The lack of CEO Pat Gelsinger from chipmaker Intel (INTC) has left the corporate’s future wanting a bit shaky. But it will get even worse as Intel misplaced loads of floor below Gelsinger’s management, and a brand new report from The Wall Street Journal reveals simply how a lot it misplaced.

Don’t Miss our Black Friday Offers:

The report famous that Gelsinger was concerned with Intel for a very long time as he started with the corporate as an entry-level technician. Those who interviewed Gelsinger years in the past discovered him “…good, very aggressive and considerably smug.” That may sound like blended reward, however the notes additionally mentioned: “He’ll match proper in.”

Gelsinger took over as CEO in 2021, and, within the course of, price Intel $150 billion value of worth. To be truthful, Intel misplaced loads of floor properly earlier than Gelsinger’s arrival, as lots of its key rivals have been getting forward of it. Gelsinger’s mandate was clear: make up for misplaced time. That was what Gelsinger got down to do, and put loads of give attention to chip manufacturing, a transfer which in the end failed to supply the supposed outcomes.

Still Not Producing Results

Speaking of outcomes, this was some extent underscored shockingly properly by the 18A manufacturing course of that’s mentioned to be failing Intel. The yield charges linked with this course of are solely hitting about 10%. This is hindering mass manufacturing to the purpose the place it’s not possible to carryout, say media stories.

We had heard beforehand that Broadcom (AVGO) was not pleased with the 18A course of, noting related points with yield charges that left 18A unable to achieve high-volume mass manufacturing. At the time, Broadcom shutdown its orders with Intel and began searching for higher choices. Now, we now have a greater concept of simply what sort of yield charges have been being generated, and the information is something however good.

Is Intel Stock a Buy?

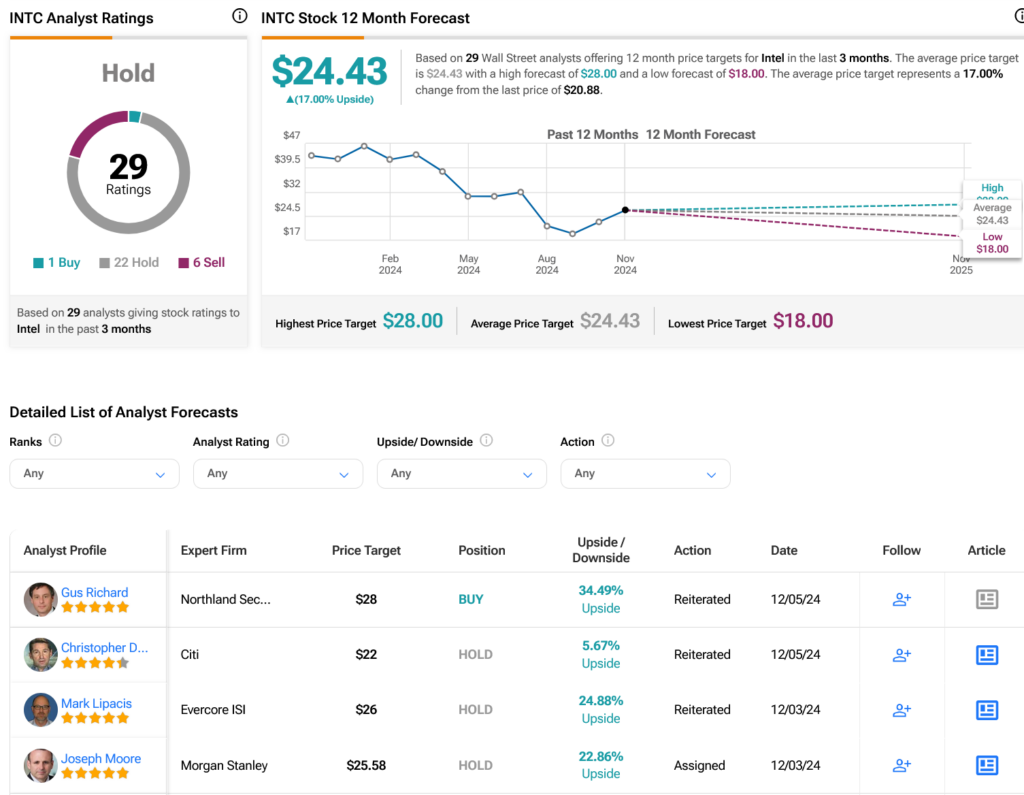

Turning to Wall Street, analysts have a Hold consensus score on INTC inventory primarily based on one Buy, 22 Holds and 6 Sells assigned prior to now three months, as indicated by the graphic under. After a 48.93% loss in its share value over the previous 12 months, the common INTC value goal of $24.43 per share implies 17% upside potential.

See extra INTC analyst scores

Disclosure