Last Updated:

Gold Outlook For 2025: The macroeconomic background may stay beneficial for the dear metallic as rates of interest fall and foreign-reserve diversification continues amid geopolitical tensions, producing an ideal storm for gold.

With the continued geopolitical, political and macro uncertainty, gold and silver are anticipated to retain their enchantment as a hedge in opposition to inflation.

Authored By Renisha Chainani:

Gold and silver had an impressive 2024 with costs rising greater than 25 per cent. Gold reached an all-time excessive of $2800 (Rs 80,000) on October 31 and Silver touched a file excessive of $35 (Rs 1,00,000) on October 23, — pushed by its operate as a “protected haven” amid geopolitical and political uncertainty.

Five components that supported gold and silver in 2024 and can proceed to affect in 2025 are:

1. Monetary Easing

In response to slowing inflation and altering financial situations, central banks world wide modified their financial coverage from tightening to easing in 2024, which finally was useful for valuable metals. The FOMC lowered the federal funds and rates of interest 3 times in 2024 and Lower borrowing prices are optimistic for gold because the metallic doesn’t pay curiosity.

The FOMC expects two price cuts in 2025, implying a cautious stance towards future financial easing. Moreover, following two years of tightening, the ECB started to ease financial coverage in 2024, consistent with international tendencies. This change makes an attempt to spice up financial development whereas inflation falls. The BoE’s November 2024 Monetary Policy Report indicated a shift in the direction of easing, echoing a worldwide development amongst central banks to encourage financial development as inflation pressures fall. Meanwhile, it’s projected that the Bank of Japan will hike rates of interest twice in 2025.

2. Political Uncertainty

Donald Trump who has received the presidential election within the United States, has proposed insurance policies that might reignite inflation. The findings point out substantial alterations in coverage and financial initiatives, with doable implications for international markets and geopolitics. In lower than two months, Trump has issued import obligation threats in opposition to China, Canada, Mexico, and all 9 BRICS members. In doing so, Trump is reigniting fears of worldwide commerce wars and inflicting international financial uncertainty.

The US authorities continues to run giant finances deficits, the US debt is rising, and curiosity funds have risen. While latest rate of interest lower have eased among the strain, there’s little signal of a drop in authorities expenditure, thus the US will almost certainly need to inflate away the debt, which is able to profit gold and silver in the long term.

3. Inflation

Inflation, which has alarmed policymakers and buyers lately, continues to normalize. However, progress could also be gradual, and specifics will differ per nation. In the United States, inflation could rise by the tip of 2025 as a consequence of greater pricing and labour bills attributable to new tariff and immigration insurance policies, earlier than returning to a reducing development in 2026 as GDP slows. In each the eurozone and the United Kingdom, inflation is anticipated to fall steadily regardless of underlying development difficulties. All these uncertainties concerning inflation would flip optimistic for gold and silver.

4. Investment Demand

Central banks remained key gamers within the gold market, boosting international gold holdings by virtually 745 tonnes within the first ten months of 2024. The Reserve Bank of India bought 77 tonnes of gold, representing a fivefold improve over the identical interval in 2023. Gold at the moment accounts for 10.2% of the RBI’s foreign money reserves, up from 7.8% a yr earlier. This makes the RBI one of many high gold consumers amongst central banks in 2024. The Turkish Central Bank purchased 72 tonnes of gold, adopted by the Polish Central Bank’s acquisition of 69 tonnes. This underlines gold’s significance as a strategic asset for central banks in threat administration and reserve diversification.

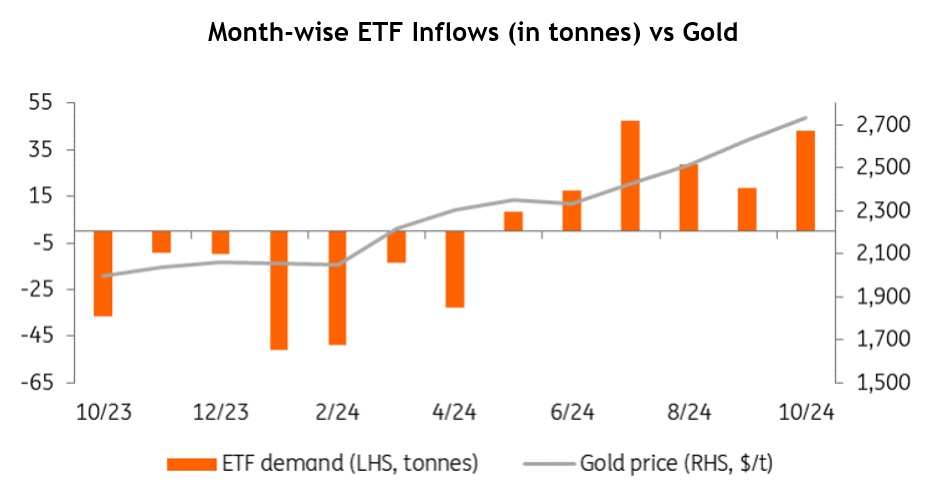

Furthermore, globally gold ETFs had inflows for the previous six months consecutively, led by North American and Asian international locations. Investors incessantly improve their holdings of gold ETFs when gold costs rise, and vice versa. However, gold ETF holdings have fallen throughout 2024 as spot gold costs have reached new highs. ETF flows lastly turned optimistic in May.

Major central banks are anticipated to proceed shopping for gold, albeit in smaller portions than final yr. ETF buyers returned to gold within the second half of 2024, following a protracted sell-off. If the Chinese authorities’s financial stimulus efforts succeed, China and India may present a agency basis for gold demand in 2025.

5. Geopolitical Uncertainty

Geopolitical dangers such because the battle in Ukraine and the state of affairs within the Middle East persist. There are rising hazards, similar to considerations about European sovereign debt and geopolitical unrest in international locations similar to South Korea and Syria. Gold has typically been seen as a protected haven throughout troublesome instances. This international financial uncertainty, mixed with the anticipated improve in inflation attributable to potential commerce wars, can have severe penalties for international monetary markets, however it’s going to almost certainly profit valuable metals costs, given gold’s position as common safe-haven property and conventional inflation hedges. With Donald Trump’s return as US president, there’s prone to be better uncertainty about commerce and tariffs, which ought to strengthen the gold value.

Outlook for 2025

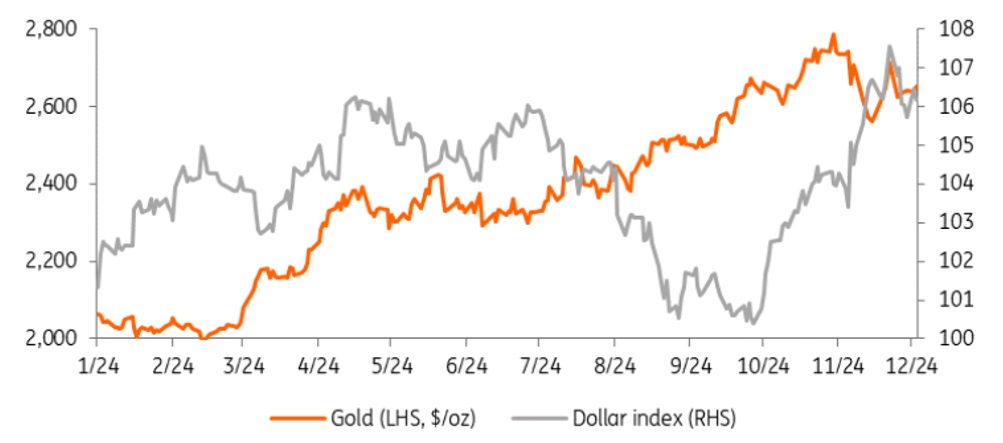

The upward development of valuable metals is anticipated to proceed within the quick to medium time period. The macroeconomic background is prone to stay beneficial for the dear metallic as rates of interest fall and foreign-reserve diversification continues amid geopolitical tensions, producing an ideal storm for gold. In the long run, Trump’s proposed insurance policies, which embrace inflationary tariffs and stronger immigration controls, will constrain the Federal Reserve’s capacity to lower rates of interest. A better US greenback and a tighter financial coverage could finally current some headwinds for gold. Increased commerce friction, however, could strengthen gold’s enchantment as a safe-haven.

With the continued geopolitical, political and macro uncertainty, gold and silver are anticipated to retain their enchantment as a hedge in opposition to inflation. Investors could undertake a “purchase on dips” technique because the metallic is anticipated to expertise periodic oscillations, however the long-term view stays beneficial for the subsequent 5-6 months and costs are anticipated to the touch $3,000 (Rs 85,000) for gold and $38 (Rs 1,15,000) for silver.

On the draw back, $2,500 (Rs 73,000) is anticipated to be a powerful help for gold and $28 (Rs 85,000) for Silver. Therefore, a 12 per cent upside is anticipated in gold and a 25 per cent upside in silver with a really restricted 3-4 per cent draw back from present ranges. One ought to at the very least allocate 10 per cent of the funding portfolio to gold and 10 per cent to silver for 2025 for higher risk-adjusted returns.

(The creator is head of analysis, Augmont Gold For All)