- Virtuals Protocol, Theta Network and Core have been the most important gainers prior to now week.

- Stellar, Raydium, and Solana had the best losses prior to now week.

The high gainers for the previous week have been reasonably fascinating ones, with AI agent token VIRTUALS main the chart. Stellar [XLM], which was featured among the many gainers, ended up as the most important loser this previous week.

Biggest winners

Virtuals Protocol [VIRTUAL]

Virtuals Protocol [VIRTUAL] has emerged because the standout performer of the week. According to CoinGecko, it has recorded an astonishing 177% enhance in worth, bringing its market cap to almost $1.6 billion.

Starting the week at round $0.55 and experiencing an preliminary 5.97% decline, VIRTUAL quickly reversed its fortunes, pushed by growing buying and selling volumes and market enthusiasm.

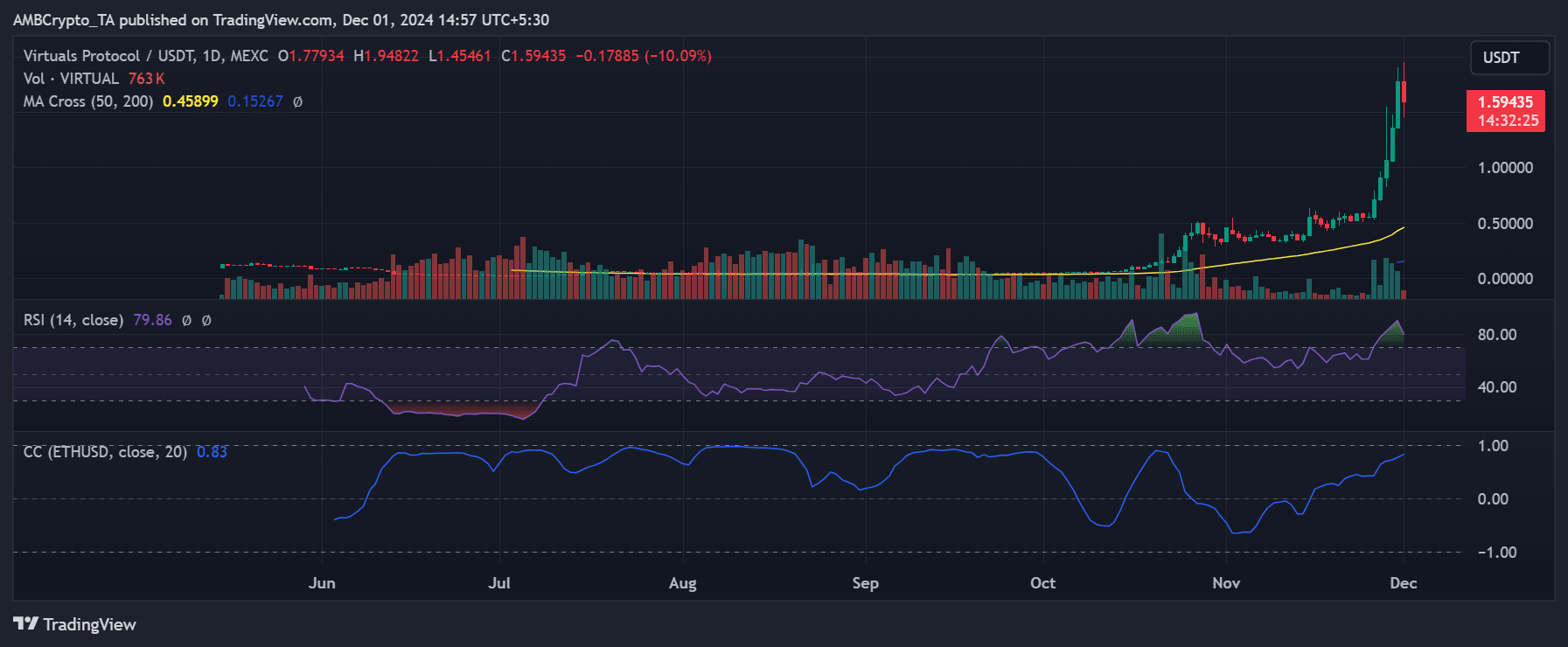

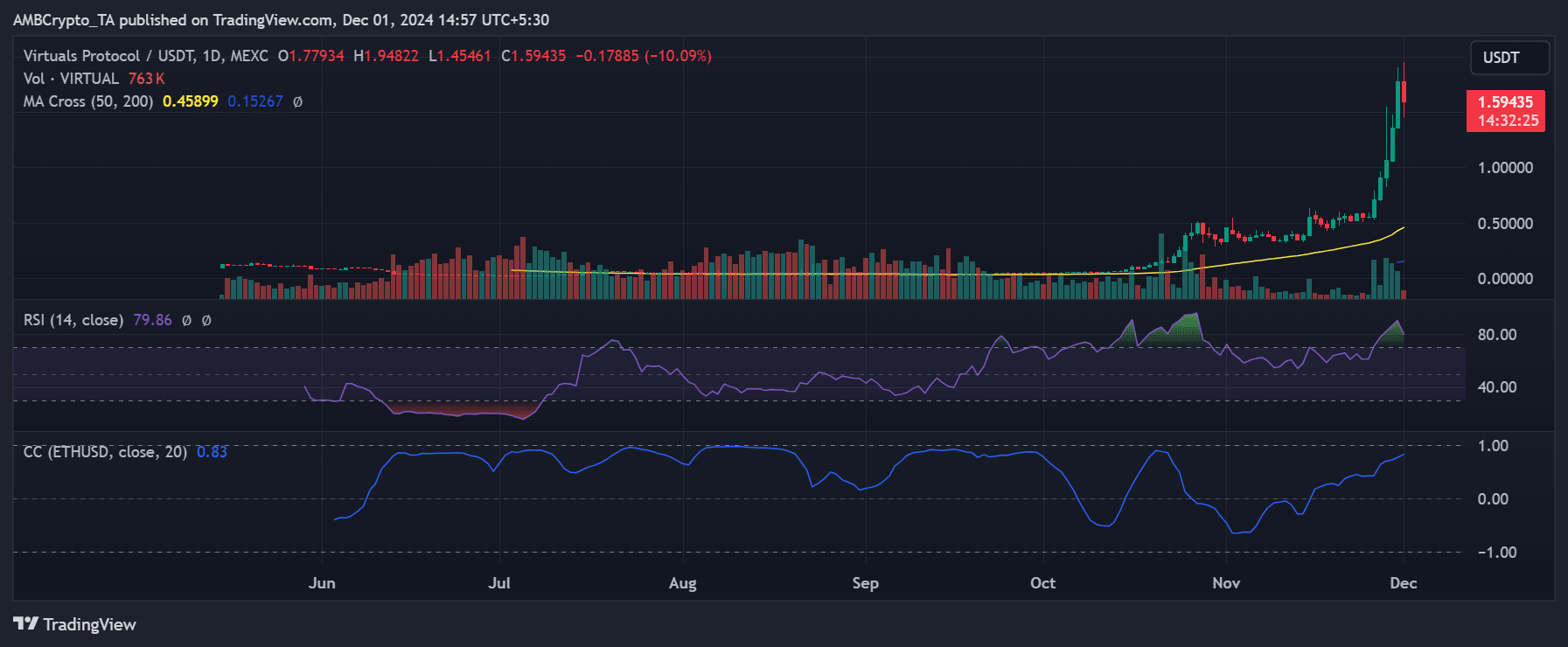

Source: TradingView

The each day chart highlighted a pointy upward trajectory, with the worth peaking at $1.94 earlier than retracing to $1.59. The spike was after an over 30% enhance on the thirtieth of November.

The RSI was 79.86 at press time, suggesting overbought circumstances, however the robust upward momentum indicated continued curiosity from traders.

The value remained effectively above the 50-day and 200-day shifting averages, with a bullish golden cross confirming a powerful upward pattern.

The correlation with Ethereum [ETH], mirrored by a 0.83 coefficient, indicated a broader market pattern supporting the rally.

The constant quantity spikes underscored sustained shopping for stress, with key help at $1.40 and resistance at $1.94.

Despite the spectacular positive aspects, profit-taking has launched slight volatility, leaving VIRTUAL’s trajectory topic to short-term corrections.

Theta Network [THETA]

Theta Token [THETA] has emerged because the second-biggest gainer of the week, climbing over 52.2% and pushing its market cap to almost $3 billion.

Beginning the week at round $1.95 with a 3.88% dip, THETA rebounded strongly, breaking previous key resistance ranges fueled by rising buying and selling volumes and broader bullish sentiment available in the market.

The chart confirmed that, like VIRTUAL, THETA spiked within the final buying and selling session. It spiked by nearly 28%. The each day chart showcases a transparent uptrend, with THETA peaking at $3.14 earlier than consolidating close to $2.98.

Trading quantity has surged, underlining robust investor curiosity. As of this writing, the amount was nearly $703 million, with an over 411% enhance.

Core [CORE]

Core DAO [CORE] secured its place because the third-biggest gainer of the week, posting an over 48% enhance, lifting its market cap to roughly $1.6 billion.

Beginning the week at round $1.07, following a 3.19% dip, CORE noticed optimistic value strikes, particularly on the final two days of the week.

A have a look at the worth confirmed that it surged by over 35% on the final day of the week. The each day chart highlights a powerful uptrend because the token surged to over $2 earlier than barely correcting to $1.96.

The RSI at 78 recommended that CORE was in overbought territory, which might sign some short-term profit-taking. Also, its quantity has seen an over 84% enhance within the final 24 hours and is over $430 million.

Top 1,000 gainers

Outside the highest 100, this week’s high gainer, Thena [THE], surged by nearly 1,280%. The second and third-largest gainers have been GAME by Virtuals [GAME] and Human Protocol [HMT], with over 659% and over 391% will increase, respectively.

Biggest losers

Stellar [XLM]

Stellar [XLM] skilled a turbulent week, rising as the most important loser amongst main cryptocurrencies, with a ten.1% decline.

The token started the week at roughly $0.53, having fun with a short 2% rise earlier than succumbing to promoting stress. Also, XLM was the most important gainer the week earlier than, reaching a excessive.

However, XLM’s each day chart highlighted a pronounced downward motion after reaching current highs.

The sharp value decline was accompanied by reducing buying and selling volumes, suggesting waning investor curiosity through the correction part.

Per CoinGecko, the amount had declined by nearly 50% within the final 24 hours and was round $1.95 billion at press time. Also, its market cap has taken an over 5% hit and is round $15.27 billion.

Raydium [RAY]

Raydium [RAY] emerged because the second-biggest loser this week, shedding 9.4% of its worth.

The token started the week buying and selling at round $6.12, exhibiting a marginal enhance of lower than 1% earlier than coming into a constant downward trajectory.

Its chart indicated a big correction after a powerful rally in November, throughout which RAY gained substantial upward momentum.

However, the current pullback recommended profit-taking by traders and a brief pause within the upward momentum.

At the top of the week, RAY was buying and selling at round $5.45 after a decline of over 4%. At press time, RAY was buying and selling close to $5.39, with vital help recognized across the $5.00 degree.

Also, its market capitalization has declined by over 3% and is round $1.57 billion as of this writing.

Solana [SOL]

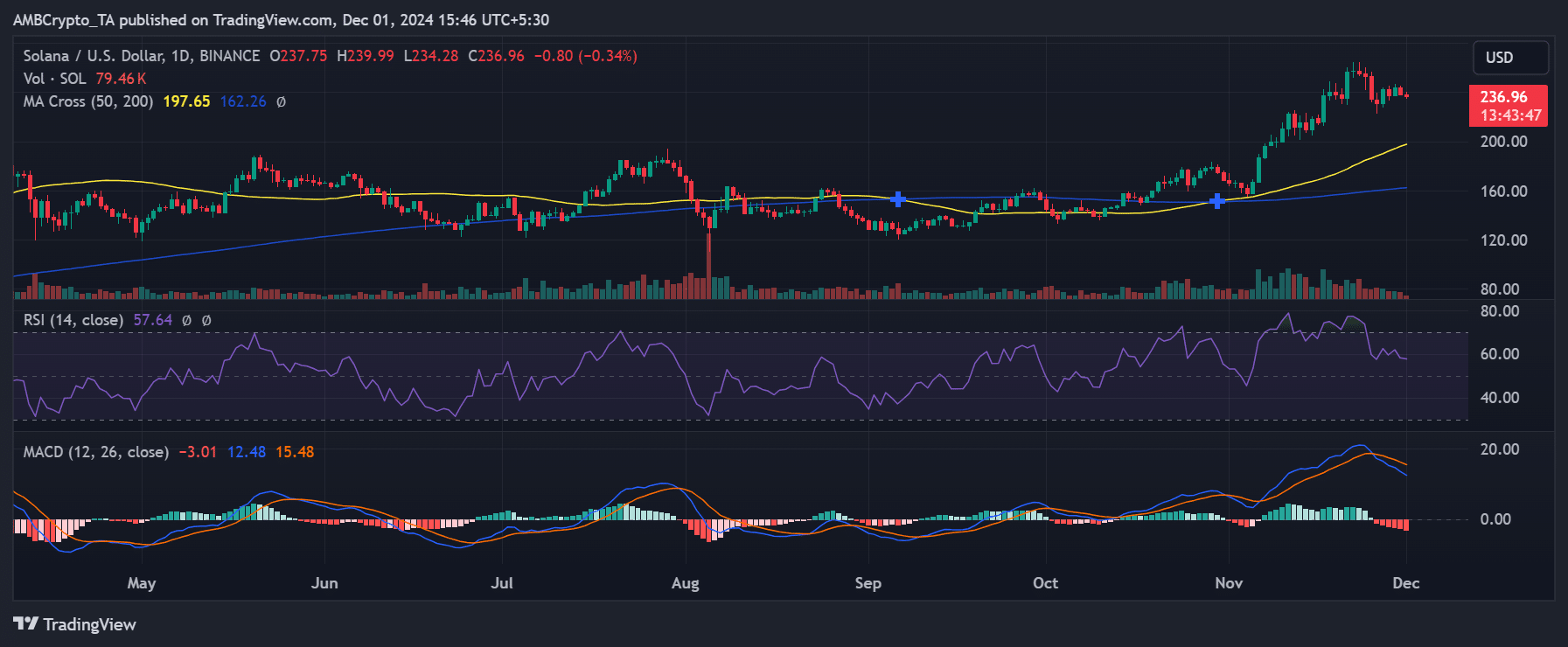

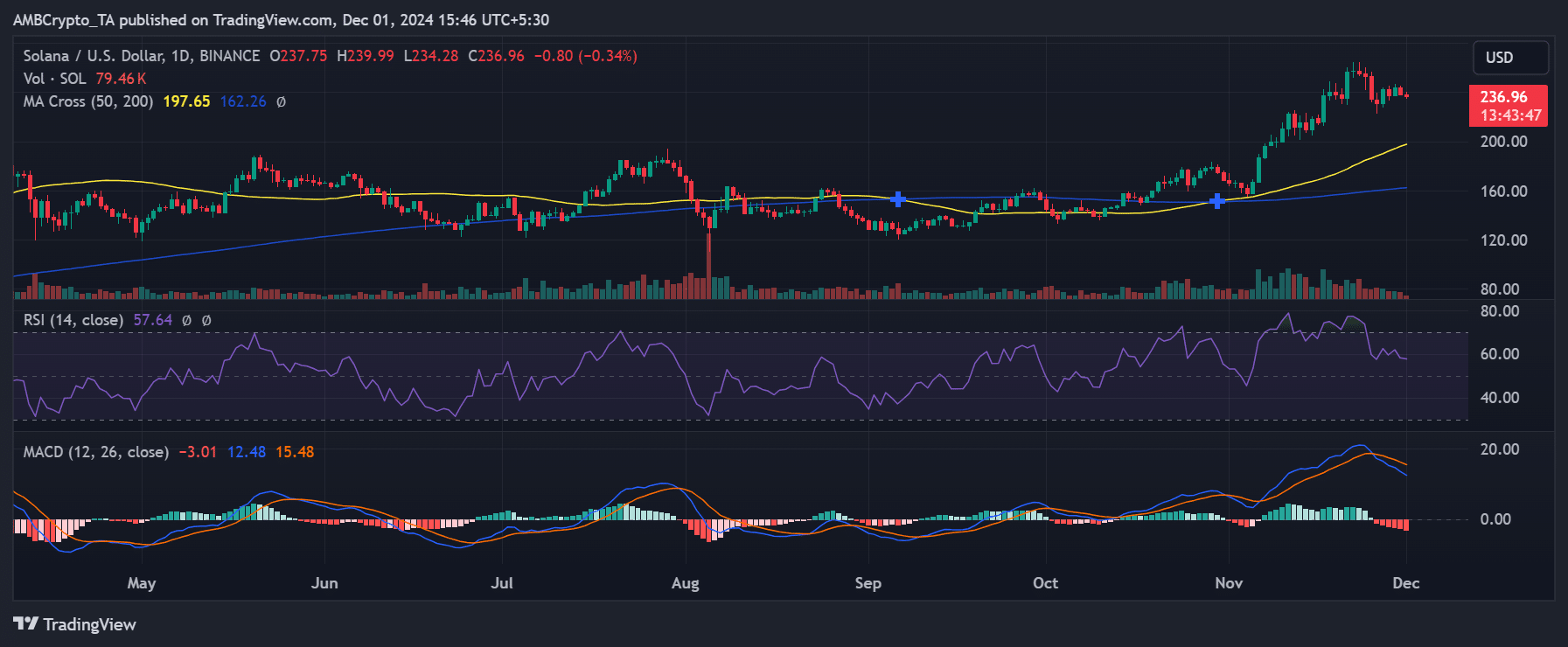

Solana [SOL] concluded the week because the third-biggest loser, registering a 6.7% decline. Starting the week at round $254, SOL confronted a downward trajectory and ended at round $237.

It was buying and selling close to $237 at press time. Despite preliminary stability, promoting stress mounted, resulting in a pullback.

The 50-day shifting common ($197.65) remained effectively above the 200-day shifting common ($162.26), indicating a bullish long-term pattern.

However, the RSI has dropped to 57.64, signaling a cooldown from overbought ranges noticed in prior weeks. The MACD histogram exhibits bearish momentum, with the MACD line descending under the sign line.

Source: TradingView

SOL’s speedy help lies at $230, whereas resistance at $260 continues to restrict upward actions.

The pullback aligns with broader market corrections, though Solana’s sturdy community fundamentals have cushioned steeper declines.

Despite the current dip, SOL’s long-term construction remained bullish, underpinned by sustained buying and selling quantity and robust market sentiment.

A decisive transfer above $260 might renew bullish momentum, focusing on $280. However, failure to carry the $230 help would possibly set off additional draw back.

Top 1,000 losers

Outside the highest 100, this week’s high loser was We Love T*ts [TITS], with an over 58% decline.

The second and third-biggest losers have been Hasbulla’s Cat [BARSIK] and First Convicted RACCON [FRED], with a 50% and 46% declines, respectively.

Conclusion

Here’s the weekly recap of the most important gainers and losers. It’s essential to keep in mind the unstable nature of the market, the place costs can shift quickly.

Thus, doing your personal analysis (DYOR) earlier than making funding choices is greatest.