The Future Fund LLC Managing Partner and Tesla TSLA bull Gary Black stated on Friday that the EV firm’s earnings per share (EPS) revisions haven’t stored tempo with the inventory worth surge since Donald Trump’s victory within the Presidential elections.

What Happened: “We know that $TSLA is up +51% YTD (vs NDX +28%), all of which is for the reason that Nov election (TSLA +50% vs NDX +7%) on the assumption that ally Trump can streamline TSLA’s efforts to safe autonomous deployment licenses. The query is: Have TSLA Adj EPS ests elevated as effectively? The quick reply will not be a lot,” Black stated on Friday.

Black famous that Tesla’s FY2025 adjusted EPS estimates are up by just one.6% for the reason that election.

“Put in a different way, all of TSLA’s +50% worth appreciation for the reason that election displays P/E growth, which on FY’25 eps ests have elevated from 77x earlier than the election to 114x at the moment (+48%),” he stated whereas including that he continues to be “very bullish” on the inventory.

However, Black additionally stated that he’s “cautious” as he believes a number of expansions ought to replicate an acceleration in earnings development. The growth, he stated, might come subsequent yr if Tesla will get robotaxi deployment permits from Texas and California or if different automakers try and license the corporate’s full self-driving driver help software program.

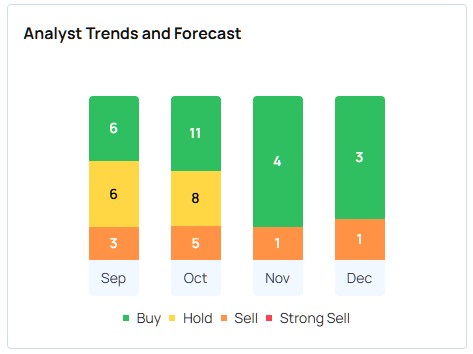

Why It Matters: Overall, analysts have a consensus score of “Buy” on the Tesla inventory, with the very best worth goal being $411. The most up-to-date analyst rankings by Guggenheim, BofA Securities, and Roth MKM have a median worth goal of $318.33, implying an 18% draw back.

Tesla shares closed up 5.3% at $389.22 on Friday. The inventory is up by almost 57% year-to-date, taking its market capitalization over $1 trillion, in keeping with knowledge from Benzinga Pro.

Check out extra of Benzinga’s Future Of Mobility protection by following this hyperlink.

Read Next:

Photo courtesy: Tesla

Overview Rating:

Speculative

Market News and Data dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.