- Algorand’s TVL jumped 300% in a month, with Folks Finance driving DeFi development.

- ALGO’s worth maintains bullish momentum, supported by rising community exercise.

Algorand [ALGO] has seen a exceptional enhance in Total Value Locked (TVL) over the previous month. Fueled by protocols like Folks Finance, this development displays a renewed curiosity in Algorand’s ecosystem.

Meanwhile, regardless of minor retracements, ALGO’s bullish worth efficiency and rising community exercise spotlight sustained momentum.

DeFi driving the Algorand surge

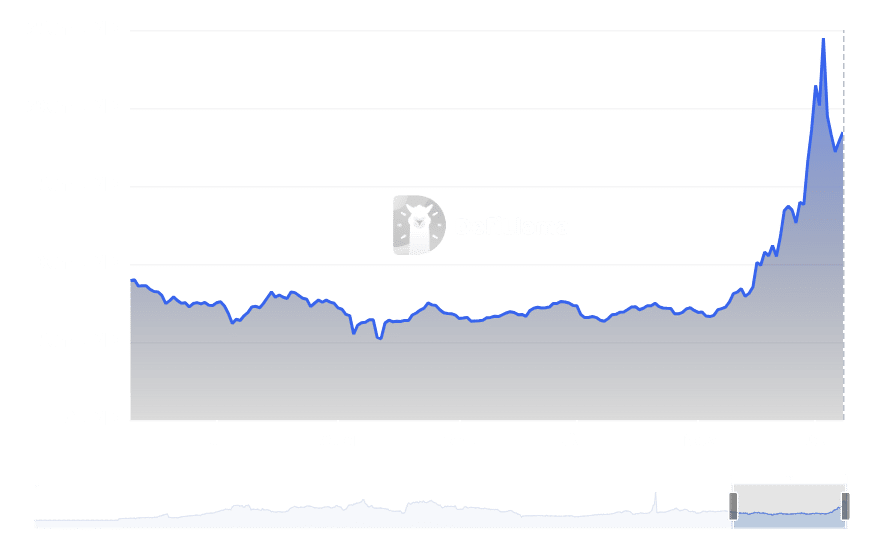

Algorand has skilled a powerful surge in Total Value Locked (TVL), recording over 300% development prior to now 30 days, in response to DeFiLlama.

On the third of December, the blockchain’s TVL hit $244.74 million, its second-highest degree in historical past.

However, on the time of writing, TVL has settled round $184.5 million, reflecting a slight retracement however sustaining an upward trajectory.

Source: DefiLlama

The TVL development was considerably propelled by Folks Finance, which noticed a 289% enhance over the previous month, with greater than $284 million in property locked.

This makes it the main protocol driving Algorand’s DeFi ecosystem growth. Other DeFi protocols on Algorand have additionally seen a gentle enhance in exercise, signaling a renewed curiosity in its ecosystem.

Price efficiency: Bullish momentum sustained

Algorand’s native token, ALGO, has mirrored the constructive on-chain metrics with substantial worth positive factors.

ALGO was buying and selling at $0.4965, reflecting a slight dip from its latest highs however sustaining a robust general uptrend. The token broke above its 200-day shifting common, signaling a bullish outlook.

Source: TradingView

The Relative Strength Index (RSI) of 74.08 means that ALGO is at present in overbought territory, indicating potential consolidation or profit-taking.

However, the Average Price Oscillator (APO) continues to show upward momentum, highlighting sustained bullish sentiment.

Volume evaluation: Network and market exercise surge

The latest efficiency of Algorand’s Total Value Locked (TVL) is strongly supported by its sturdy quantity exercise. The buying and selling quantity on the community noticed a surge, reaching 27.36 million on the eighth of December.

Data from DefiLlama reveals a major spike in Algorand’s community quantity, peaking at 2.33 billion ALGO in late November.

Source: DefiLlama

Although it has since retraced to roughly 788.44 million ALGO, the elevated ranges nonetheless signify heightened exercise on the community.

This aligns with the explosive TVL development recorded on platforms like Folks Finance. The development suggests elevated community engagement.

Additionally, knowledge from Santiment reveals a major spike in ALGO’s quantity, peaking at $2.33 billion ALGO throughout late November.

Although it has since retraced to roughly $788.44 million, the elevated ranges nonetheless signify heightened exercise on the community.

Source: Santiment

Is your portfolio inexperienced? Check out the ALGO Profit Calculator

The interaction between community and buying and selling volumes paints an image of heightened utility and curiosity in Algorand.

However, with each metrics pulling again from their latest highs, it stays to be seen if the community can maintain its latest momentum or if a correction is imminent.