- Ethereum’s trade reserve was dropping, signaling excessive shopping for stress.

- However, the RSI was resting within the overbought zone.

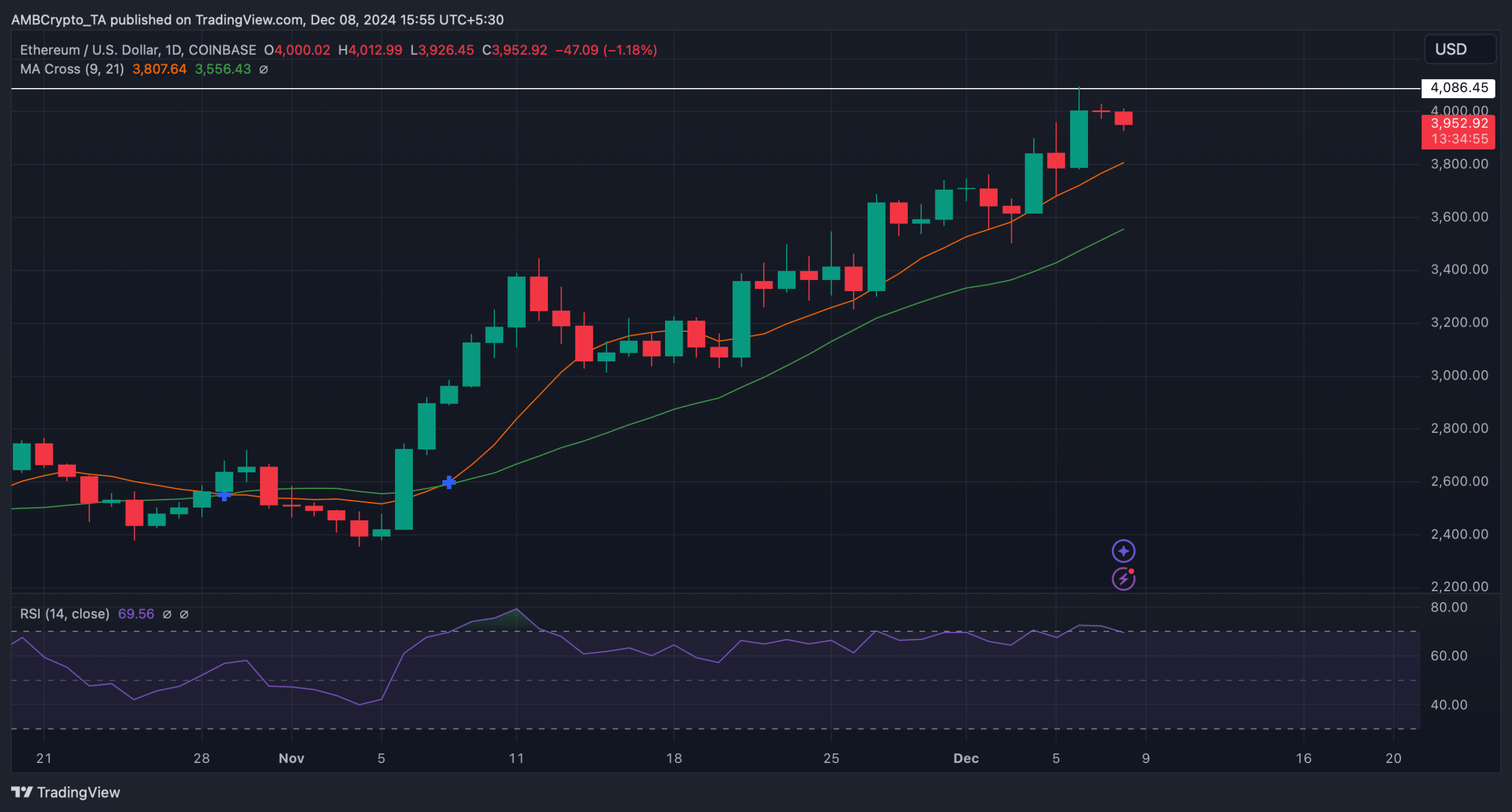

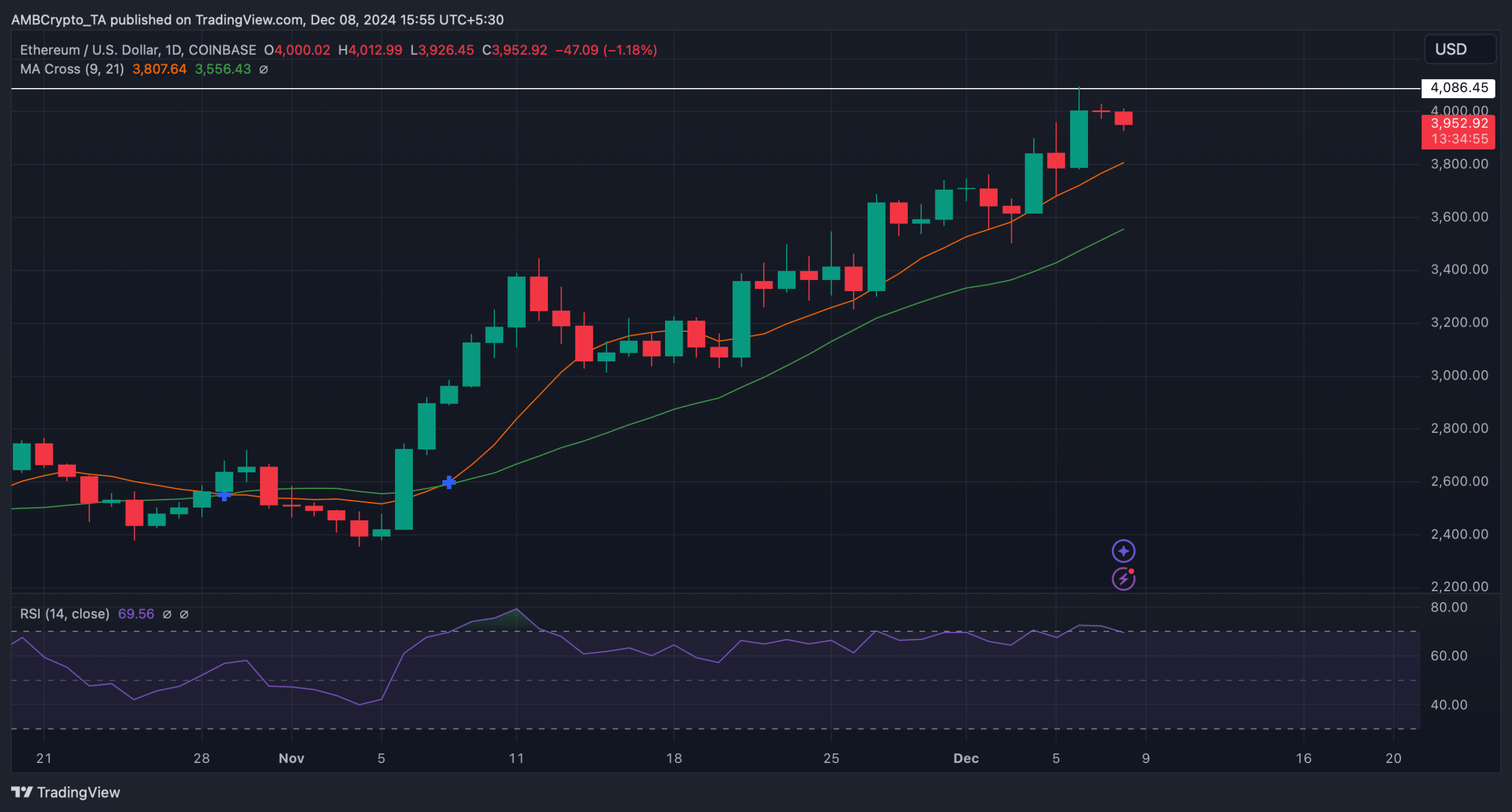

Ethereum [ETH] has been struggling to breach the $4k barrier for fairly a while now, as it’s getting rejected close to the resistance.

However, newest evaluation revealed that the trail for ETH transferring in direction of a brand new all-time excessive is fairly clear. Therefore, AMBCrypto investigated additional to seek out out whether or not that’s really the case.

Ethereum is heading in the right direction

ETH’s worth registered a 7% worth hike final week, pushing the token’s worth close to $4k. At the time of writing, ETH was buying and selling at $3.05k with a market capitalization of over $476 billion.

In the meantime, Ali Martinez, a preferred crypto analyst, posted a tweet revealing that there was nothing stopping ETH from reaching new all-time highs. The solely modest resistance zone forward was round $4,540.

But so long as the $3,560 demand zone holds, the chances favor the bulls.

Will ETH contact $4.5k quickly?

Since Martinez’s tweet revealed the potential for ETH touching $4.5k, AMBCrypto assessed the token’s on-chain metrics to seek out the chance of that occuring within the brief time period.

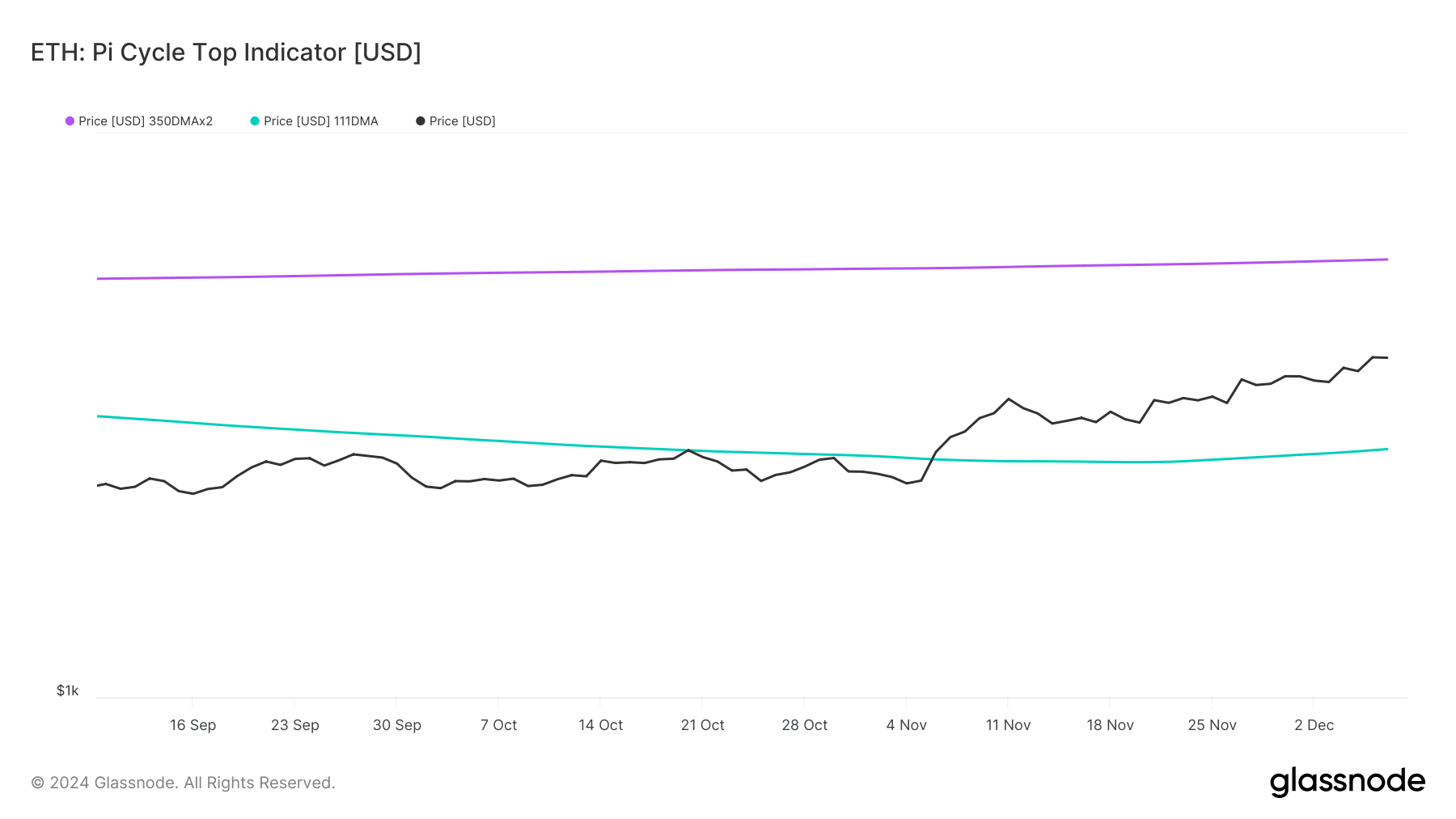

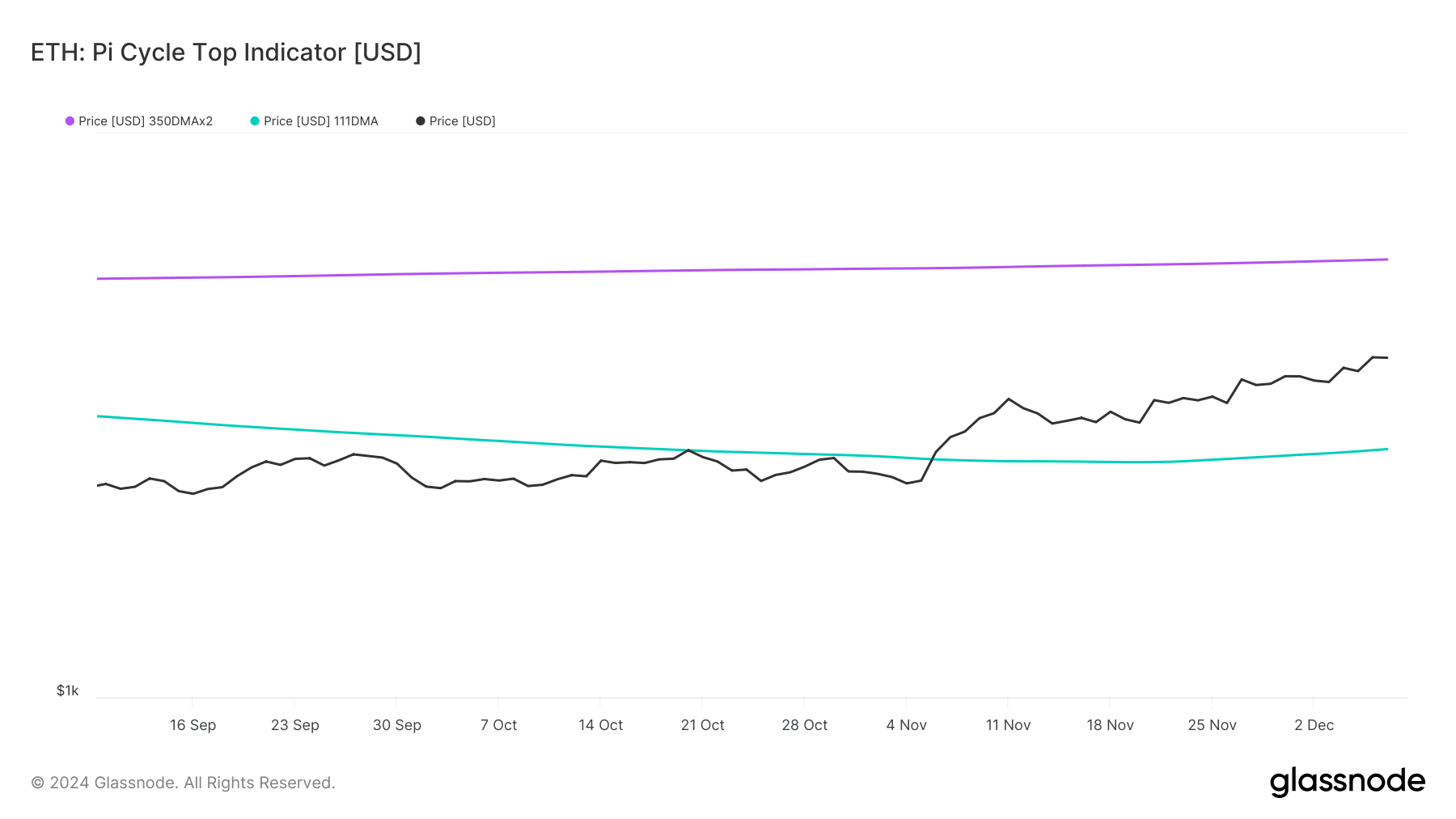

ETH’s Pi Cycle Top indicator revealed that ETH was buying and selling effectively between its market high and backside. If the metric is to be believed, ETH’s doable market high was at $5.9k.

Therefore, it appeared possible for ETH high attain $4.5k quickly.

Source: Glassnode

CryptoQuant’s knowledge revealed that purchasing stress on the token was rising. This was evident from ETH’s declining trade reserve.

Additionally, Ethereum’s Coinbase premium was inexperienced, which means that purchasing sentiment amongst US buyers was robust. However, just a few metrics additionally regarded bearish.

For occasion, ETH’s taker purchase/promote ratio turned purple. Whenever this occurs, it signifies that promoting sentiment is dominant within the derivatives market. More promote orders are crammed by takers.

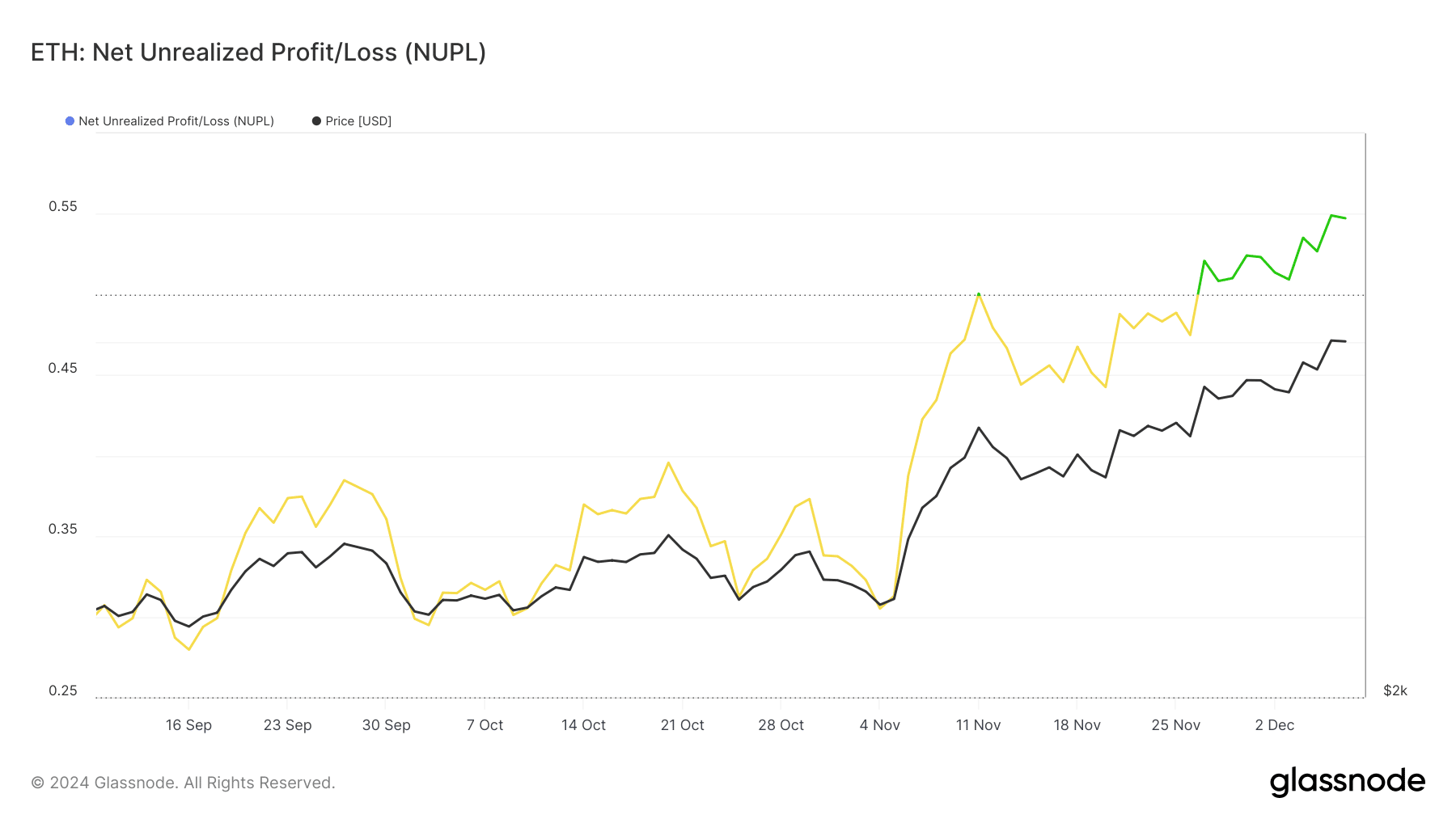

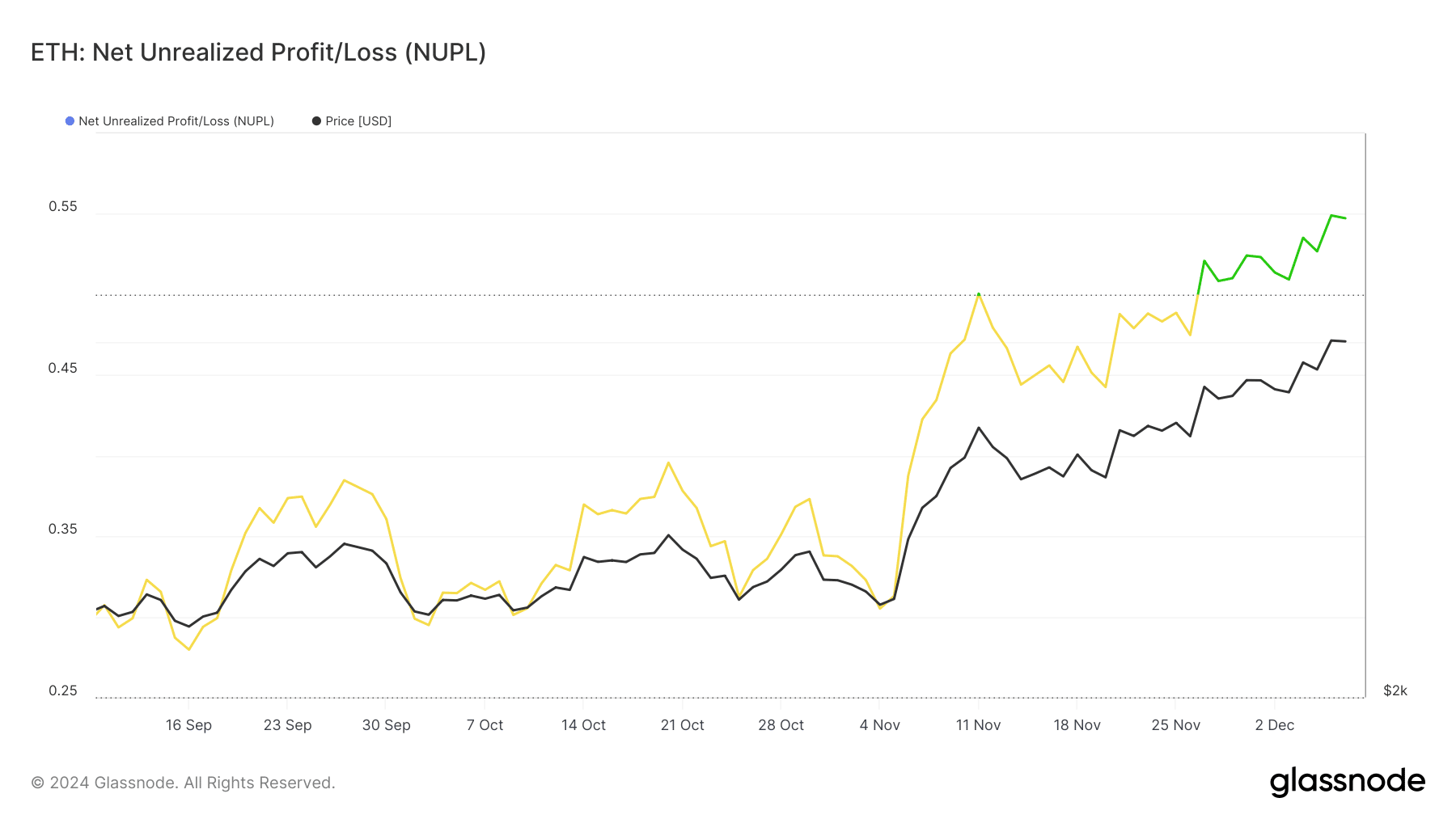

Apart from this, ETH’s Net Unrealized Profit/Loss (NUPL) entered the “perception” section.

For starters, the NUPL is the distinction between Relative Unrealized Profit and Relative Unrealized Loss. Historically, at any time when the metric reached this stage, it was adopted by worth corrections.

If historical past repeats, then ETH may not be capable of go above $4k within the short-term.

Source: Glassnode

Trouble for ETH was removed from over. The token’s Relative Strength Index (RSI) was resting within the overbought territory.

Read Ethereum’s [ETH] Price Prediction 2024–2025

This would possibly inspire buyers to promote their holdings, which has the potential to push ETH’s worth down within the coming days.

Nonetheless, the MA Cross indicator supported the bulls, because the 9-day MA was effectively above the 21-day MA.

Source: TradingView