- Recent information confirmed a major outflow of XRP by whales from one of many high exchanges.

- Market sentiment was bullish, with expectations that XRP may attain $4 earlier than establishing a brand new buying and selling vary.

Over the previous month, XRP skilled a exceptional rally, recording a 148.54% enhance in worth. However, its momentum has slowed, coming into what seems to be an accumulation section.

This interval of consolidation has contributed to a extra subdued worth development, leading to weekly losses of two.43% and a each day dip of 0.93%.

Analysis by AMBCrypto highlighted the opportunity of a worth restoration, however there was a risk that the method could face delays, relying on market circumstances.

Whales set off market-shifting strikes in XRP

According to Whale Alert, XRP has seen a major outflow from Binance, one of many largest cryptocurrency exchanges, over the previous 24 hours.

Tracking information confirmed that 800,000 XRP, valued at $1,927,321,529 on the time of recording, was moved out of the trade.

Large-scale outflows like this typically factors to a bullish market sentiment.

Investors transferring sizeable holdings from exchanges to non-public wallets usually point out a choice for holding fairly than promoting, as personal wallets are much less generally used for buying and selling.

This development means that whales are positioning themselves for potential long-term features.

If such outflows persist, they might result in a provide squeeze, decreasing the liquidity of XRP on exchanges and probably driving up its worth.

XRP stays in an accumulation section, with its worth oscillating inside an outlined vary over the previous weeks.

XRP may attain $4 after accumulation

The latest whale-driven provide squeeze exhibits the opportunity of a breakout from this section. Should a breakout happen, XRP may climb by 66.44%, reaching roughly $4.

This accumulation section in technical time period is called a symmetrical triangle, which entails buying and selling forwards and backwards, inside a converging assist and resistance.

Source: Trading View

If a breakout doesn’t materialize, XRP is prone to stay within the accumulation section, buying and selling sideways with out important worth actions, notable features, or substantial losses till the section concludes.

AMBCrypto analyzed the market sentiment round a possible bullish transfer, discovering a combined response amongst buyers concerning XRP’s near-term trajectory.

XRP market exhibits contradictory alerts

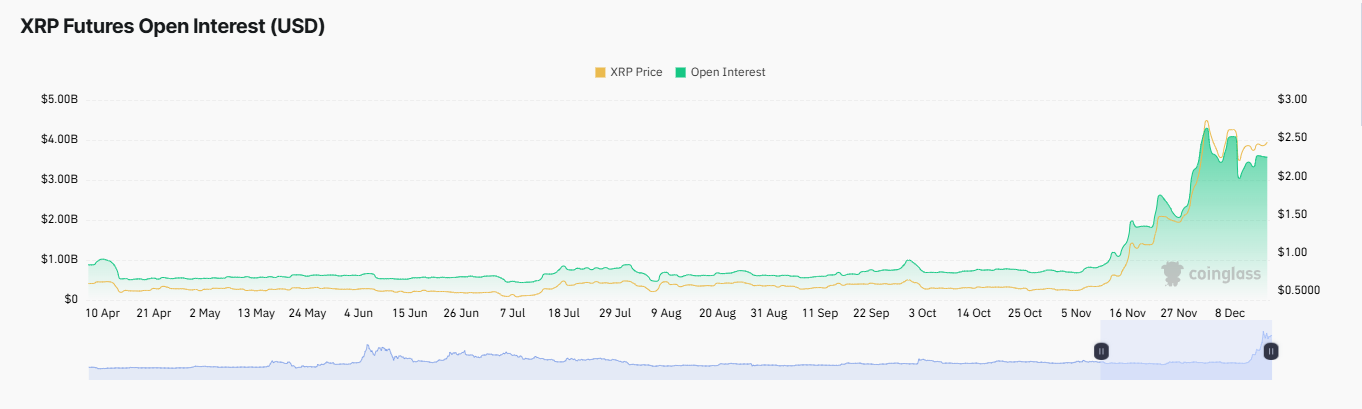

At the time of writing, XRP’s Open Interest (OI) has dropped by 2.35% during the last 24 hours, standing at $0.35 billion.

A gradual decline in Open Interest signifies that the worth of quick positions outweighs lengthy positions available in the market, suggesting lingering downward stress on the asset.

Read XRP’s Price Prediction 2024–2025

However, the Funding Rate gives a glimmer of optimism because it stays within the bullish territory with a optimistic studying of 0.0102% over the identical interval.

Source: Coinglass

While the bullish Funding Rate aligns with the present optimistic sentiment, a reversal in Open Interest tendencies could be essential to solidify a transparent market course for XRP.