- Daily buying and selling quantity on Blur NFT market place was up 5x over the previous month.

- Short merchants get trapped as BLUR reveals an uptrend bar amid latest total market correction.

The each day buying and selling quantity on Blur [BLUR] NFT market place elevated by greater than 5X in November. This was the most important spike in quantity, reaching and surpassing $35 million.

The surge corresponded with heightened exercise suggesting rising curiosity in NFT platforms doubtlessly influencing the worth of the BLUR token.

Notably, the amount spikes weren’t constant; as a substitute, they appeared in sharp bursts, indicating reactive buying and selling habits.

Source: Token Terminal

If the development of elevated NFT exercise continues, the worth of BLUR might reply positively, mirroring the peaks in quantity.

However, this might largely rely on the opposite circumstances and the sustained curiosity in buying and selling on Blur platform. This instructed BLUR was turning into a key participant in NFT house, warranting shut monitoring for future market reactions.

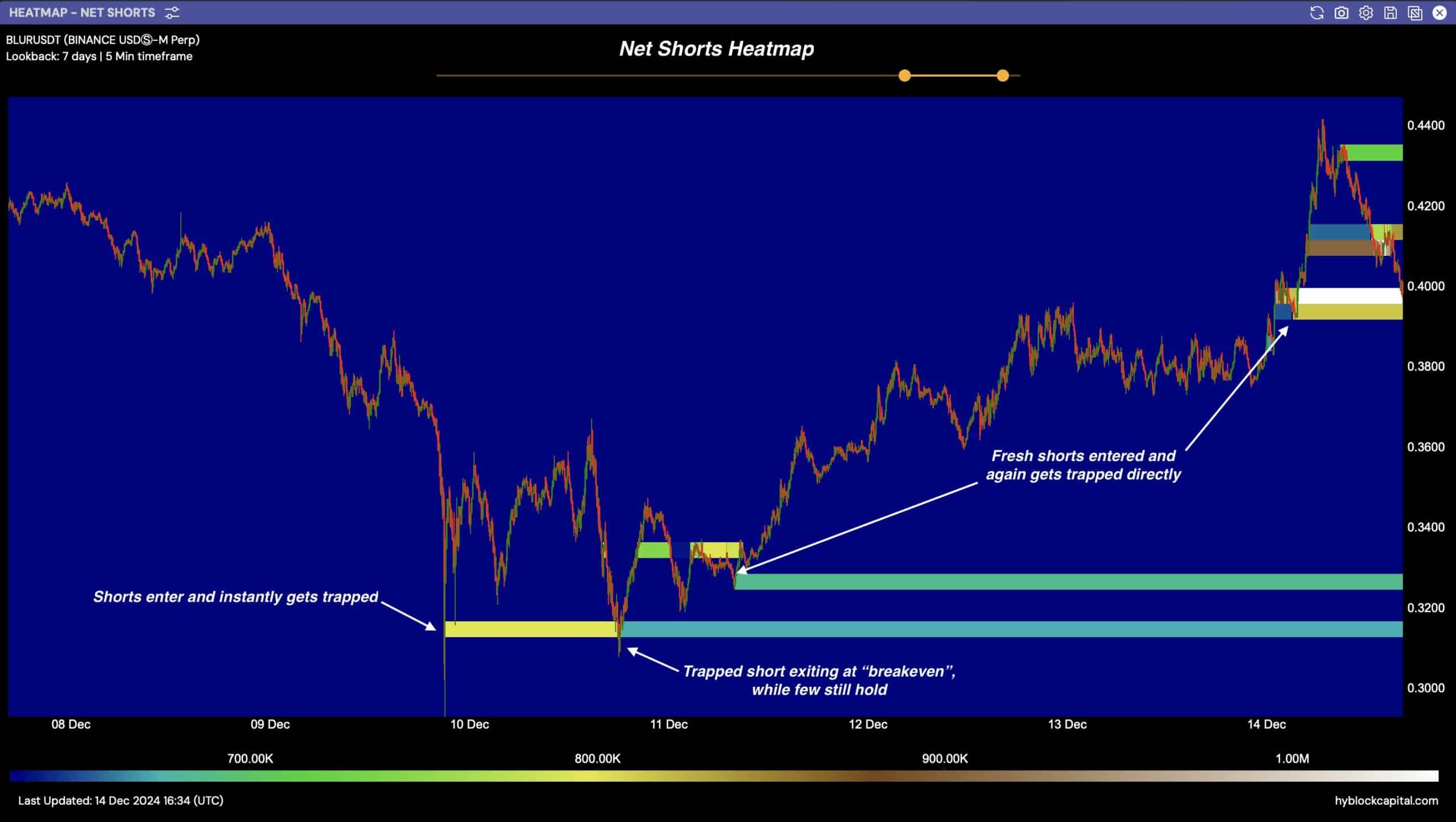

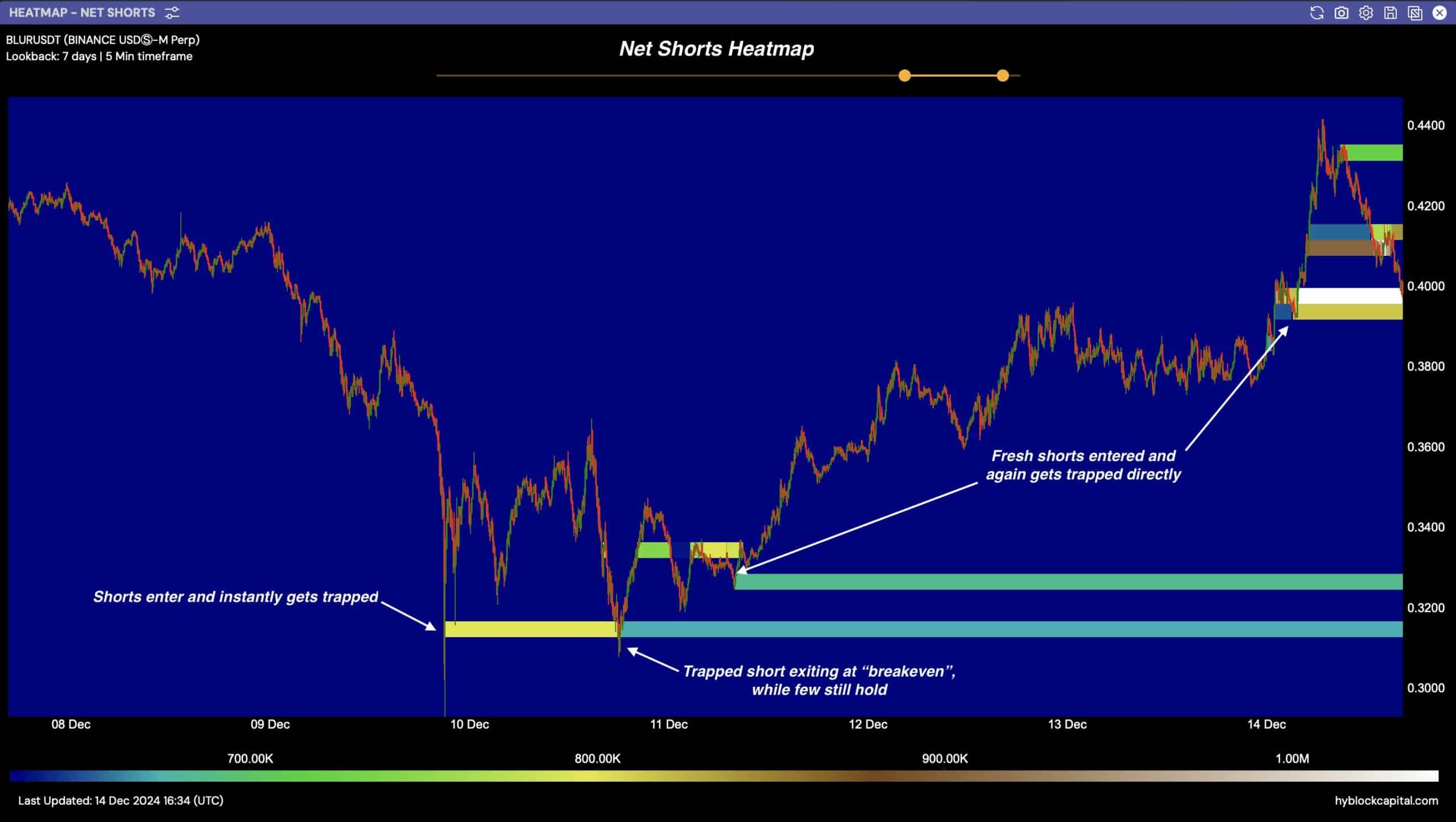

BLUR brief merchants trapped

BLUR’s short-selling exercise over the previous week induced a right away spike in worth, trapping shorts as a result of fast rebound. This highlighted focus of orders, signaling crowded brief trades.

Subsequently, recent shorts entered the market, solely to seek out themselves trapped as the worth escalated quickly, reaching a peak round $0.44.

The trapped shorts indicated volatility and the dangerous nature of betting towards a powerful BLUR uptrend.

Source: Hyblock Capital

This exercise indicated the place shorts entered and their exit factors, suggesting doable continuation if the development of trapping shorts persists, resulting in potential brief squeezes that might additional drive up costs.

Prediction and spot influx/outflow

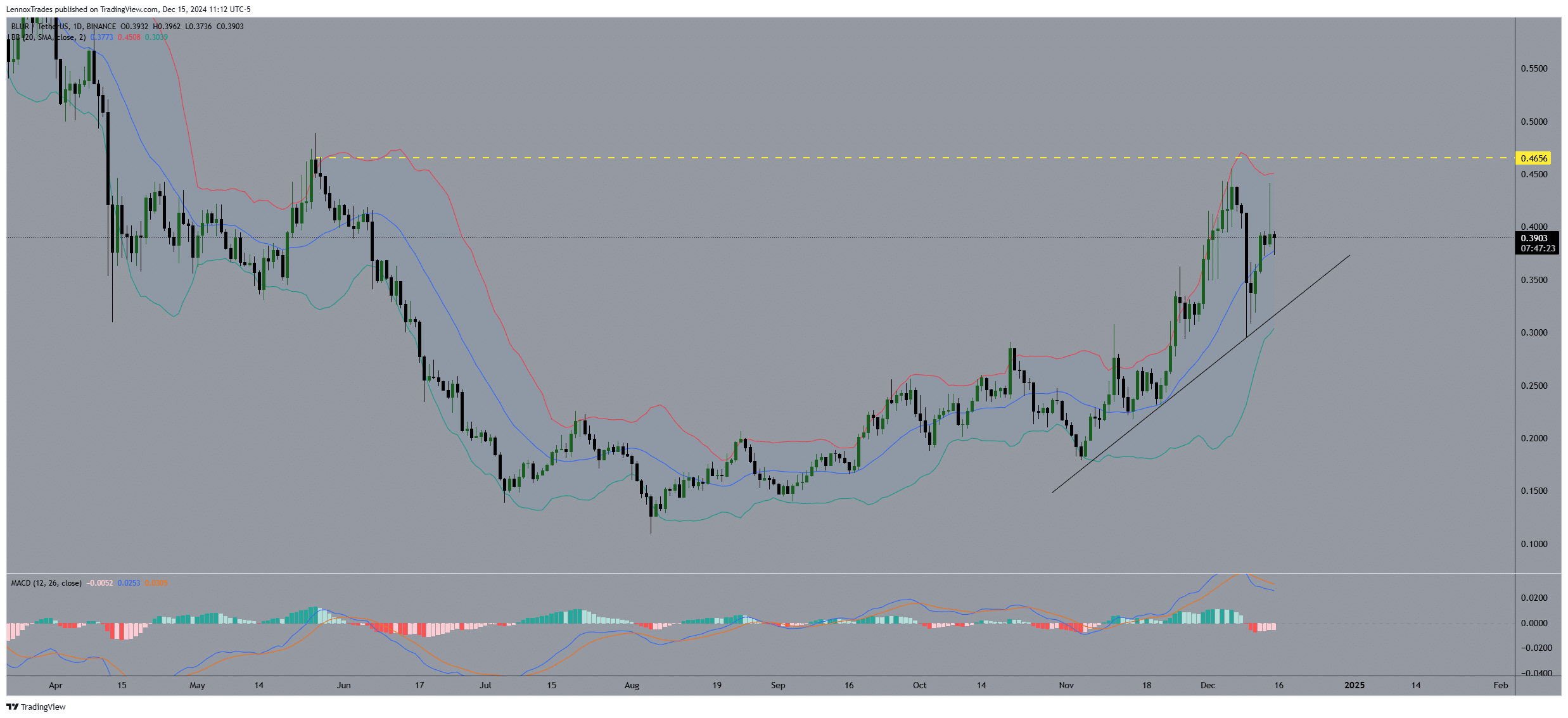

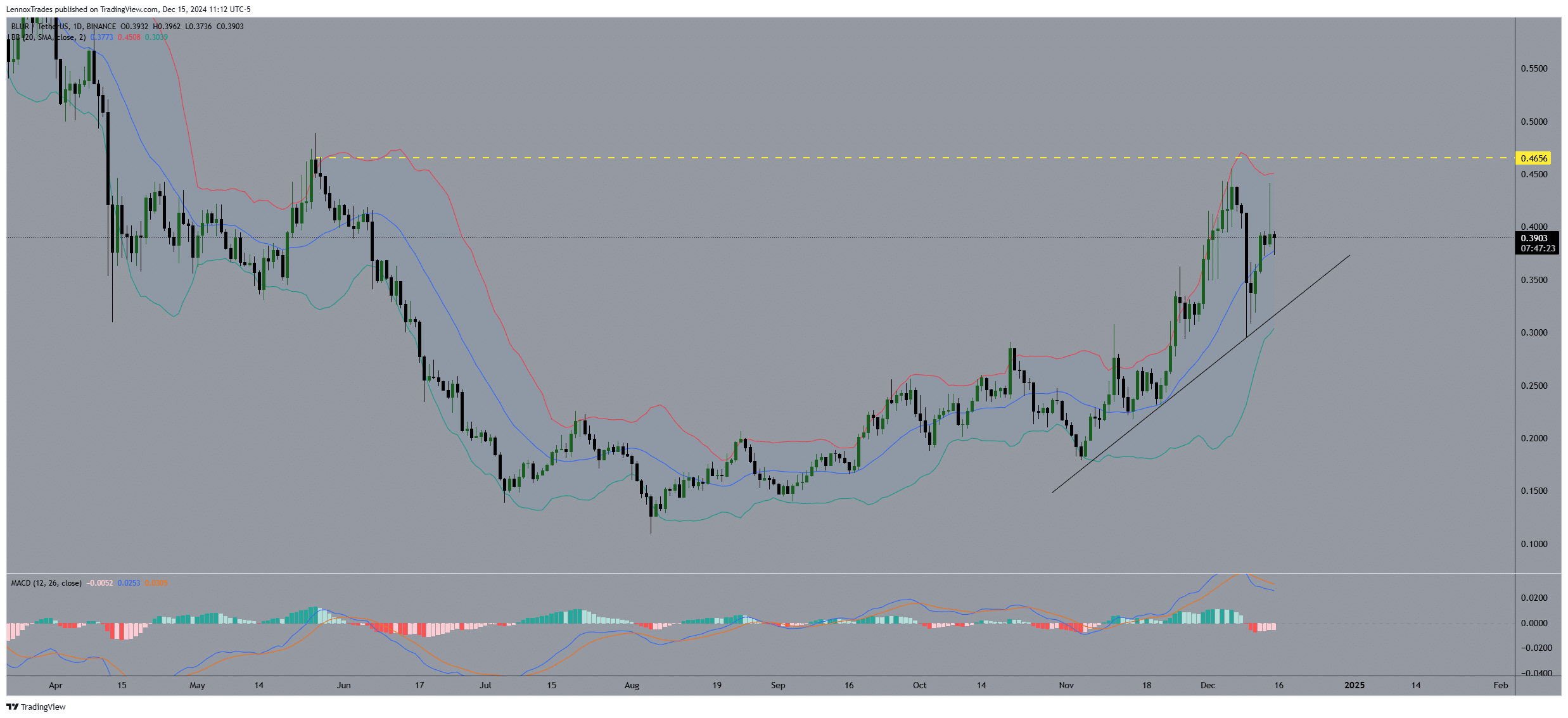

BLUR responded to the continued resurgence within the NFT market, beginning the month at $0.25 swiftly climbing close to $0.45 by mid-December. This doubtlessly attracted extra merchants.

This confirmed a bullish development constantly staying above each the 50-day and 200-day SMAs, suggesting a powerful upward momentum.

Additionally, the MACD being beneath the worth, confirmed bullish sentiment because it remained within the optimistic all through this era. The sharp uptick in MACD strengthened the bullish development.

Source: Trading View

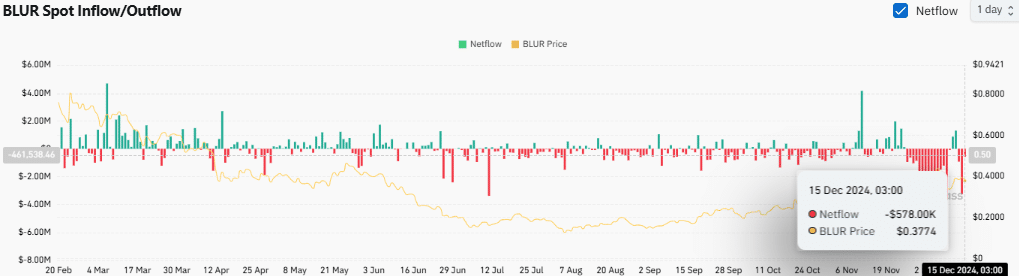

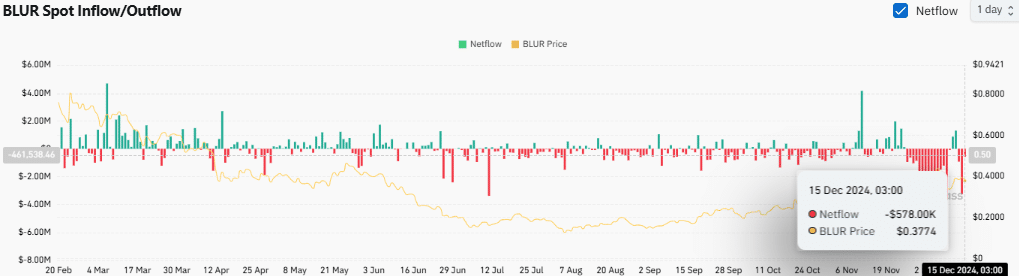

A pointy outflow of funds exceeding $6 million coincided with a spike in BLUR worth, suggesting sturdy shopping for curiosity or withdrawal from exchanges.

Source: Coinglass

Netflows remained comparatively secure adopted by a speedy outflow, indicating excessive volatility yearly.

The patterns instructed that the inflows and outflows had been essential. If the development continues, BLUR might expertise additional worth volatility, influenced by giant transfers out and in of exchanges.