- XRP faces mounting resistance close to $2.40, triggering a ten% correction to $2.00

- Liquidations and profit-taking add stress, making the $2.00 degree essential for XRP

XRP’s rally hit a wall at $2.40, plunging over 10% to check the crucial $2.00 help. While the broader market weak spot performs a job, mounting liquidations and profit-taking look like accelerating the drop.

As merchants eye the $2.00 degree, the query looms: can XRP maintain the road or is extra draw back forward?

XRP rally stalls at $2.40 amid mounting resistance

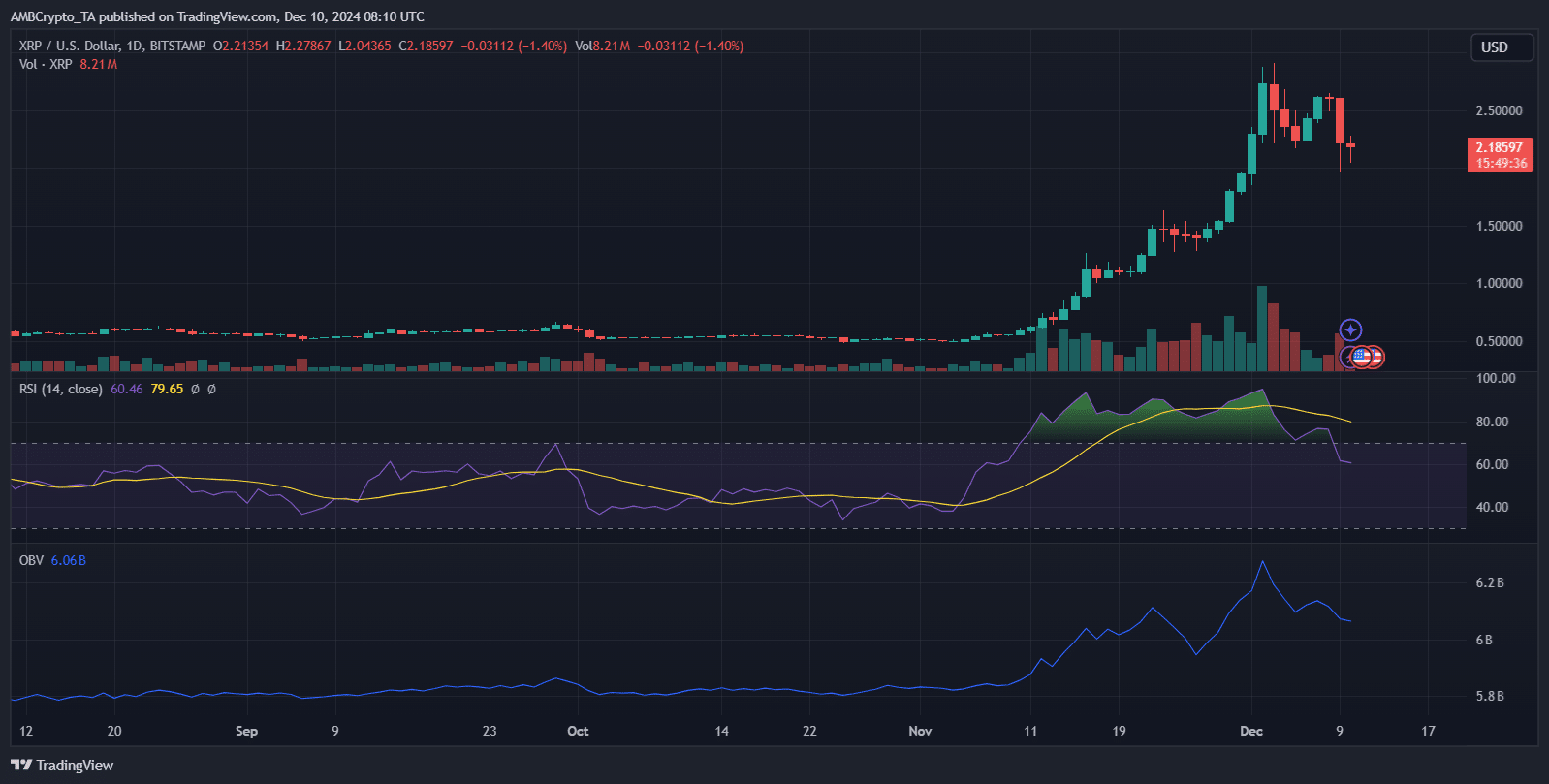

Source: TradingView

XRP’s rally to $2.50 was abruptly halted on the $2.40 resistance, resulting in a pointy correction under $2.30. The each day RSI has retreated from overbought ranges, because it hit 60.65 at press time, indicating waning bullish momentum.

Meanwhile, the OBV confirmed a decline from its peak, reflecting decreased shopping for stress and fading market enthusiasm.

Despite a minor restoration above $2.20, XRP’s failure to regain the $2.30 mark, mixed with bearish momentum indicators, suggests persistent promoting stress.

Without a decisive push above $2.30, XRP may stay weak to additional losses, with $2.00 rising as a crucial help degree to look at.

The $2 help: XRP’s crucial line within the sand

The $2.00 degree stands as a pivotal help for XRP, each psychologically and technically. Historically, key spherical numbers like $2.00 act as a magnet for merchants, usually serving as a robust ground or set off level for additional declines.

Technically, shedding this degree may sign a shift in XRP’s medium-term pattern, with potential for a deeper correction towards the $1.88 and even $1.75 help zones.

A decisive break under $2.00 may additionally set off a cascade of liquidations as leveraged positions unwind, amplifying promoting stress. With the RSI already in bearish territory and the value struggling under main shifting averages, holding $2.00 is crucial.

If this help fails, it may spark heightened volatility and doubtlessly derail bullish restoration efforts within the close to time period.

The function of liquidations and investor sentiment

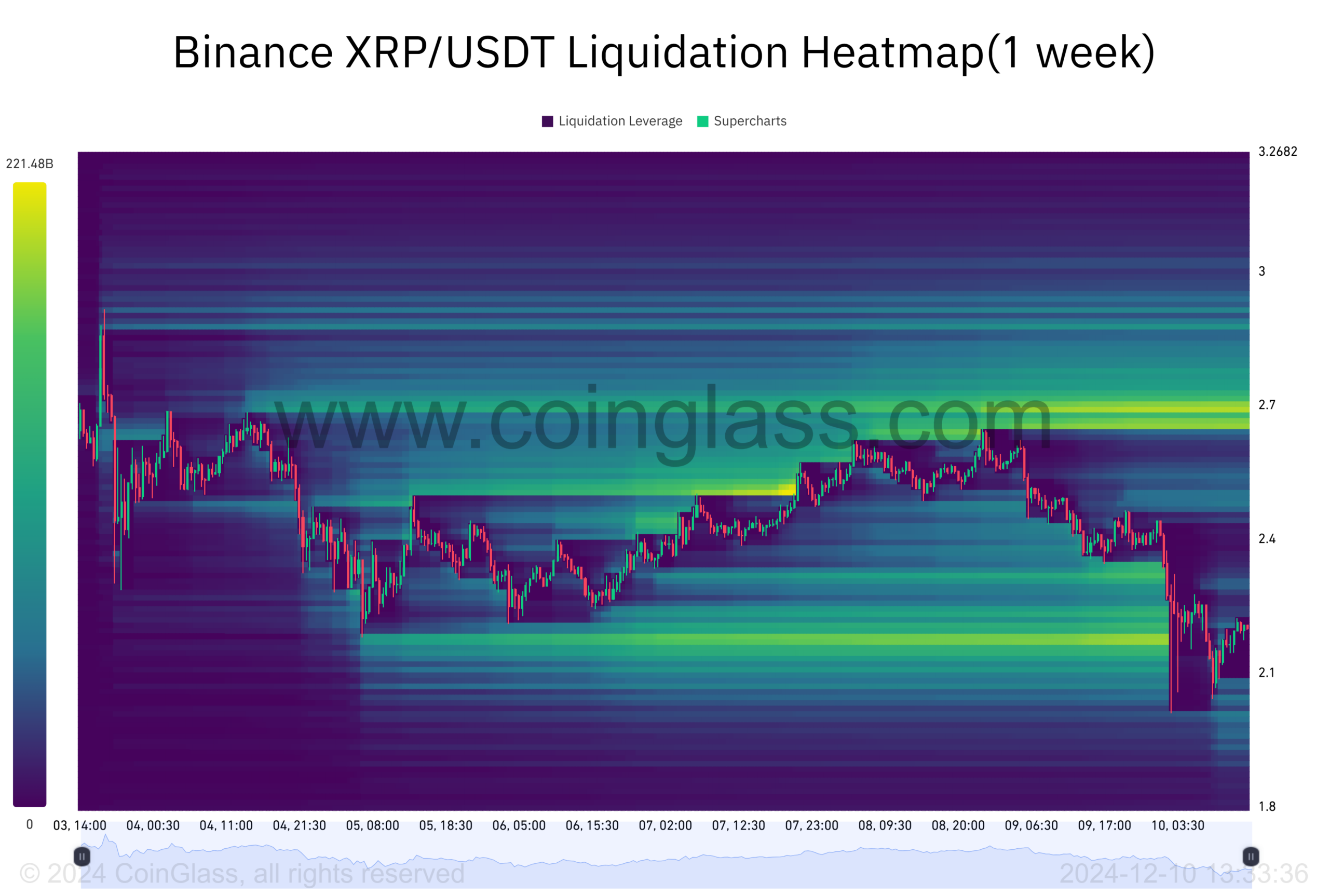

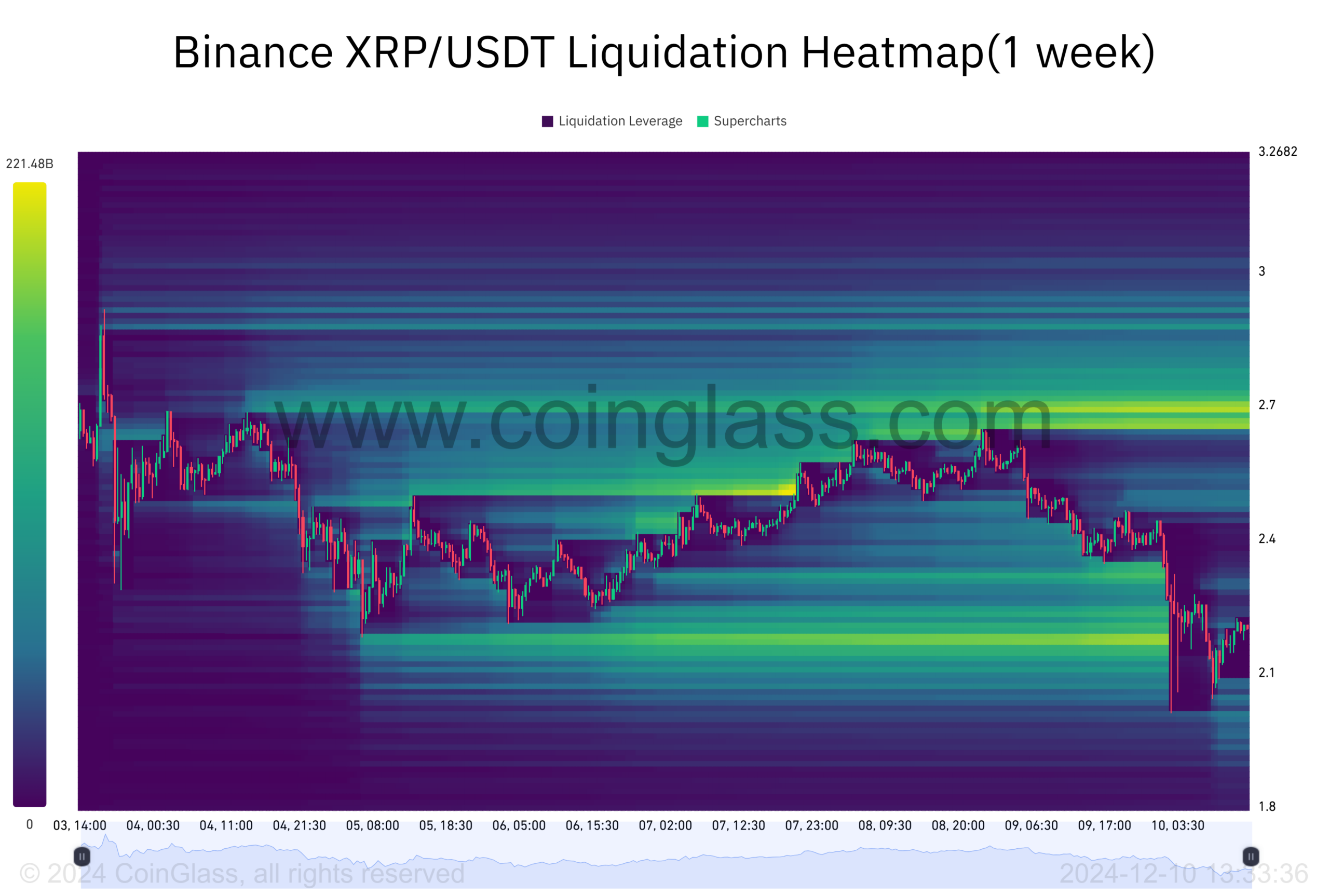

Liquidation knowledge reveals important turbulence throughout XRP’s drop from $2.50 to $1.98. The heatmap highlights clustered liquidations between $2.40 and $2.25, with intensified exercise close to $2.10 as lengthy positions have been forcibly closed.

This suggests overleveraged merchants contributed to the value cascade, compounding bearish momentum.

Source: Coinglass

On-chain habits signifies a surge in retail exits alongside potential whale sell-offs as XRP approached crucial help. If the $2.00 degree is breached, extra liquidation cascades may amplify draw back volatility, mirroring current patterns.

These dynamics present the precarious stability between technical ranges and market sentiment.

Is XRP poised for a reversal or extra losses?

XRP’s capacity to reverse its downtrend hinges on whether or not it may well reclaim the $2.30 resistance and stabilize – the trail to restoration appears unsure, particularly as liquidation pressures persist.

Read XRP’s Price Prediction 2024–2025

A bounce from the $2.00 help may spark a short-term restoration, but when promoting momentum accelerates, XRP dangers deeper declines, doubtlessly focusing on sub-$2.00 ranges.

The upcoming value motion will rely closely on broader market sentiment and the habits of leveraged merchants, making a decisive transfer essential for XRP’s subsequent course.