As Michael MacGillivray noticed synthetic intelligence changing into extra ubiquitous in on a regular basis life, the 25-year-old needed his investments to mirror that. It didn’t take lengthy to determine how he needed to play the pattern.

“Whenever you take a look at AI, it’s like, all of the roads result in Nvidia,” mentioned MacGillivray, who’s spent hundreds of {dollars} on shares this 12 months from his house in Michigan. “It positively was a fantastic funding.”

MacGillivray’s purchases have contributed to the practically $30 billion poured into Nvidia on steadiness by on a regular basis buyers this 12 months, in line with knowledge from Vanda Research. That has made it the most-bought fairness by retail merchants on internet in 2024, as of Dec. 17.

Nvidia has seen nearly double the quantity of internet inflows from this group in contrast with the SPDR S&P 500 ETF Trust (SPY), which tracks the broad benchmark for the U.S. inventory market. It can also be on tempo to dethrone Tesla, the retail investor favourite that earned the most-bought title in 2023. (The agency calculates internet flows for every safety by subtracting its whole outflows from inflows.)

“Nvidia turned out to be the one inventory that form of stole the present from Tesla due to spectacular worth positive aspects,” mentioned Marco Iachini, senior vp at Vanda. “The efficiency speaks for itself.”

‘Up and up and up’

It’s the newest feather within the cap for Nvidia. The AI titan has enamored buyers huge and small for greater than a 12 months. The chipmaker gained admission to the extremely regarded Dow Jones Industrial Average final month and is, by and much, the 30-stock index’s finest performer of 2024.

Despite rocky buying and selling in December, the “Magnificent Seven” inventory is monitoring to complete 2024 greater by greater than 180%. That surge has propelled the inventory into an elite group of corporations with market caps that exceed $3 trillion. Nvidia has additionally develop into the second-most valuable company within the U.S.

Naturally, this push into Nvidia shares has resulted within the inventory taking part in a bigger position within the common investor’s holdings. Vanda knowledge reveals Nvidia has a weight of greater than 10% within the typical mom-and-pop dealer’s portfolio, up from simply 5.5% at first of 2024. It’s now the second largest holding of the typical retail investor, sitting marginally behind Tesla.

Additionally, Nvidia’s retail inflows on internet in 2024 are greater than 885% bigger than the quantity seen simply three years prior.

“Nvidia actually stands out when it comes to how rapidly retail buyers turned such a giant a part of the possession stake,” mentioned Gil Luria, head of expertise analysis at D.A. Davidson, an funding financial institution. “The ascent was outstanding.”

One of these particular person stockholders is Genevieve Khoury, a social media marketer. She first started shopping for shares in 2022 on the suggestion of her dad, who works within the expertise sector. Khoury plans to take a seat on her shares till she will money within the nest egg for a down fee on a house or different important buy.

“It saved going up and up and up,” mentioned the Los Angeles-area resident. “I’m simply holding it.”

‘Jaw dropping’

Inflows tended to spike this 12 months round Nvidia’s earnings reviews, in line with Vanda’s Iachini. Retail buyers additionally purchased in throughout an early August dip, which coincided with a broader market sell-off.

To make certain, the inventory has seen inflows cool to an extent because it misplaced some steam. D.A. Davidson’s Luria famous that shares had been costlier six months in the past than in current periods.

Even as Nvidia continued beating Wall Street expectations for earnings, it wasn’t exceeding estimates by sufficient to proceed the inventory’s speedy worth development, Luria mentioned. Now, he mentioned the inventory has come to extra “balanced” and “affordable” ranges.

Despite this current volatility, particular person buyers reminiscent of Prajeet Tripathy stay optimistic over the corporate’s management inside AI and give attention to innovation. “I believe that it’s solely going to maintain rising exponentially,” mentioned Tripathy, a current faculty graduate.

Though investing is essentially a digital exercise, market members’ love for Nvidia has spilled into the actual world. Several gathered in New York City in late August for a well–documented watch celebration centered round Nvidia’s earnings report. This occasion got here inside months of the inventory’s 10-to-1split, a transfer that’s sometimes performed to incentivize retail buyers.

While Nvidia’s retail possession is substantial, this issue hasn’t pushed the price-to-earnings a number of greater in the identical manner that it has for Tesla and Palantir, Luria mentioned. Still, Morningstar fairness strategist Brian Colello mentioned Nvidia has “pretty important” volatility for a inventory of its dimension, which may underscore the position retail merchants can play in driving share costs.

“It’s jaw dropping at occasions that such a big firm can have such a giant transfer within the inventory worth on any given day,” Colello mentioned.

What retail buyers need subsequent

2024 marks the second straight 12 months {that a} single inventory has eclipsed the SPDR S&P 500 ETF Trust in internet flows. However, sizable inflows to the ETF can assuage any considerations that buyers are forgoing broad index funds deemed protected investments, in line with Iachini. The previous two years of excessive inflows into megcap tech names can as an alternative mirror merchants chasing the ongoing bull market, Iachini mentioned.

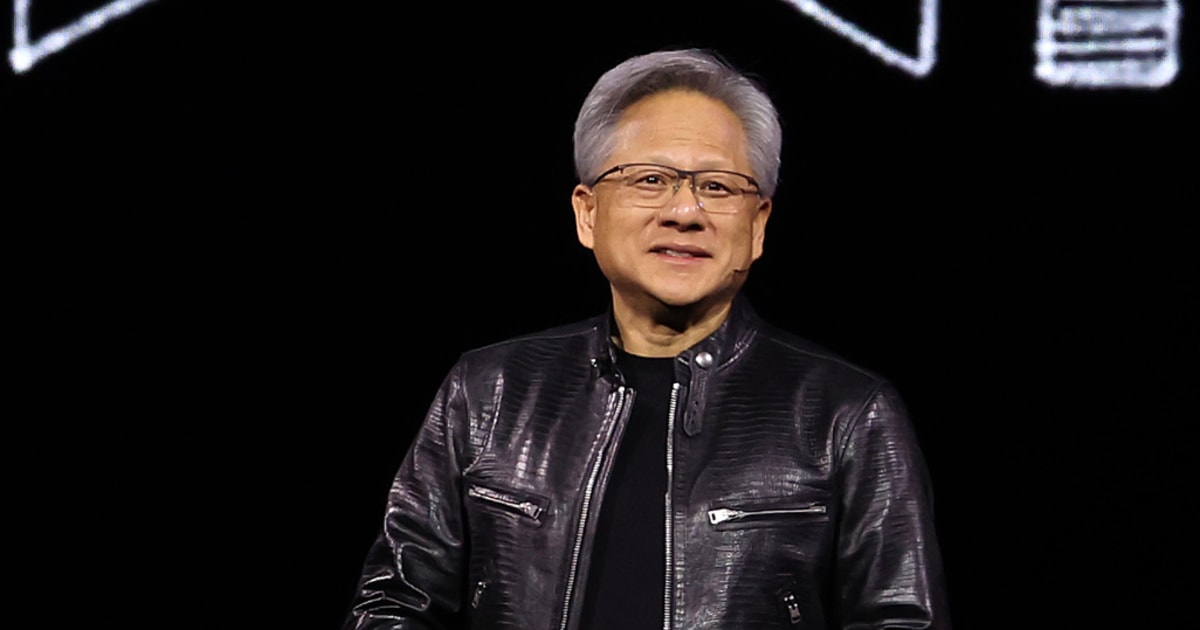

Notwithstanding robust returns, Iachini mentioned, Nvidia is usually a stunning choose for the everyday at-home investor. Despite Nvidia CEO Jensen Huang’s signature leather-based jacket, the corporate lacks a “God-like” character that may garner retail investor consideration, Iachini mentioned. For an instance, he pointed to Tesla CEO Elon Musk, who made waves this 12 months for his public backing of President-elect Donald Trump through the marketing campaign.

Looking forward, Palantir has gained traction among the many retail crowd through the fourth quarter and might be a favourite within the new 12 months, Iachini mentioned. The software program inventory has been the ninth most-bought safety on steadiness in 2024, beating Amazon, Alphabet and Microsoft, per Vanda knowledge.

Palantir CEO Alex Karp thanked small-scale investors throughout a video posted Sunday that was set in opposition to a snow-covered backdrop. “Exceedingly grateful to all of you particular person buyers who took the time and alternative, and had the braveness to look previous standard, rusty, crusty platitudes,” Karp mentioned within the clip, whereas sporting reflective goggles and gripping ski poles.

Fittingly sufficient, Palantir was one current pickup from Khoury, the social media marketer in California, on a buddy’s recommendation. Khoury is eager for a Nvidia-like run, so she will retain bragging rights with acquaintances who consider they know extra about investing than her. It’s going properly to date: The inventory has skyrocketed near 380% in 2024, making it one of the best performer within the S&P 500 year-to-date.

“Multiple occasions in faculty, individuals would try to discuss to me about it like I didn’t know what I used to be speaking about,” mentioned Khoury, who graduated this 12 months with a level in finance. “I’m like, certain, yeah, I don’t know what I’m speaking about, however I do have Nvidia.”

“Probably,” she mentioned, “my portfolio appears to be like higher than yours.”