- On the bullish facet, the emergence of a head-and-shoulders sample factors to a possible upside.

- However, warning prevails resulting from a notable imbalance in lengthy liquidations over the previous 24 hours.

Despite a powerful 15.65% rally over the previous week, market exercise round Jupiter [JUP] has slowed. The asset slipped by 0.24% on the day by day chart, reflecting weak bearish strain but in addition elevating considerations about waning momentum.

For now, uncertainty dominates, with no clear indication of the place the asset is headed subsequent.

Bullish sentiment builds round JUP

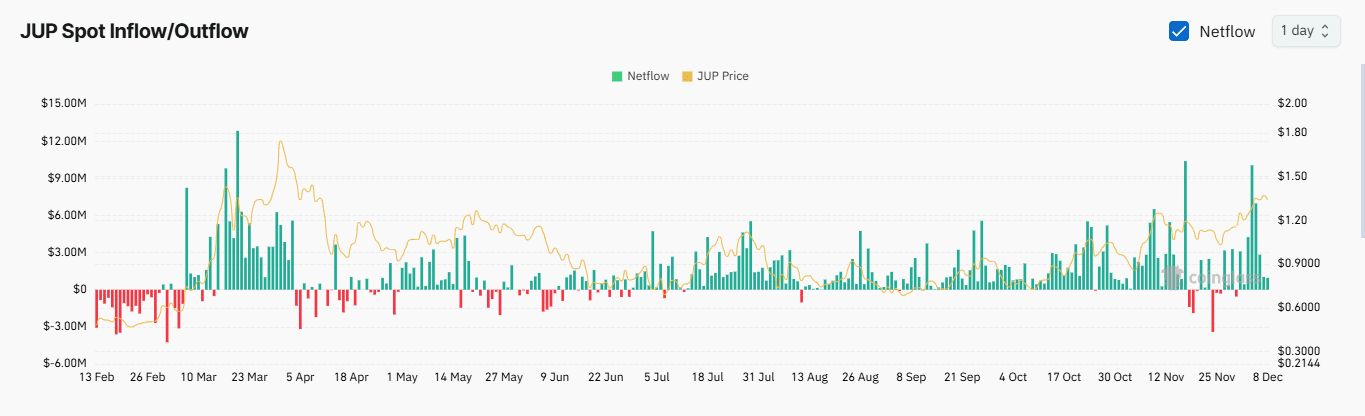

Bullish momentum seems to be forming round JUP, supported by declining Exchange Netflow and a gradual rise in Open Interest over latest days.

Exchange Netflow, which tracks shopping for and promoting exercise by measuring property moved on and off exchanges, gives perception into market sentiment.

Recent information signifies a lower in JUP deposits on exchanges, suggesting that market members are opting to carry relatively than promote. This habits strengthens JUP’s place by lowering its obtainable provide on exchanges.

Source: Coinglass

Meanwhile, Open Interest has elevated by 2.62% up to now 24 hours, reaching $169.02 million. This rise additional bolsters bullish sentiment, because it displays a rising variety of unsettled contracts, predominantly held by lengthy merchants.

Together, these elements counsel optimism available in the market, though broader tendencies should still form JUP’s trajectory.

JUP set to ascertain a brand new market excessive

JUP has damaged by means of the neckline of a basic cup-and-shoulders sample at $1.2663, a big resistance stage that would sign the beginning of a full-fledged rally.

If this sample performs out, JUP may climb a further 49.96%, reaching $1.90—surpassing its earlier all-time excessive of $1.85. This projected transfer aligns with the power of the sample displayed on the chart.

Source: Trading View

However, bearish sentiment persists available in the market and will delay JUP’s upward momentum.

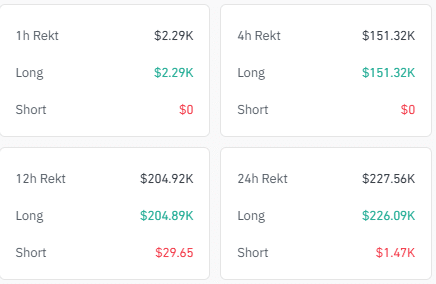

Imbalance in market liquidations

Over the previous 24 hours, there was a notable imbalance in market liquidations. At the time of writing, lengthy liquidations totaled $226,090, whereas quick liquidations have been considerably decrease, amounting to simply $1,470.

Source: Coinglass

Read Jupiter’s [JUP] Price Prediction 2024–2025

Such a disparity, the place lengthy and quick liquidations present a large hole, signifies that market sentiment is skewed towards one facet. In this case, sentiment favors the bears.

If this development persists, the market is prone to proceed transferring downward until stronger bullish forces emerge to counteract it.