The capital market surged previous the 108,000-point milestone on Thursday, propelled by a shopping for frenzy, mounting expectations of a major rate of interest minimize within the State Bank of Pakistan’s (SBP) upcoming financial coverage assembly on December 16, alongside record-low inflation and enhancing financial fundamentals.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Shares Index climbed 3,134.63 factors, or 2.98%, to shut at 108,238.96 factors, after hitting an intraday excessive of 108,345.98 factors.

“Strong liquidity, steady macro indicators, anticipated charge minimize in December’s MPC, and perceived low political threat are all driving the market,” mentioned Muhammad Saad Ali, Director of Research at Intermarket Securities Ltd. “Stock-specific information can also be serving to the bullish sentiment,” he added.

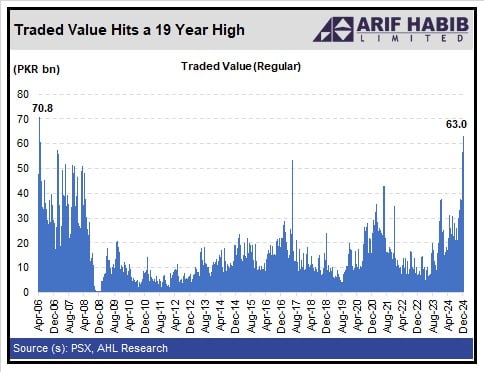

The PSX added one other milestone by attaining its highest market exercise in almost 19 years, with a traded worth of Rs63 billion ($227 million). This marks the very best exercise within the common market since April 17, 2006, underscoring the energy of investor curiosity and liquidity.

Finance Minister Mohammad Aurangzeb reaffirmed the federal government’s dedication to financial stabilisation by structural reforms and adherence to the International Monetary Fund (IMF) programme.

Speaking at an occasion in Islamabad, Aurangzeb highlighted that the present account deficit has narrowed, inflation has dropped to a 70-month low, and the nation’s financial system is exhibiting indicators of restoration.

The Ministry of Finance additionally reported improved monetary stability, attributing it to ongoing reforms.

As inflation continues to plummet expectations are rising for additional financial easing, signalling a brighter financial outlook.

The SBP has already slashed rates of interest by 700 foundation factors (bps) throughout 4 consecutive conferences since June, bringing the speed to fifteen%. Experts broadly anticipate one other vital discount, with most analysts predicting a minimize of a minimum of 200 bps.

A ballot performed by Topline Securities revealed that 71% of respondents anticipate a minimal discount of 200 bps, with 63% forecasting precisely 200 bps, 30% anticipating 250 bps, and seven% anticipating a bigger minimize.

The case for financial easing is supported by November’s Consumer Price Index (CPI) inflation, which clocked in at 4.9%—its lowest in 78 months and properly under the SBP’s goal vary of 5-7%.

“This studying locations inflation considerably under the goal, leaving substantial room for additional charge cuts,” Topline Securities famous.

The decline in inflation is attributed to quicker meals disinflation and adverse electrical energy value changes. Analysts predict inflation will stay in single digits within the coming months, sustaining a positive setting for financial easing.

The commerce information launched by the Pakistan Bureau of Statistics (PBS) has additional bolstered market sentiment. Pakistan’s commerce deficit narrowed by 7.39% throughout the first 5 months (July-November) of the present fiscal yr, standing at $8.651 billion in comparison with $9.341 billion throughout the identical interval final yr.

Exports rose by 12.57% to $13.69 billion, whereas imports elevated by 3.90% to $22.342 billion. November’s commerce deficit narrowed even additional, dropping 18.60% year-on-year to $1.589 billion in comparison with $1.952 billion in November 2023.

Thursday’s rally follows a formidable session on Wednesday, when the KSE-100 Shares Index climbed 545.26 factors, or 0.52%, to shut at 105,104.33 factors after reaching an intra-day excessive of 105,473.56 factors