Super Micro Computer Inc. SMCI inventory surged practically 9% in after-market hours buying and selling after the corporate obtained an extension from Nasdaq to file its overdue annual and quarterly studies by Feb. 25.

What Happened: The AI server producer, identified for its superior liquid cooling expertise, has been beneath scrutiny since August when it delayed its annual report submitting, citing the necessity to consider inside controls over monetary reporting.

This delay got here shortly after Hindenburg Research disclosed a brief place, alleging accounting and governance points.

Last month, Super Micro appointed BDO USA as its new auditor and submitted a compliance plan to Nasdaq to deal with the itemizing risk. The firm goals to finish all obligatory filings by the prolonged deadline to keep up its Nasdaq itemizing.

Additionally, Super Micro has launched a seek for a brand new finance chief, following suggestions from a particular committee investigating its accounting practices.

See Also: Dormant Bitcoin Whale Awakens After 11 Years, Moves $257M Worth Of BTC

Why It Matters: The extension granted by Nasdaq is an important step for Super Micro because it navigates via a difficult interval marked by auditor resignations and allegations of misconduct.

In October, the corporate’s impartial auditor, Ernst & Young, resigned over governance and transparency considerations, inflicting a big drop in inventory worth. This resignation prompted the formation of an impartial particular committee to assessment the allegations.

In early December, the committee concluded its assessment, discovering no proof of misconduct by the corporate’s administration or board. This discovering led to a considerable enhance in Super Micro’s inventory value, with shares leaping over 30% following the announcement. Despite these optimistic developments, analysts from JPMorgan have suggested buyers to observe the acceptance of the committee’s findings by the newly appointed auditors, BDO.

The ongoing demand for Super Micro’s AI servers, significantly within the synthetic intelligence sector, underscores the significance of resolving these points swiftly.

Price Action: SMCI inventory closed at $43.93 on Friday, up 6.8% for the day. In after-market hours, it surged by 8.9%. Year-to-date, SMCI inventory is up 54%, in response to information from Benzinga Pro.

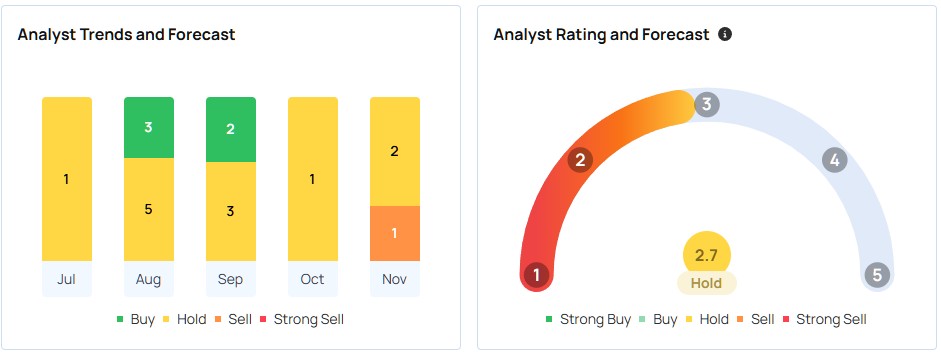

Furthermore, Benzinga Pro information reveals analysts have a consensus “Buy” ranking on the SMCI inventory. Based on the three most up-to-date analyst rankings from Goldman Sachs, JP Morgan, and Wedbush, the typical value goal of $27.67 implies a draw back of 37%.

Read Next:

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and printed by Benzinga editors.

Photo courtesy: Wikimedia

Market News and Data dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.