essential, making certain that each asset contributes meaningfully to long-term objectives and wealth creation.

Disclaimer: The views and funding ideas by consultants on this News18.com report are their very own and never these of the web site or its administration. Readers are suggested to examine with licensed consultants earlier than making any funding selections.