- Percentage of Litecoin wallets in revenue has risen to its highest degree since 2021 after latest positive factors

- A bearish reversal is probably going after an inverse cup and deal with sample on the decrease timeframe

Litecoin (LTC) has gained by greater than 50% over the previous month, mirroring the widespread positive factors throughout the altcoin market. However, regardless of this rally, some analysts really imagine that Litecoin could also be useless.

In an X publish, common analyst Ali Martinez famous that LTC is now buying and selling on the identical worth as again in 2017. Moreover, he argued that it now lacks sturdy fundamentals to drive any long-term development.

According to him, whereas LTC may proceed to register some short-term positive factors, it’ll nonetheless be caught inside a consolidation vary.

Litecoin pockets profitability hits 2021 highs

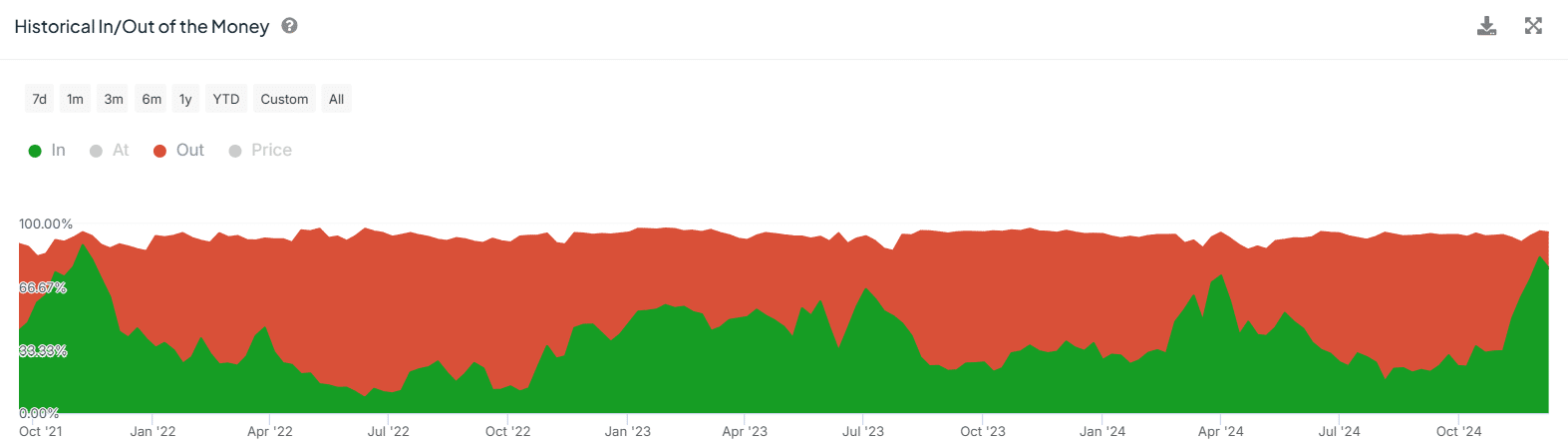

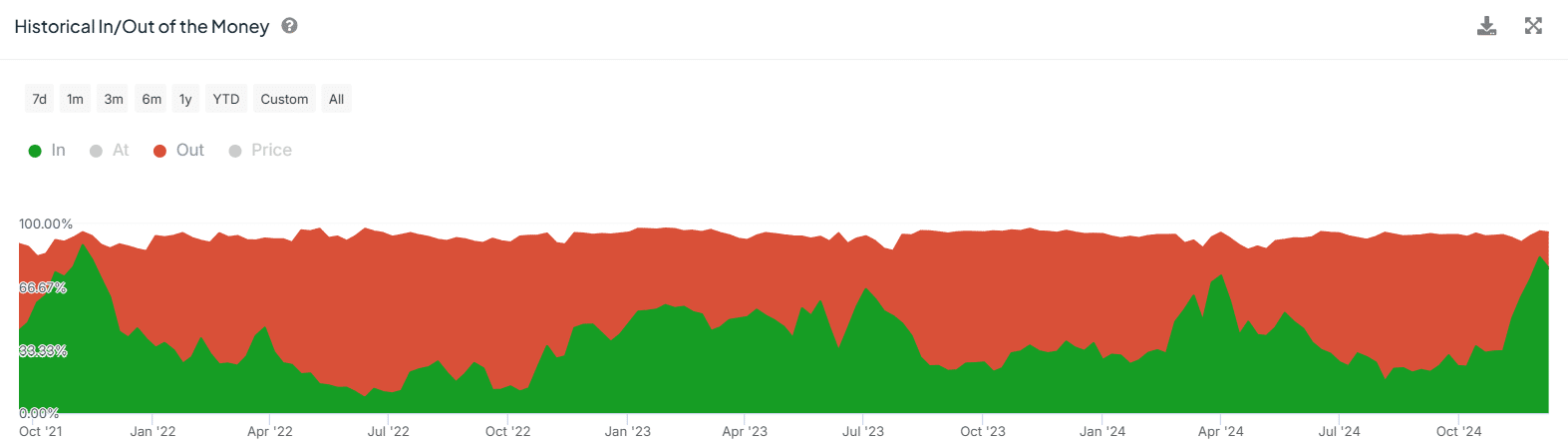

Despite this bearish outlook, nevertheless, Litecoin’s latest positive factors led to a surge within the variety of wallets which can be in revenue to its highest ranges since 2021. In reality, knowledge from IntoTheBlock revealed that 78% of LTC holders, equal to six.33 million addresses, are actually worthwhile.

Conversely, the wallets which can be in losses have dropped from 46% to 16% in only one month.

Source: IntoTheBlock

A spike in pockets profitability may enhance market confidence and result in a bullish outlook for Litecoin.

However, some merchants who purchased early and people who purchased in the course of the rally may begin to take earnings, inflicting the pattern to weaken.

Is a excessive handle depend a constructive indicator?

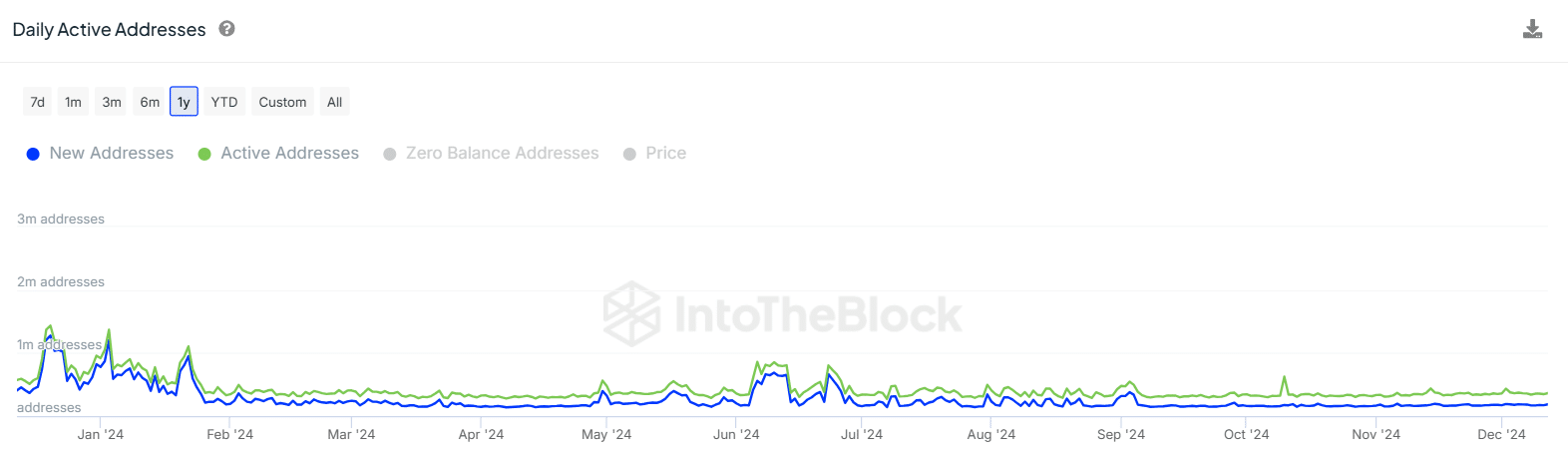

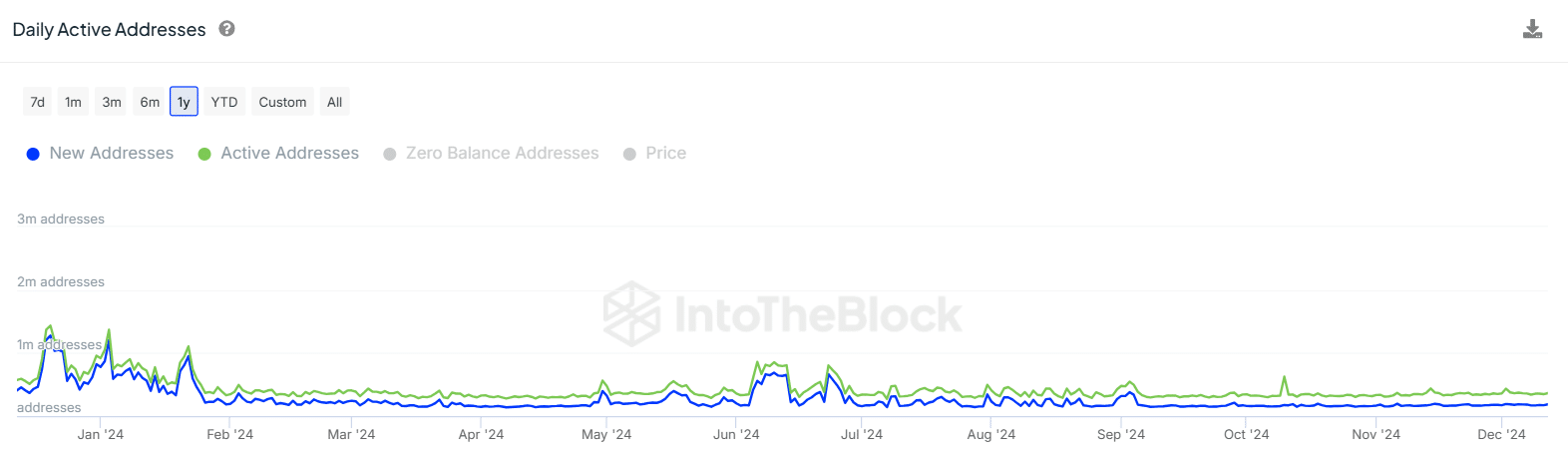

The variety of lively addresses on Litecoin stood at 364,000 at press time – The next depend than for many altcoins. For occasion, Cardano (ADA), an altcoin with a market capitalization that’s 4 instances larger, has round 41,000 lively addresses.

(Source: IntoTheBlock)

On the opposite, a have a look at the long-term image revealed that Litecoin’s handle depend has been on a downward trajectory. Especially since at the beginning of the yr, the lively addresses stood at a couple of million.

This advised that Litecoin’s utility has dropped this yr, which may have a destructive impression on the worth.

Litecoin worth evaluation as THESE bearish indicators emerge

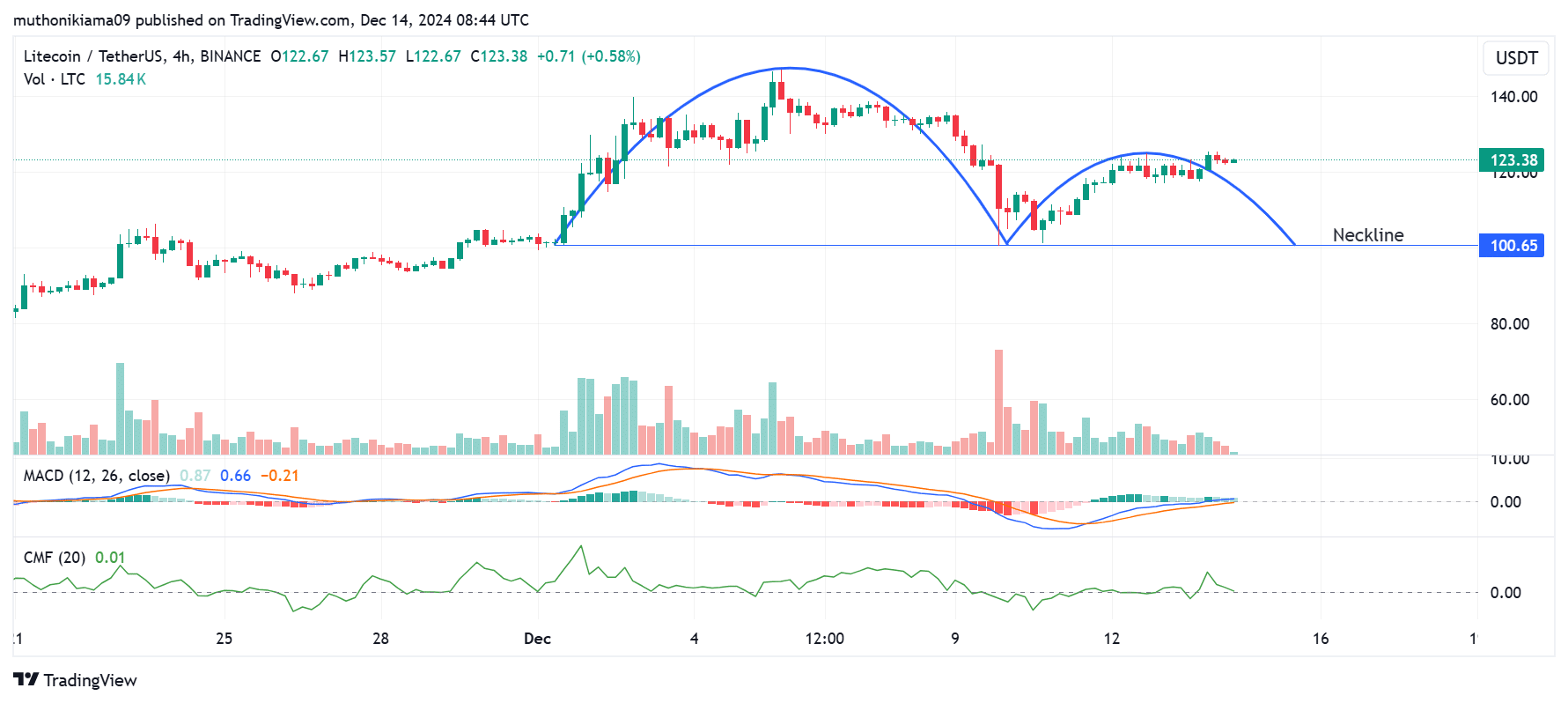

Litecoin, at press time, was buying and selling at $123 after positive factors of 1.57% in 24 hours. This altcoin may very well be on the verge of a downtrend after an inverse cup and deal with sample appeared on its four-hour chart.

If Litecoin succumbs to this bearish strain and the worth reverses itself, merchants ought to be careful for the neckline of this sample at $100.65. Especially since a drop under may set off extra losses.

(Source: Tradingview)

The Chaikin Money Flow (CMF) implied that purchasing strain has been weakening on account of its drop to the zero line. If it flips destructive, it may point out a surge in promoting exercise that might result in bearish traits.

At the identical time, the Moving Average Convergence Divergence’s (MACD) histogram bars pointed to weak shopping for strain. However, the MACD line on the decrease timeframe was constructive – An indication that momentum was nonetheless barely bullish.

Litecoin’s Open Interest drops

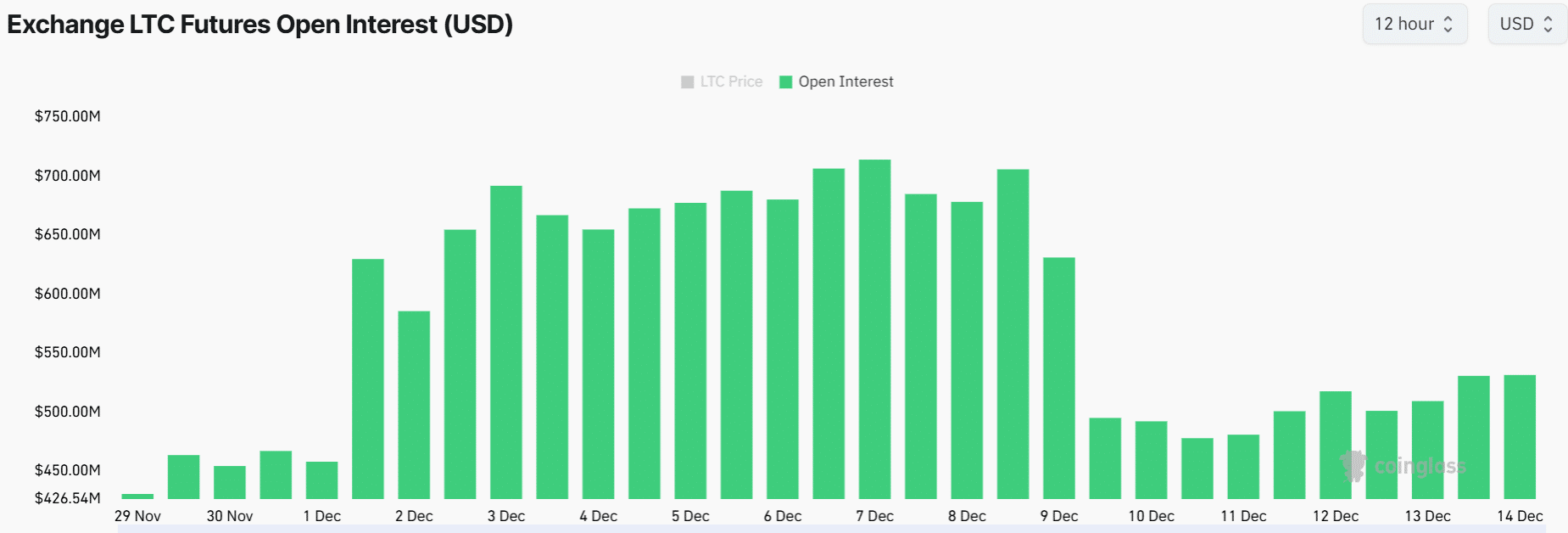

Finally, knowledge from Coinglass indicated that speculative exercise round Litecoin has dropped after hitting a multi-month peak earlier this month when the OI surged to $706M.

At press time, Litecoin’s OI had dropped to $531M – An indication that some merchants had closed their positions.

(Source: Coinglass)

A drop in OI may imply bearish sentiment on account of diminished market participation as merchants turn into cautious and indecisive.