- Dormant XRP tokens reactivated, boosting liquidity and fueling renewed investor confidence.

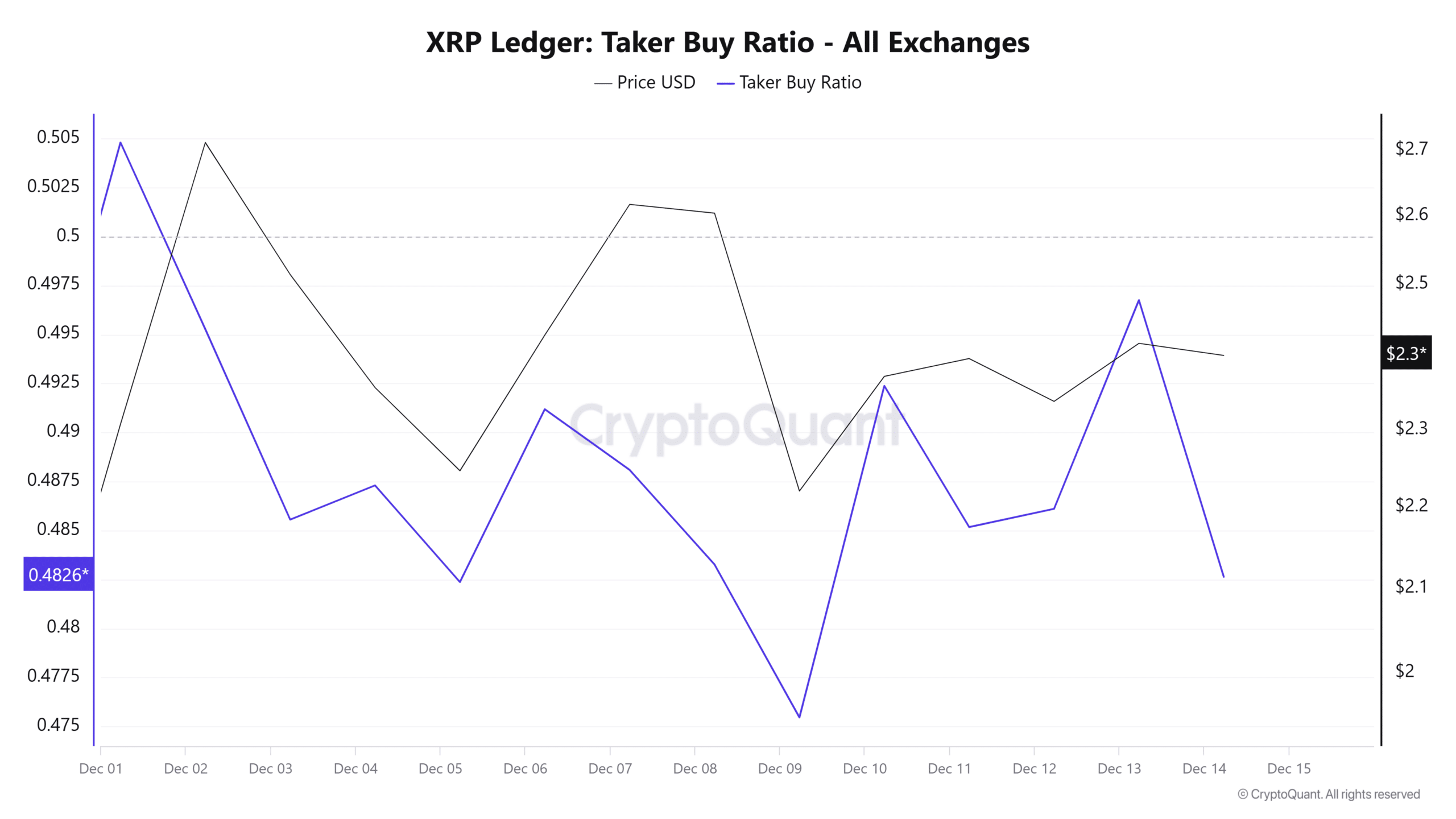

- Rising taker purchase ratio displays rising bullish dominance in XRP’s derivatives market.

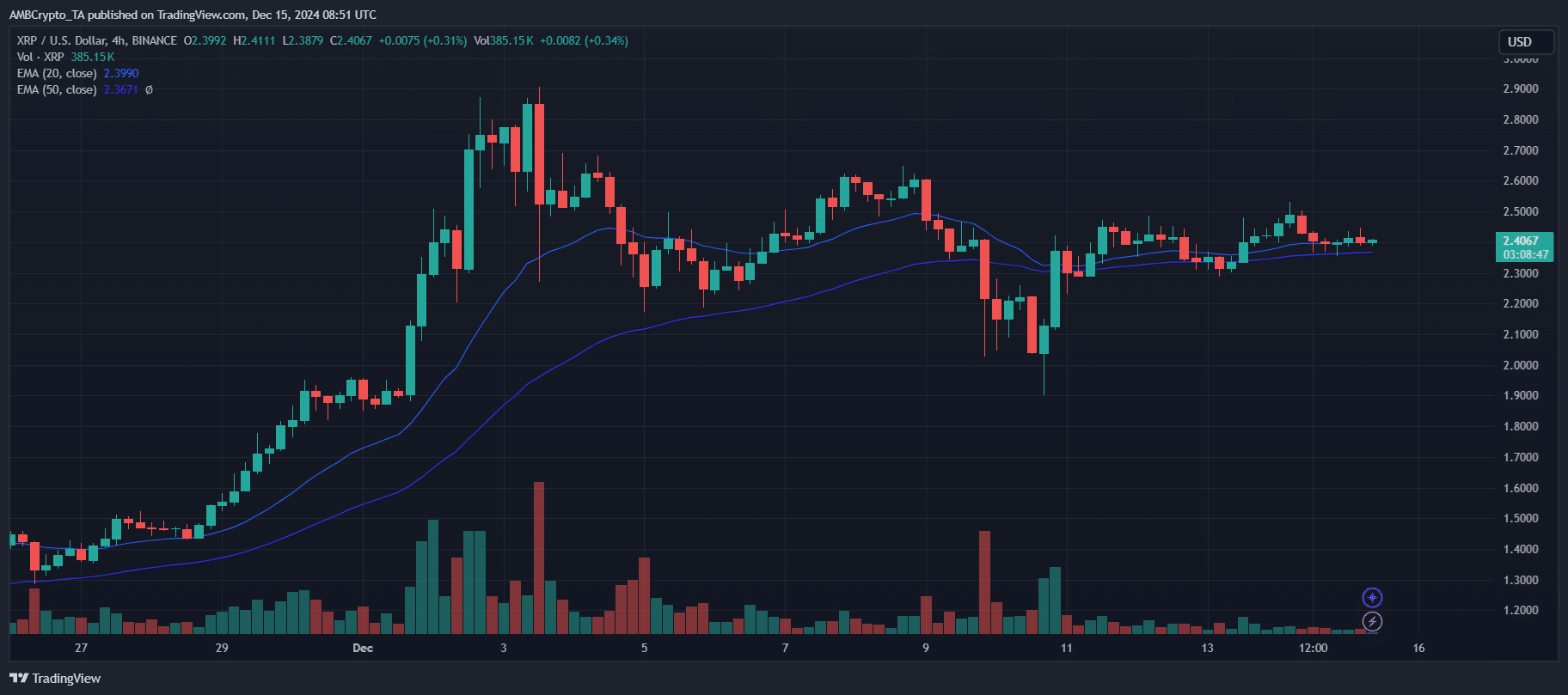

On the tenth of December, Ripple’s [XRP] worth briefly slipped under $2, fueling hypothesis that its prolonged uptrend is perhaps working out of steam.

However, the swift 8% rebound over the previous 24 hours has reignited optimism.

Beyond the floor, under-the-radar indicators level to XRP’s rally having extra room to develop, signaling that its bullish momentum could also be removed from over. Here’s what might drive XRP increased.

Dormant XRP tokens are on the transfer

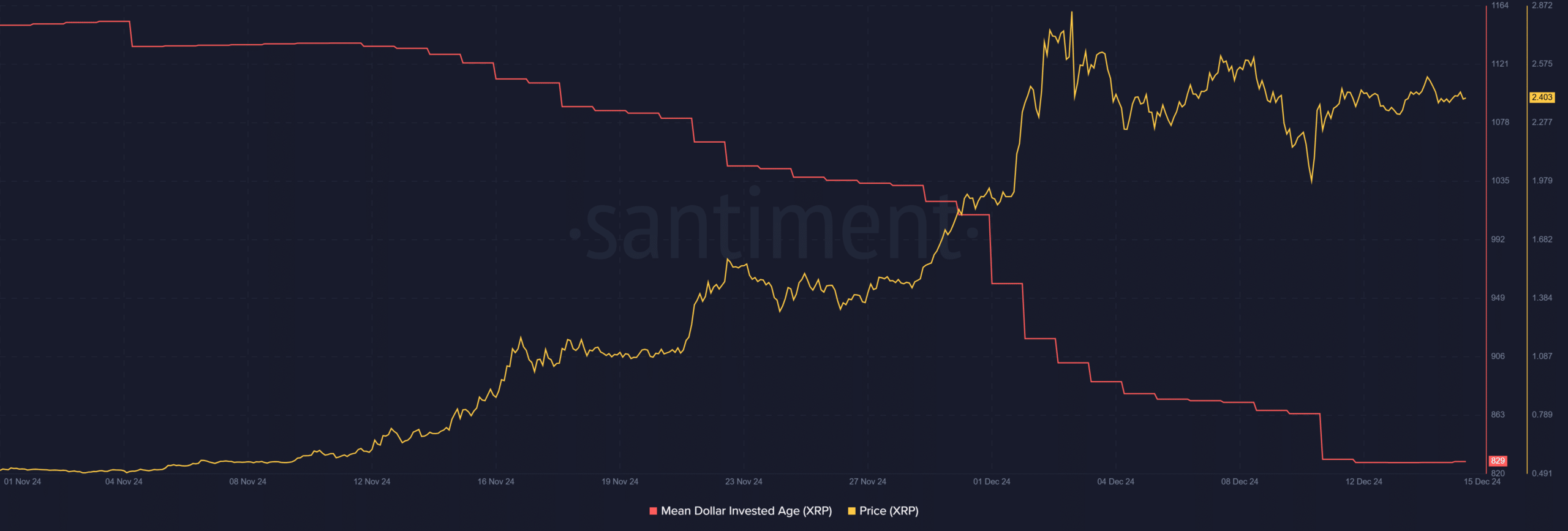

The Mean Dollar Invested Age (MDIA) for XRP has sharply declined, signaling important on-chain exercise.

Historically, a low MDIA displays the reactivation of beforehand dormant tokens, usually suggesting renewed investor confidence.

In distinction, a rising MDIA implies stagnation, as cash held by long-term stakeholders stay untouched, capping upside potential.

Source: Santiment

Currently, XRP’s MDIA has dropped to its lowest degree since early November.

This downward shift signifies that long-inactive tokens are re-entering circulation, boosting liquidity and buying and selling volumes — each essential drivers for sustained worth momentum.

The recirculation of dormant belongings usually coincides with bullish phases, as contemporary buying and selling exercise means that each retail and bigger stakeholders are capitalizing on worth actions.

Combined with XRP’s swift worth rebound, the falling MDIA underscores rising market participation and strengthens the case for XRP’s bullish outlook.

If this development persists, XRP might preserve its upward trajectory.