Getty Images

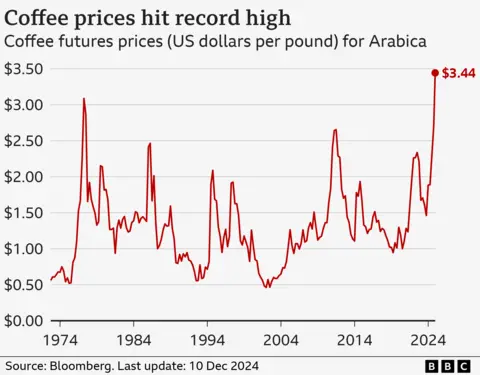

Getty ImagesCoffee drinkers could quickly see their morning deal with get dearer, as the worth of espresso on worldwide commodity markets has hit its highest stage on document.

On Tuesday, the worth for Arabica beans, which account for many international manufacturing, topped $3.44 a pound (0.45kg), having jumped greater than 80% this 12 months. The price of Robusta beans, in the meantime, hit a contemporary excessive in September.

It comes as espresso merchants count on crops to shrink after the world’s two largest producers, Brazil and Vietnam, had been hit by unhealthy climate and the drink’s recognition continues to develop.

One skilled informed the BBC espresso manufacturers had been contemplating placing costs up within the new 12 months.

While lately main espresso roasters have been in a position to soak up value hikes to maintain clients pleased and preserve market share, it appears like that is about to vary, in line with Vinh Nguyen, the chief govt of Tuan Loc Commodities.

“Brands like JDE Peet (the proprietor of the Douwe Egberts model), Nestlé and all that, have [previously] taken the hit from greater uncooked materials costs to themselves,” he stated.

“But proper now they’re virtually at a tipping level. Numerous them are mulling a value improve in supermarkets in [the first quarter] of 2025.”

Italian espresso large Lavazza stated it had gone to nice lengths to guard its market share and never go on greater uncooked materials prices to clients, however hovering espresso costs had ultimately pressured its hand.

“Quality is paramount for us and has at all times been the cornerstone of our contract of belief with shoppers,” the corporate informed BBC News.

“For us, this implies persevering with to deal with very excessive prices. So, we’ve got been pressured to regulate costs”.

At an occasion for traders in November, a prime Nestlé govt stated the espresso business was going through “powerful occasions”, admitting his firm must modify its costs and pack sizes.

“We usually are not resistant to the worth of espresso, removed from it,” stated David Rennie, Nestlé’s head of espresso manufacturers.

Drought and heavy rain

The final document excessive for espresso was set in 1977 after uncommon snowfall devastated plantations in Brazil.

“Concerns over the 2025 crop in Brazil are the primary driver,” stated Ole Hansen, head of commodity technique at Saxo Bank.

“The nation skilled its worst drought in 70 years throughout August and September, adopted by heavy rains in October, elevating fears that the flowering crop may fail.”

It isn’t just Brazilian espresso plantations, which largely produce Arabica beans, which have been harm by unhealthy climate.

Robusta provides are additionally set to shrink after plantations in Vietnam, the most important producer of that selection, additionally confronted each drought and heavy rainfall.

Coffee is the world’s second most traded commodity by quantity, after crude oil, and its recognition is growing. For instance, consumption in China has greater than doubled within the final decade.

“Demand for the commodity stays excessive, whereas inventories held by producers and roasters are reported to be at low ranges,” stated Fernanda Okada, a espresso pricing analyst at S&P Global Commodity Insights.

“The upward pattern in espresso costs is predicted to persist for a while,” she added.