- Bitcoin has surged by 39.72% over the previous month.

- An analyst predicted a December rally to as much as $140k, citing historic performances.

After the U.S. presidential elections, Bitcoin [BTC] noticed an exponential surge, mountain climbing from a low of $66K to a brand new all-time excessive of $99,800.

However, since hitting this excessive, it has skilled a market correction, going again right down to $90,742. This elevated market volatility has left crypto analysts conflicted, with some optimistic over a surge previous $100k whereas others noticed a possible decline.

One of those optimistic analysts is the favored crypto analyst Ali Martinez, who has instructed a December rally, citing U.S. presidential elections.

Bitcoin’s historic efficiency

In his evaluation, Martinez posited that Bitcoin has traditionally surged in December after the U.S. presidential elections.

Source: X

According to him, BTC made important features within the final two cycles. As such, in 2020, BTC surged from a low of $17,570 to a excessive of $29,300, marking a 66.84% enhance.

In 2016, BTC elevated from $740 to a excessive of $981. This was a 32.56% enhance.

This historic sample reveals Bitcoin experiencing worth pumps in December following the U.S. presidential elections.

As such, if historical past is something to go by, we may see BTC make appreciable features all through the month. In this regard, Martinez predicted that the king coin may hit between $125,000 to $140, 000.

What the charts say

Although Bitcoin has retraced since hitting its present ATH, the king coin remained in a bullish part. As such, the prevailing situations simply level in direction of potential features on worth charts.

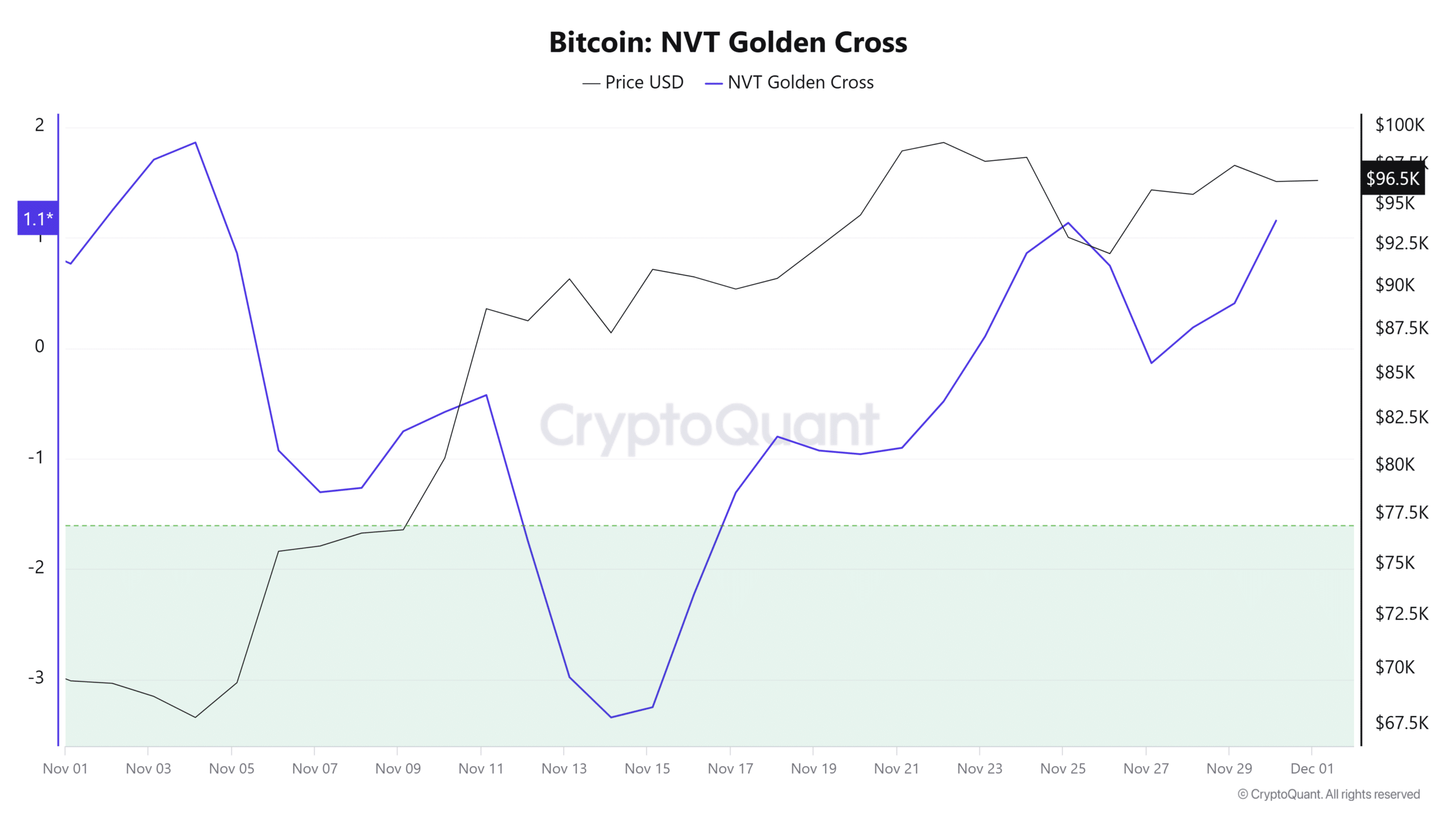

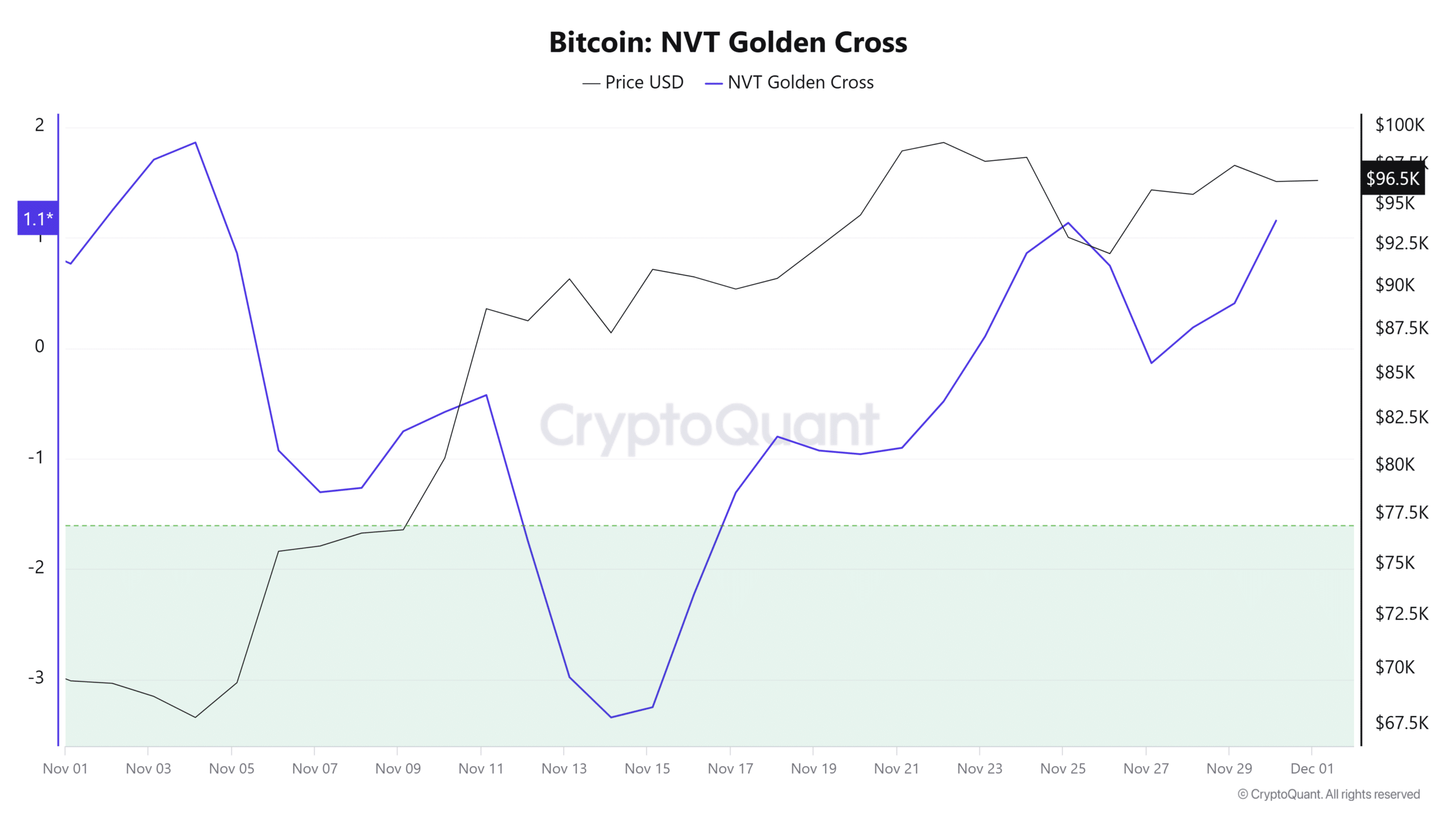

Source: Cryptoquant

For instance, the Bitcoin NVT Golden Cross has surged from -0.13 to 1.1 at press time. When NVT golden cross rises, it suggests long-term confidence within the asset’s development trajectory.

As such, traders are valuing the community past present on-chain exercise and see development potential whatever the transaction quantity.

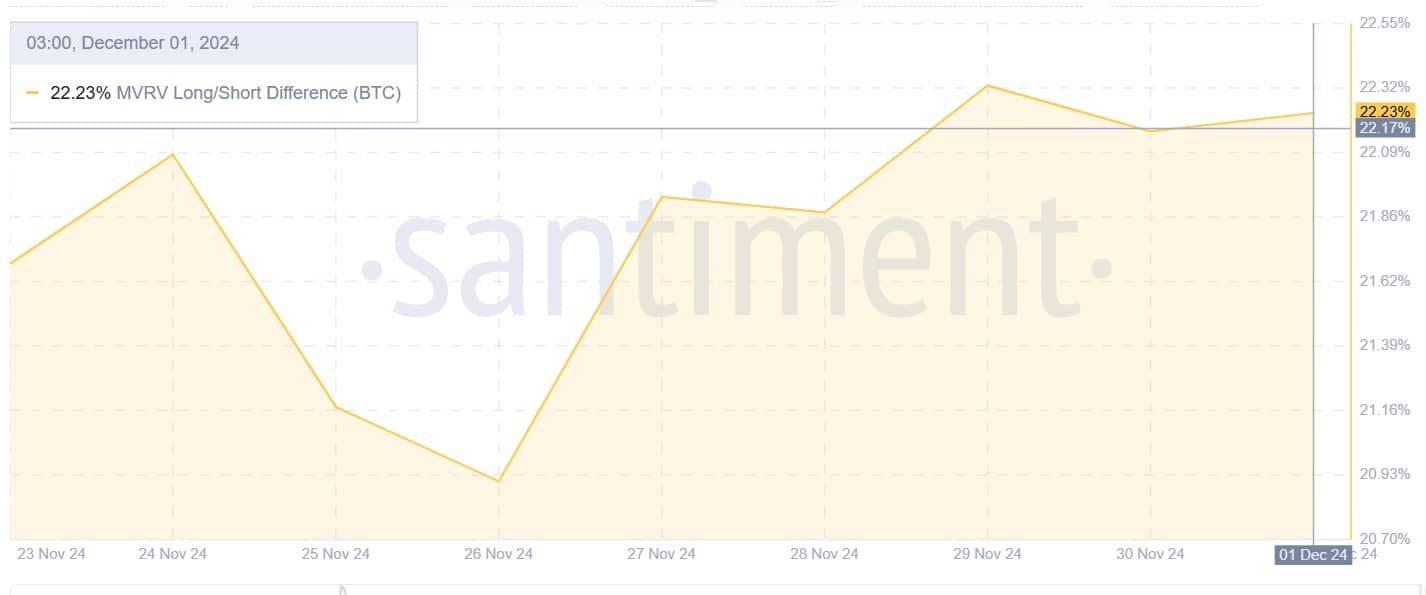

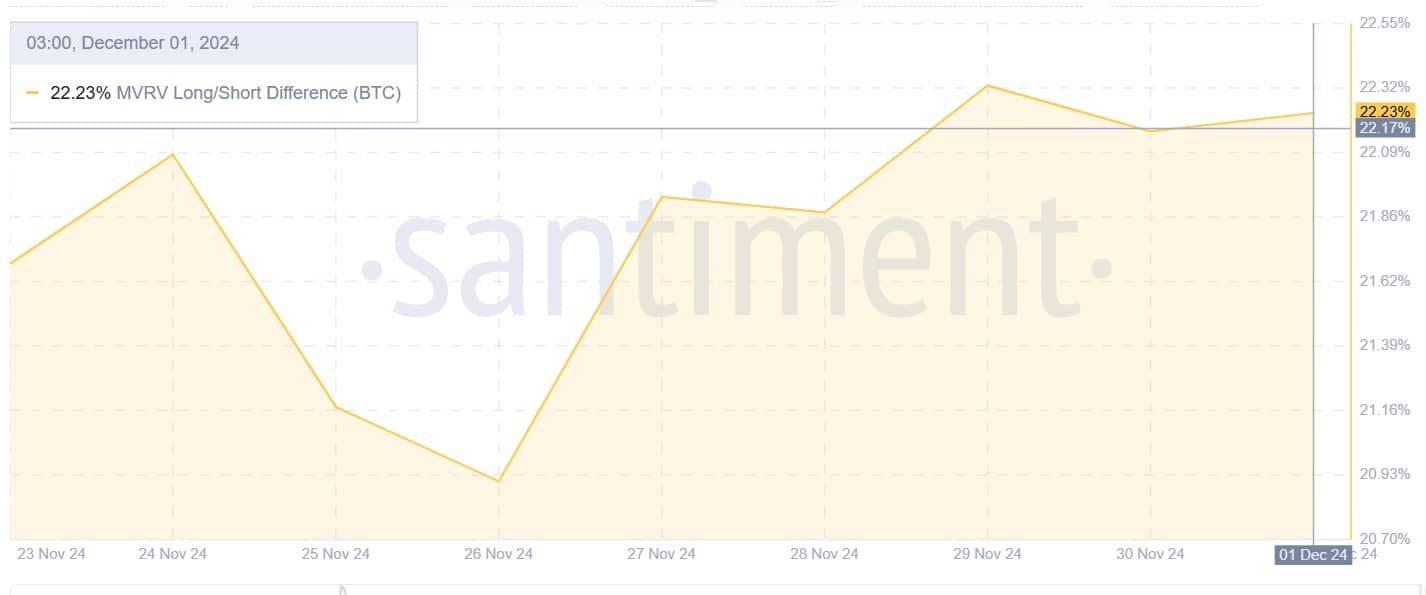

Source: Santiment

Additionally, this long-term confidence is additional evidenced by the rising MVRV lengthy/quick distinction.

A surge on this indicator means that lengthy place holders are more and more assured, although they’re presently in revenue.

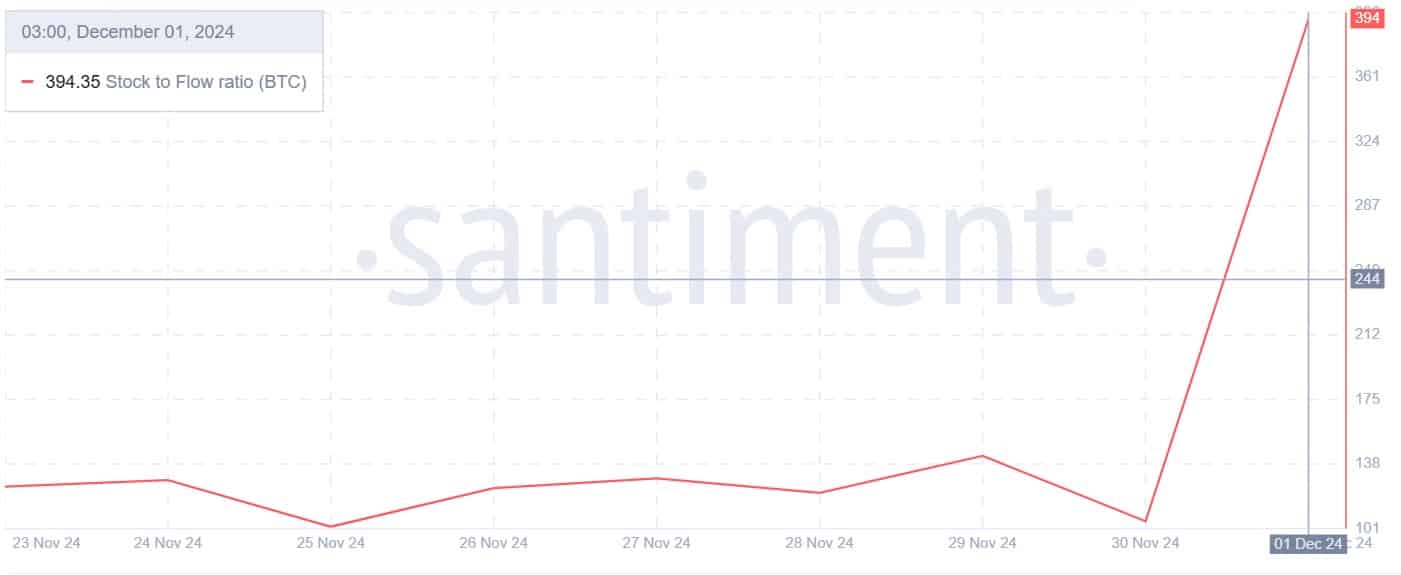

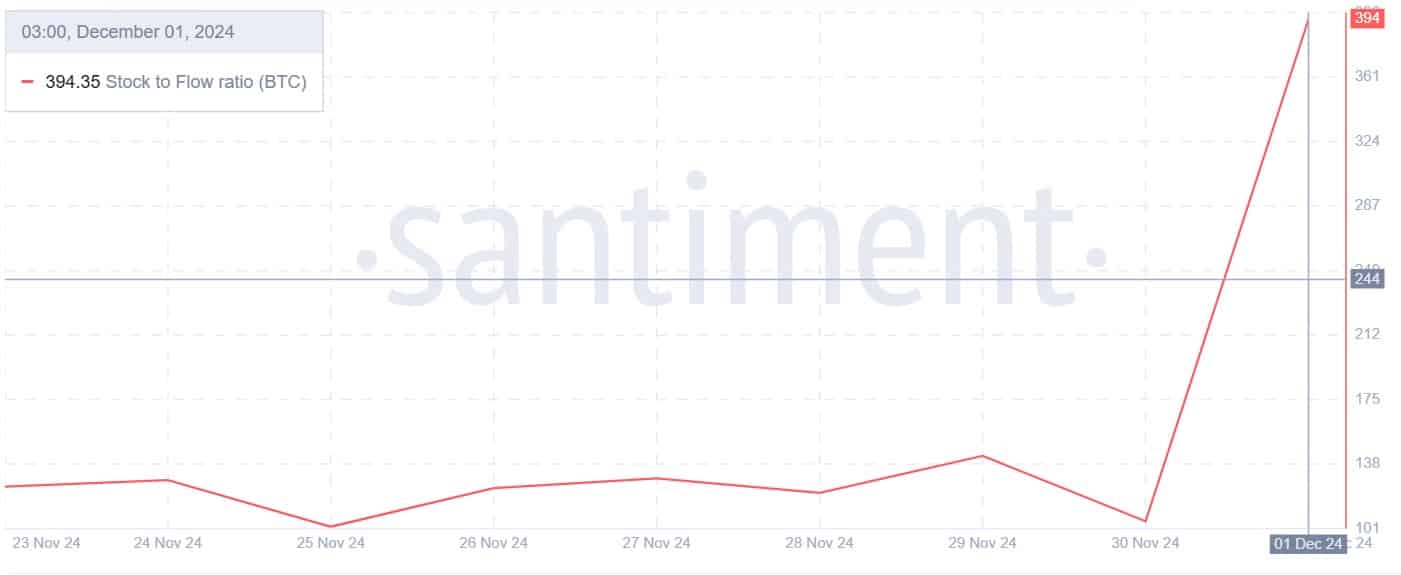

Source: Santiment

Finally, Bitcoin’s stock-to-flow ratio has surged from a low of 105 to 494 as of this writing. A surge in SFR reveals that BTC is presently scarce and low in provide.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Usually, shortage is the true measure of Bitcoin’s worth and when it’s scarce and demand rises, costs rise.

In conclusion, Bitcoin is well-positioned for extra features. The current market retrace look like mere corrections earlier than one other uptrend begins.