- Floki was nearing a breakout, with $0.00028980 because the crucial resistance for bullish momentum.

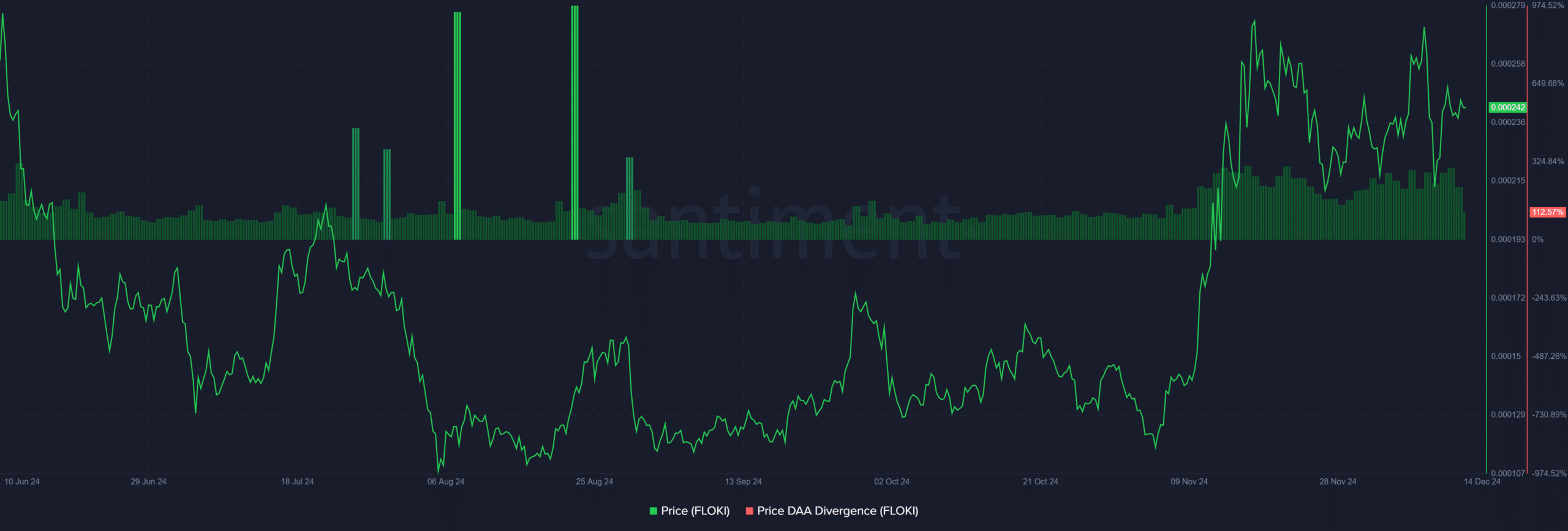

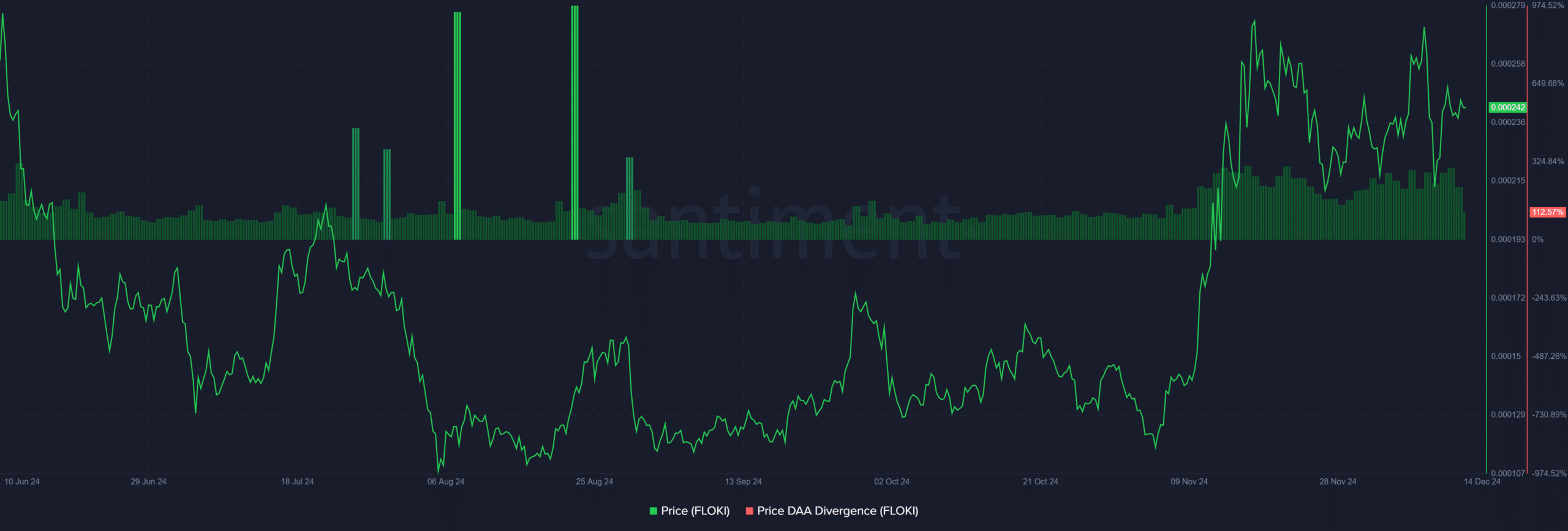

- Market metrics confirmed optimism, with a 112.57% price-DAA Divergence supporting potential upside.

Floki [FLOKI]is gaining consideration because it edged nearer to breaking out of its long-term descending channel. At press time, Floki was buying and selling at $0.0002417, down by 0.09%, within the final 24 hours.

The worth is consolidating above the $0.00021129 help degree, with key resistance at $0.00024862, as proven by the 0.786 Fibonacci retracement degree.

If Floki clears this resistance, it might problem $0.00028980 and rally towards the subsequent goal at $0.00034883. Traders are carefully waiting for a decisive transfer to substantiate bullish momentum.

Source: TradingView

Technical indicators counsel a possible for a rally

Fibonacci retracement ranges present $0.00024862 because the fast barrier Floki should overcome. A breakout right here might result in testing $0.00028980, a crucial resistance level. Additionally, the Relative Strength Index (RSI) was at 56.21, indicating the market stays in a impartial zone.

This suggests there’s room for upward motion if shopping for stress intensifies. Moreover, the consolidation close to the resistance zone signifies merchants are positioning for a breakout, including to the anticipation.

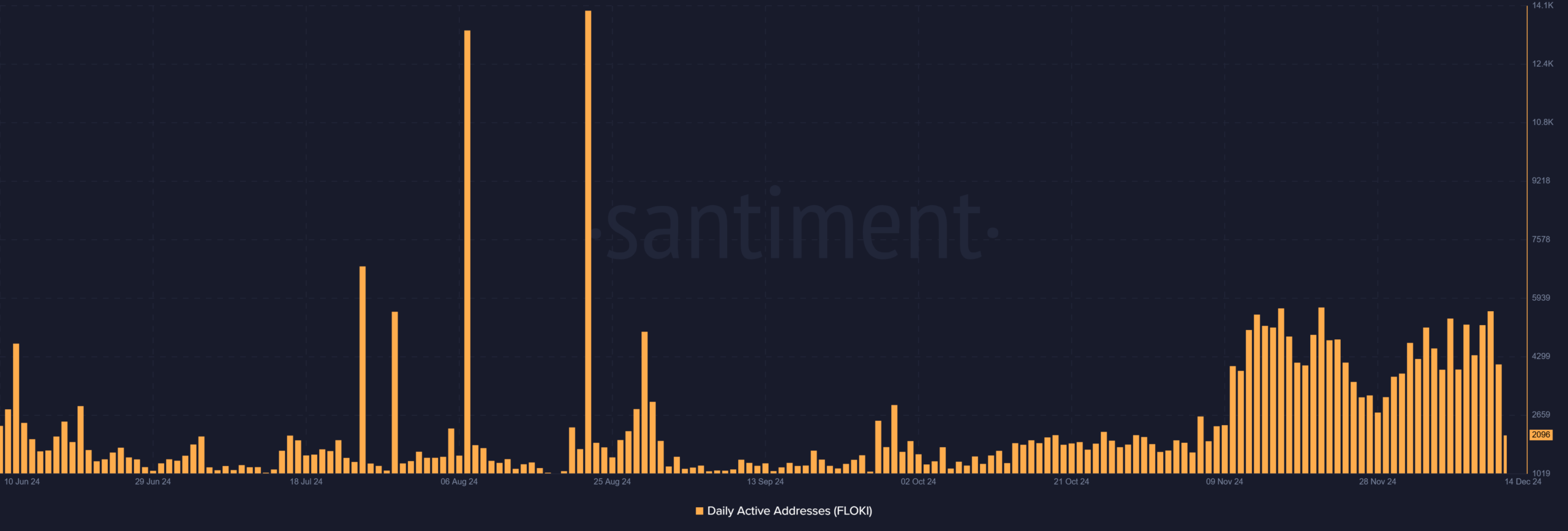

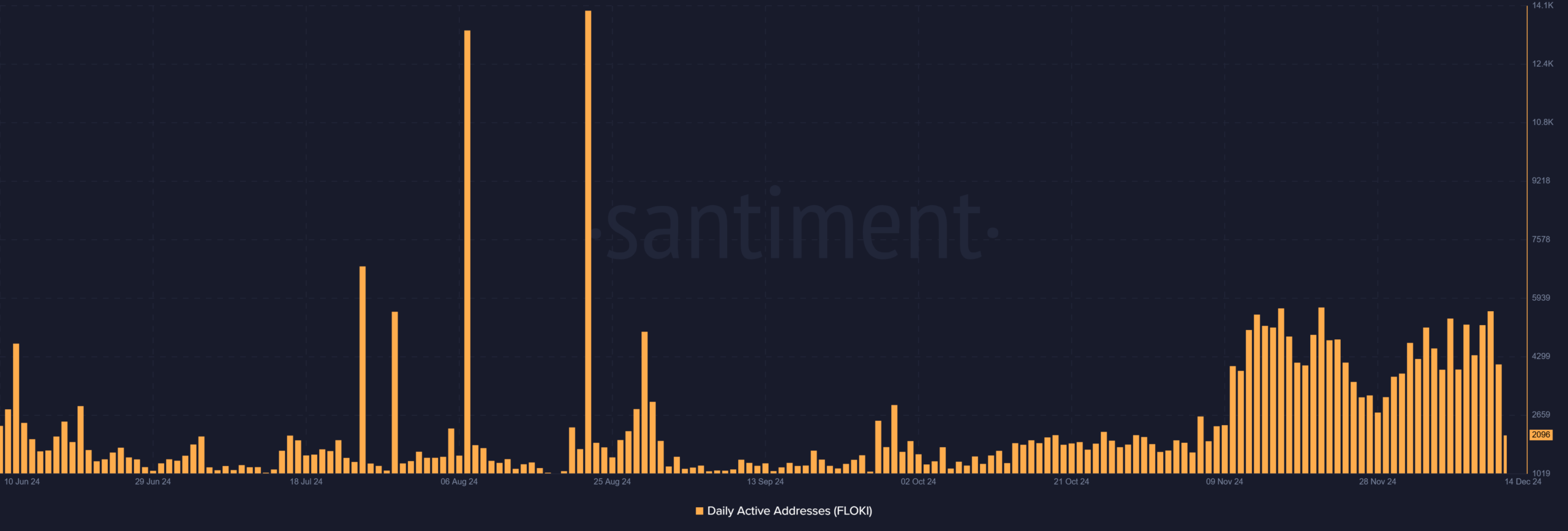

Daily lively addresses present a decline

Floki’s day by day lively addresses have dropped considerably to 2,096 from 4,085 the day past. This sharp decline displays lowered short-term community exercise, probably because of merchants ready for a transparent breakout sign.

However, this lower doesn’t essentially point out an absence of curiosity. Instead, it could counsel warning amongst market members as Floki nears a crucial level in its worth motion.

Source: Santiment

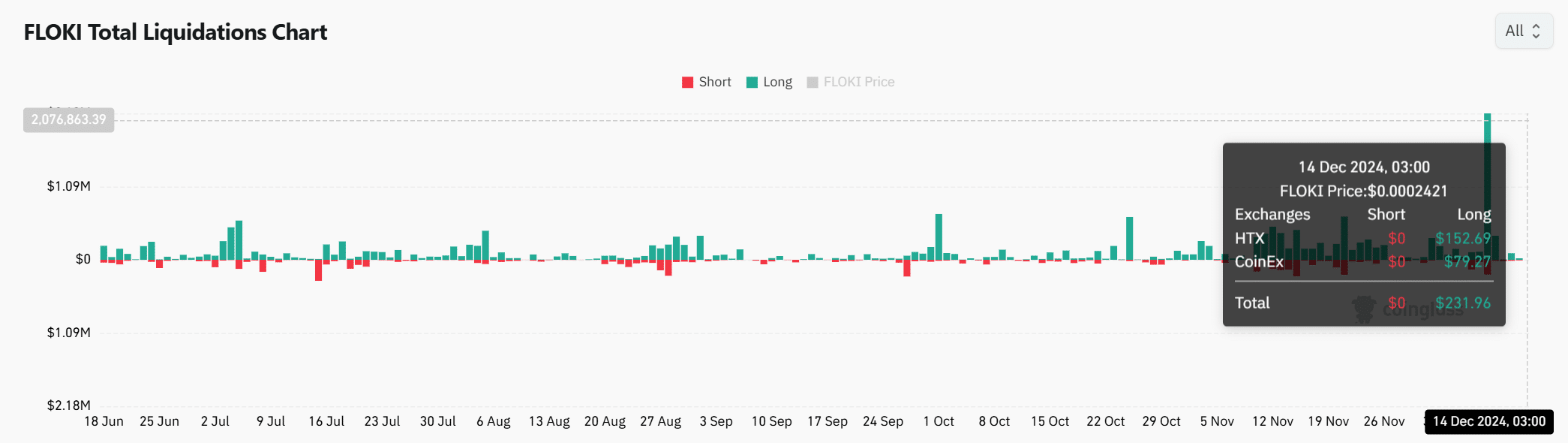

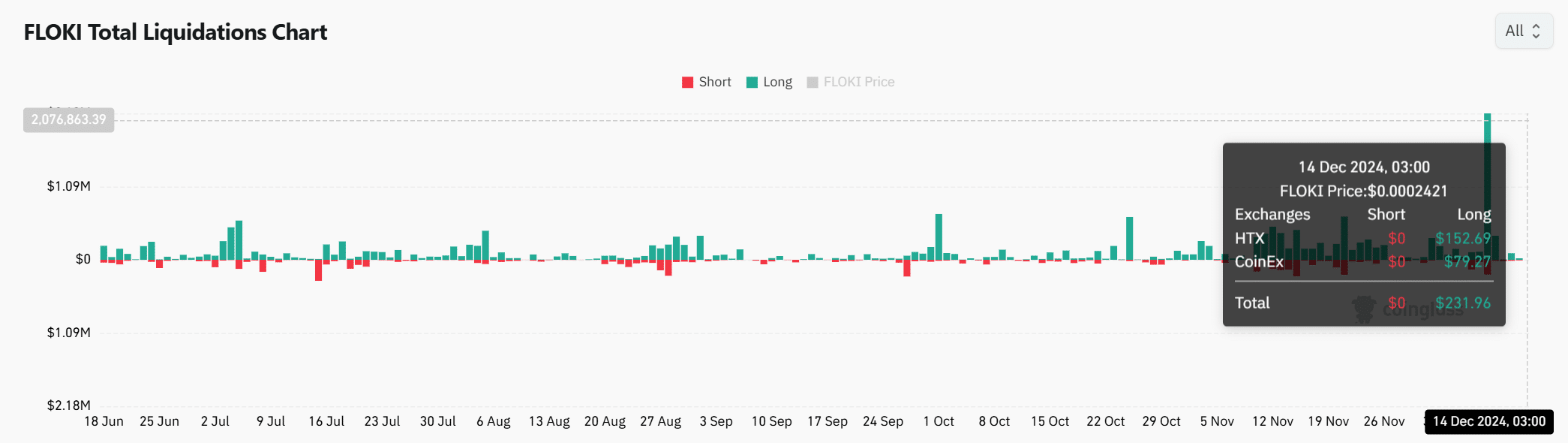

FLOKI liquidations stay low

Interestingly, liquidation information reveals $231.96 in liquidated longs, whereas shorts stay at $0. This means that bulls have taken greater dangers forward of the potential breakout, whereas bears keep on the sidelines.

Thus, the muted liquidation exercise displays market warning as merchants await a decisive transfer. If Floki breaks resistance, liquidation volumes are anticipated to rise sharply, probably amplifying volatility.

Source: Coinglass

Price-DAA divergence indicators optimism

Floki’s price-DAA divergence climbed to a powerful 112.57%. This sharp enhance suggests underlying confidence from long-term holders, whilst day by day lively addresses decline.

Therefore, the divergence highlights optimism for sustained upward momentum, particularly if key resistance ranges are breached.

Source: Santiment

Realistic or not, right here’s FLOKI’s market cap in BTC’s phrases

Can FLOKI verify the breakout?

FLOKI is at a crucial juncture in its worth motion. With robust price-DAA divergence and a steady RSI, the token is technically positioned to problem its resistance ranges.

A confirmed breakout above $0.00028980 might spark a rally in the direction of $0.00034883. However, warning is warranted as on-chain exercise reveals lowered engagement. The subsequent transfer will decide if FLOKI can seize the momentum and solidify its upward pattern.