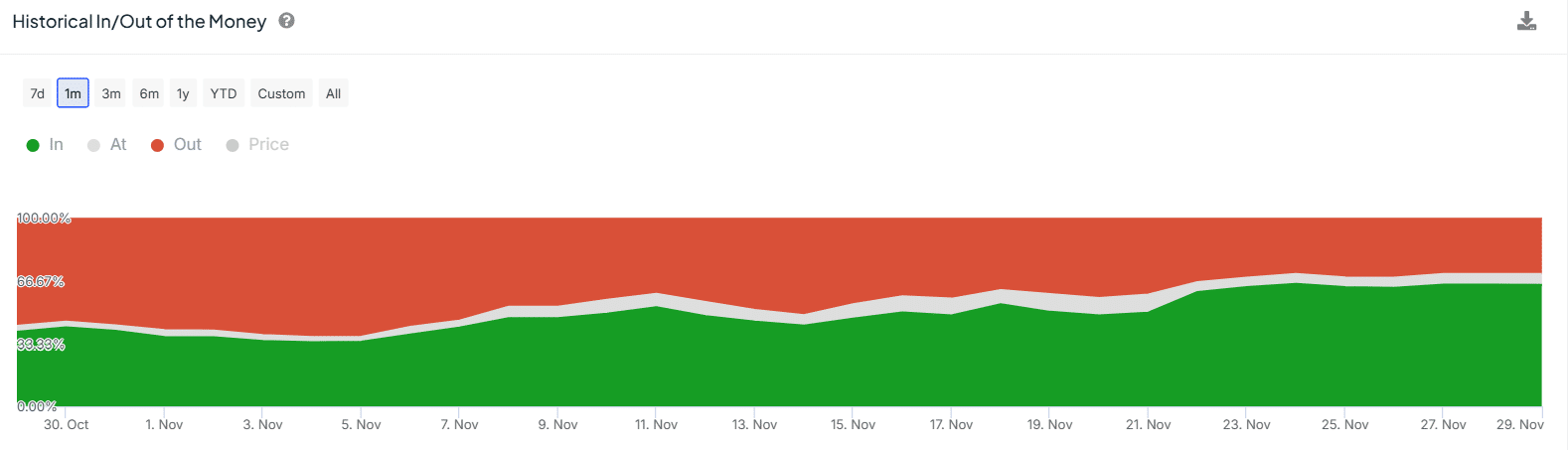

- Chainlink’s alternate provide ratio progressively rose to a one-month excessive as pockets profitability climbed

- Open curiosity surged to its highest degree since April too

November delivered vital positive aspects for many altcoins, together with Chainlink (LINK), with the crypto buying and selling at $18.63 at press time. In reality, after gaining by round 5% within the final 24 hours alone, LINK’s month-to-month positive aspects have now surpassed 52% on the charts.

These positive aspects appear to have stirred profit-taking actions, with the identical highlighted by the rising alternate provide ratio. Data from CryptoQuant revealed a gradual uptick on this metric to a month-to-month excessive of 0.161.

(Source: CryptoQuant)

When this ratio rises, it factors to a rise in LINK tokens being despatched to exchanges – An indication of rising sell-side strain. This could be a bearish signal, particularly if there is no such thing as a uptick in shopping for exercise to soak up the bought cash.

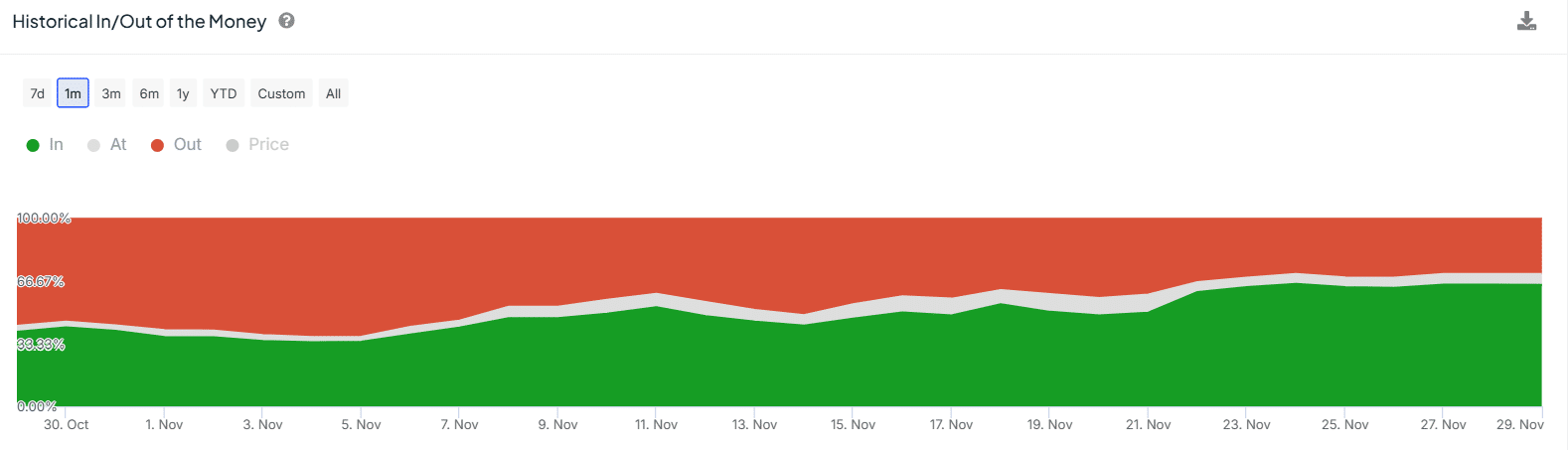

Here, it’s value mentioning that the hike within the alternate provide ratio coincided with rising pockets profitability. According to IntoTheBlock, 64% of LINK holders are actually in revenue – A big bounce from 36% in direction of the start of November.

At the identical time, wallets in losses dropped from 59% to 29%.

(Source: IntoTheBlock)

Rising pockets profitability can be good for the value as it might result in constructive market sentiment.

However, for LINK to proceed its uptrend, it wants a surge in shopping for exercise.

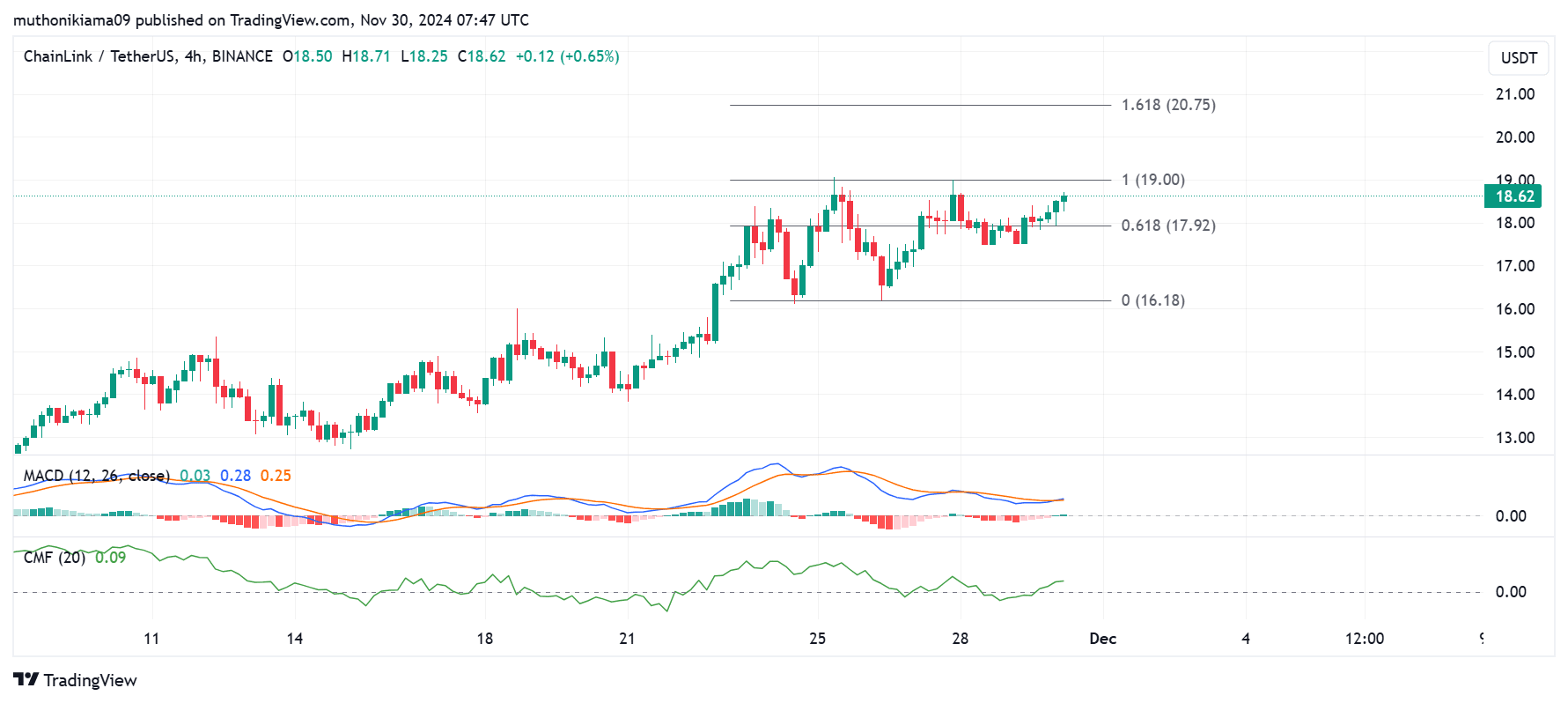

Chainlink value evaluation – Are consumers lively?

Chainlink’s four-hour chart revealed that purchasing strain has been better than the promoting strain. This was evidenced by the Chaikin Money Flow (CMF) indicator which had a constructive worth of 0.02. The CMF was additionally tipping north, suggesting that extra consumers have entered the market not too long ago.

The Moving Average Convergence Divergence (MACD) line additionally created a purchase sign after crossing above the Signal line. If the MACD line continues to development above the Signal line, it may strengthen the altcoin’s bullish development.

(Source: Tradingview)

If consumers handle to push LINK previous the resistance degree at $19, the token may intention for $20.75. However, Chainlink has been rejected at this help degree a number of instances, with extra shopping for volumes wanted to help a breakout.

At press time, the variety of lively addresses recommended that purchasing volumes had been low. According to IntoTheBlock, these addresses dropped by almost 50% in a single week from 7,420 to 4,210. New addresses additionally declined from 2,650 to 1,530.

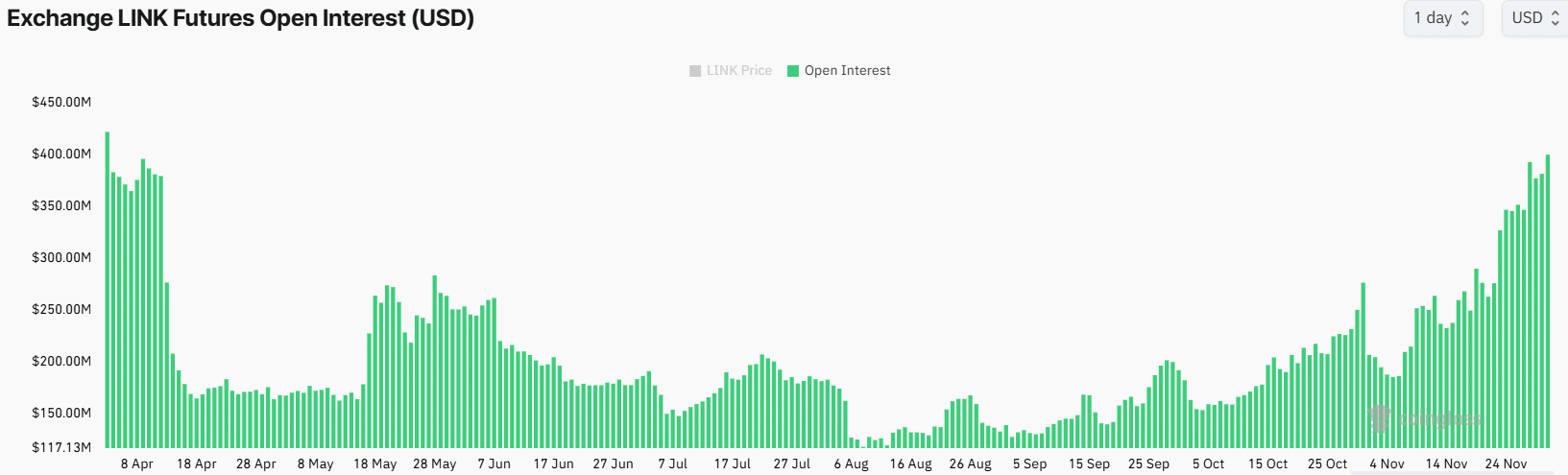

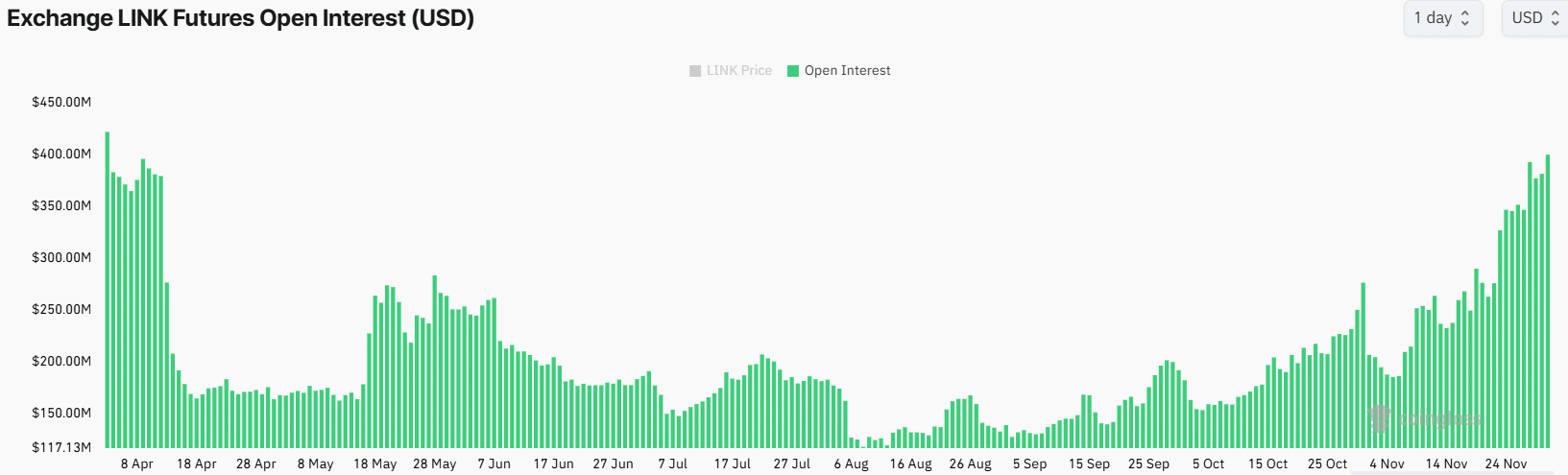

Open curiosity approaches 8-month excessive

On the derivatives market entrance too, Chainlink has seen a surge in exercise. In. reality, Open Interest (OI) climbed to its highest degree in additional than seven months.

(Source: Coinglass)

LINK’s OI, at press time, stood at $396M – An indication that by-product merchants are opening new positions on the altcoin.

Chainlink’s funding charges additionally surged, highlighting that many of the newly opened positions had been by lengthy merchants betting on extra positive aspects.