- Altcoin season’s hypothetical timeline revealed {that a} true run larger could also be but to start

- Bitcoin would wish to develop a lot larger to maintain the type of altcoin seasons seen prior to now

With Bitcoin [BTC] preventing for management of the $100k-level, altcoins have had the time to pattern larger. This is a basic incidence although – In a bull run, each time BTC tendencies larger, most altcoin stand nonetheless and vice versa. It ties in nicely with the concept of capital rotation within the crypto market.

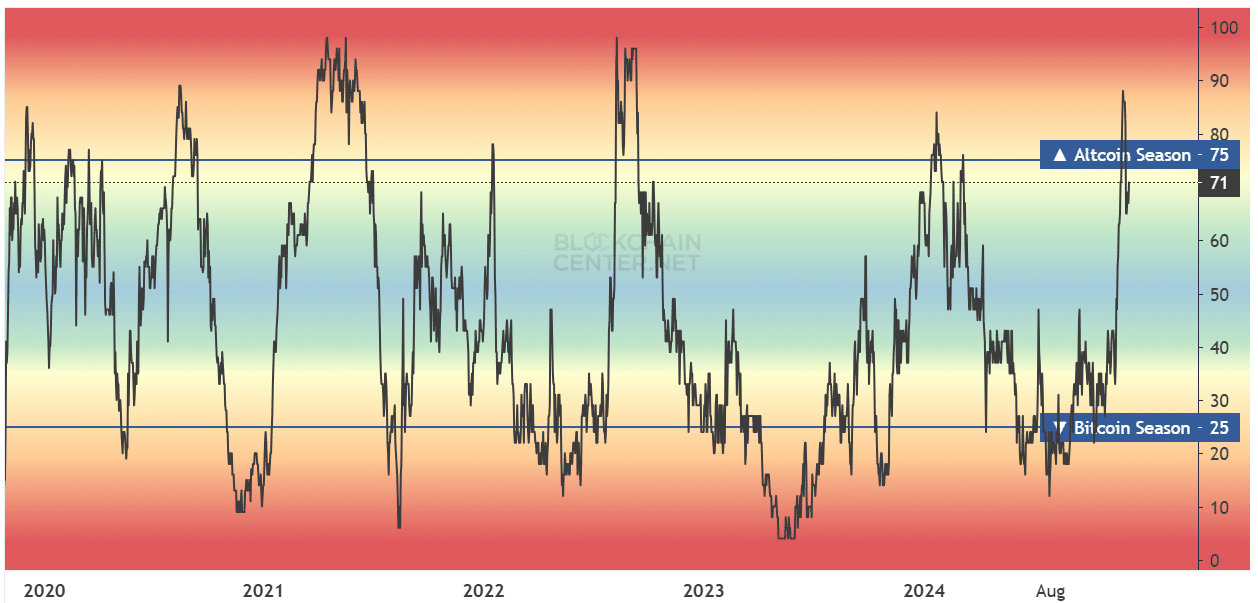

Source: Blockchain Center

The altcoin season index confirmed that it has been altcoin season for shut to 2 weeks now, however the studying had already receded to 71 at press time.

However, this doesn’t imply that the cycle is over and it’s time to promote – Far from it.

Altcoin season timeline, and the gas that might drive it

Source: CryptoQuant

Stablecoins are vital for the crypto ecosystem. They present a protected haven from volatility, present liquidity to the market, and allow DeFi actions. A hike in stablecoin flows to exchanges is bullish and an indication of heightened shopping for energy.

For instance- We can see the Tether [USDT] alternate reserves rocketed larger over the previous three months.

Source: CryptoQuant

Zooming in on the 2020-21 run, elevated alternate reserves of Tether, probably the most standard stablecoins, coincided with a full-blown altcoin season. Minting stablecoins and their switch from the treasury to centralized exchanges helps with liquidity and facilitating transactions, and is the ammunition for giant patrons.

The 2021 February leap in reserves was much like the previous two months, and it’s potential that the true altcoin season is but to reach. In the earlier cycle, it got here in May and November 2021. This time round too, we’d have to attend for Q2 and This autumn 2025 for jaw-dropping good points like final time.

Market capitalization targets for 2025

Source: TOTAL3 on TradingView

From its 2018 highs, the altcoin market cap (excluding Ethereum [ETH]) reached simply past the 223.6% extension degree at $1.12 trillion in 2021. Similarly, utilizing the 2021 run, AMBCrypto discovered that the 2025 goal on the 223.6% extension degree was $3.47 trillion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If the earlier cycle repeats itself, we are able to count on the altcoin market cap to achieve these ranges inside the subsequent ten months. It is feasible that after the tax season within the U.S. is over by April, any tax-related promoting would subside and individuals re-enter as patrons, driving costs up throughout early summer time.

“Sell in May, stroll away” is relevant to the crypto market as nicely. It is finest to not rely an excessive amount of on historic proof as totally different summers present totally different returns, however buyers ought to plan on promoting a portion of their holdings in May and November, whereas maintaining a tally of long-term value tendencies.