Rigetti Computing Stock (NASDAQ:RGTI) has been a key beneficiary of the current buzz round quantum computing (QC). Recent breakthroughs, similar to Alphabet’s Willow chip – which might full calculations in simply 5 minutes that might take classical computer systems an astonishing sextillion years – have fueled pleasure throughout the sector.

Pick the perfect shares and maximize your portfolio:

This surge in curiosity has led some to query whether or not QC may very well be the following technological leap to drive record-breaking valuations. If that proves true, the race to establish the businesses on the forefront of this rising business will solely intensify.

Among the frontrunners, RGTI stands out as a developer of QC techniques, quantum processors, and the operator of Forest — a cloud-based platform for quantum algorithm improvement. Riding the momentum, the corporate’s inventory has seen a meteoric rise lately.

With its share value skyrocketing by a whopping 1,225% over the previous three months, some have begun likening RGTI to ‘the Nvidia of the quantum realm.’ One such voice is James Foord, an investor ranked within the high 4% of TipRanks’ inventory professionals.

“I see some similarities between Rigetti and NVIDIA, as the corporate not solely produces {hardware} but in addition has Forest, which I’d liken to CUDA, as it’s an ecosystem that enables builders to construct software program for quantum computer systems,” Foord opined.

While Foord cautions that RGTI just isn’t for the “faint of coronary heart,” the investor sees a lot benefit in gaining publicity to the rising QC business. Suggesting that “quantum computing may very well be the following huge factor after AI,” Foord notes that investments on this house are shortly choosing up steam.

Rigetti’s present partnership with Nvidia underscores its ambition to dominate as a key provider of quantum computing chips. Although rivals like Google loom massive, Foord believes “Rigetti seems like it might be forward of its rivals.”

Despite the “speculative nature” of the business, Foord charges RGTI shares as Buy. (To watch Foord’s monitor file, click on right here)

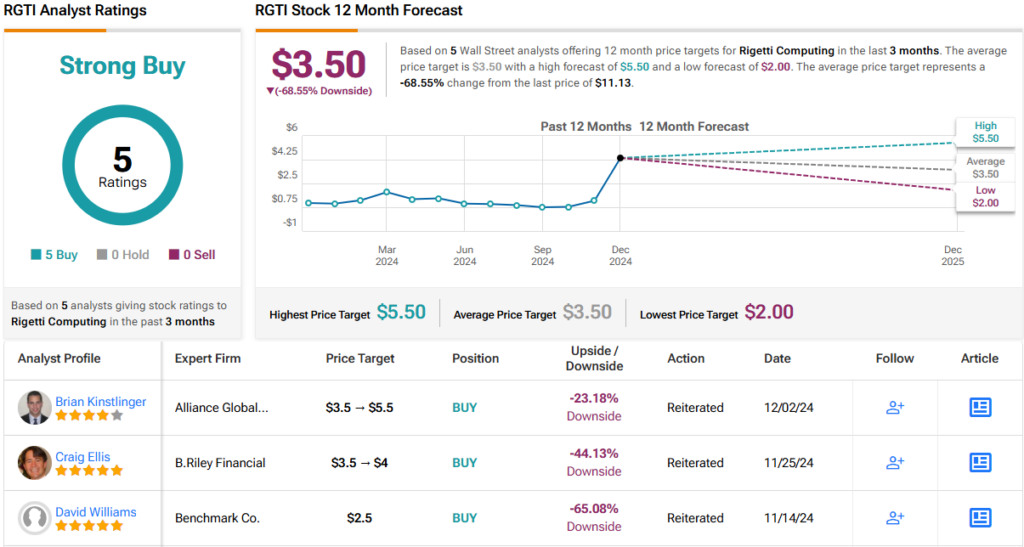

Wall Street appears to agree that RGTI is well worth the threat. With 5 unanimous Buy suggestions and no Holds or Sells, RGTI boasts a Strong Buy consensus score. However, even probably the most bullish analysts seem caught off guard by the inventory’s sudden rise. With a 12-month common value goal of $3.50, shares at present commerce at ranges that suggest a possible draw back of just about 69%. This disconnect could also be the results of analysts struggling to revise targets shortly sufficient to maintain up with Rigetti’s blistering tempo. (See RGTI inventory forecast)

To discover good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured investor. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.