Tesla Inc TSLA inventory closed up 2.9% at $400.99 on Tuesday and is up 1.55% in pre-market buying and selling after back-to-back value goal (PT) revisions by analysts, with the newest PT revisions coming from Cantor Fitzgerald and Morgan Stanley.

What Happened: Cantor Fitzgerald on Tuesday hiked Tesla’s value goal from $255 to $365 whereas sustaining a “impartial” score.

Morgan Stanley additionally hiked Tesla’s goal value from $310 to $400 whereas sustaining an “obese” score.

The two are the newest PT revisions for Tesla in the previous couple of weeks. The firm witnessed its final PT downgrade in September from RBC Capital. RBC Capital then lowered the corporate’s PT from $227 to $224. However, the funding financial institution has since then elevated PT and now has an “outperform” score on the inventory and a $313 value goal.

Year-to-date, the Tesla inventory has gained over 61%, including practically $490 billion to investor wealth on this interval. Tesla’s market capitalization has elevated from $797 billion at the start of 2024 to $1.287 trillion as of market shut on Tuesday.

Why It Matters: The most important value goal hike in latest weeks, nevertheless, is from Roth MKM analyst Craig Irwin, who was bearish on Tesla for a very long time. Last week, Irwin raised the EV firm’s value goal by 347% from $85 to $380 and upgraded the score to a “purchase” from “impartial.”

“I don’t see very many unfavorable catalysts… There are plentiful optimistic catalysts… Bias is now to the upside, not the draw back. The market cap could also be large… however they’re doing huge issues,” Irwin then stated.

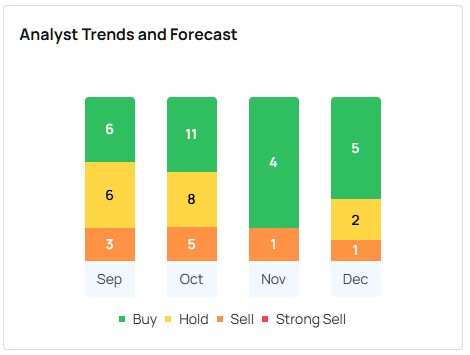

Overall, 33 analysts have a consensus score of “Buy” on the Tesla inventory, with the best value goal being $411 and the bottom value goal being $24.86. The most up-to-date analyst scores by Cantor Fitzgerald, Morgan Stanley, and Deutsche Bank have a median value goal of $378.33, implying a 6.86% draw back.

Tesla inventory is up by 61.4% year-to-date, in accordance with information from Benzinga Pro. The inventory began rallying steadily since Trump’s landslide victory within the U.S. Presidential elections.

Check out extra of Benzinga’s Future Of Mobility protection by following this hyperlink.

Read Next:

Photo courtesy: Tesla

Overview Rating:

Speculative

Market News and Data delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.