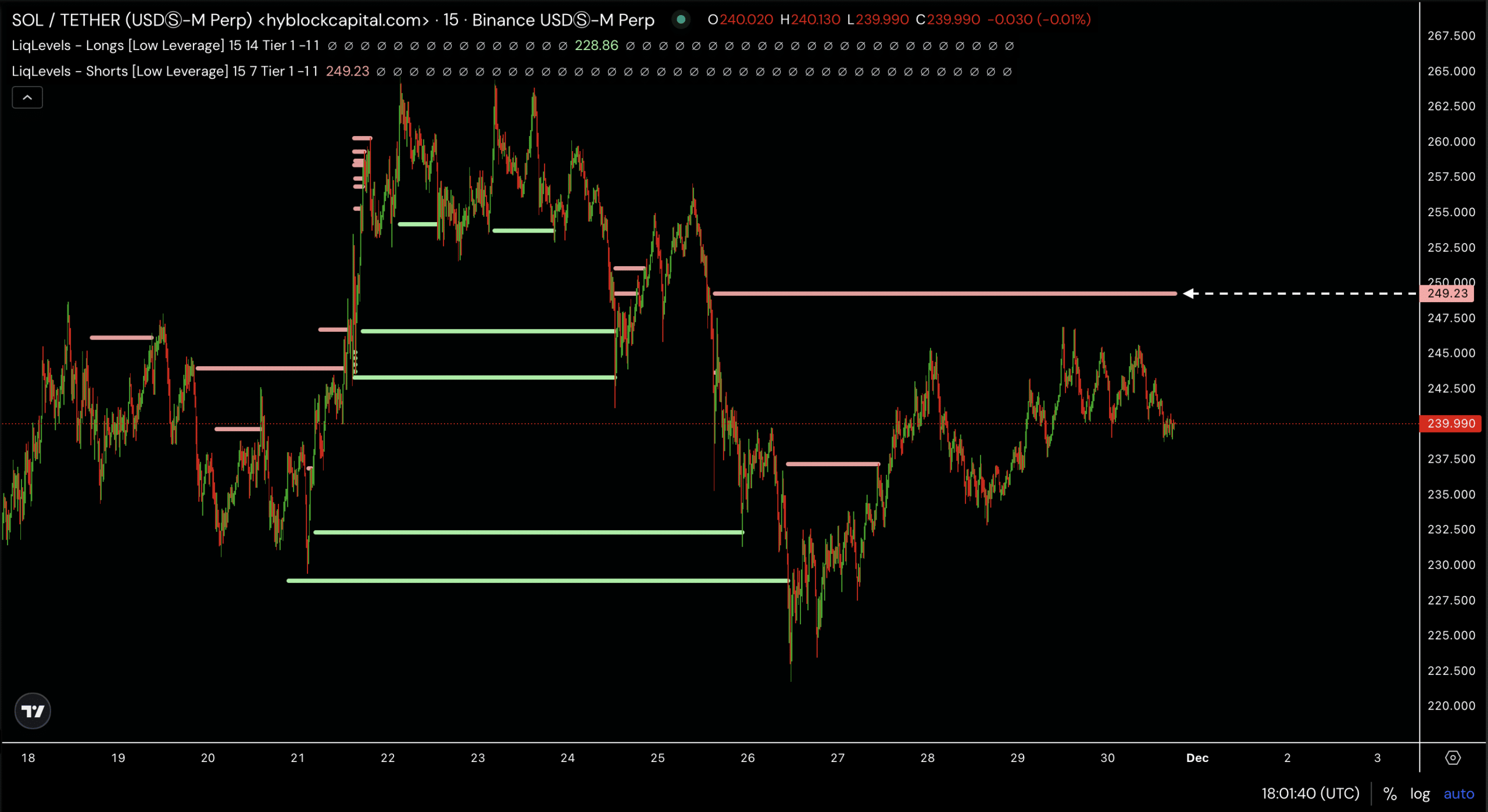

- Analysis from Hyblock highlighted $249 as a crucial stage for a possible upward transfer.

- Yet, some merchants are positioning for a rally, whereas others are betting on additional declines.

The weekend introduced uneven worth motion for Solana [SOL]. Following a 7.22% drop over the previous week, the token slid one other 3.22% within the final 24 hours, settling at $235.

The current downturn pointed to indicators of fatigue out there. Buyers appeared to be stepping again, awaiting clearer alerts.

While some see the pullback as a routine correction, others warn it might mark the start of a deeper slide.

SOL clears low leverage liquidity, eyes key goal

According to Hyblock, SOL seemed to be navigating a low-leverage liquidity section as its worth trended decrease on the charts.

This habits usually means that SOL is clearing out low-leverage liquidity ranges, probably setting the stage for an upward transfer.

If this situation performs out, Hyblock’s chart signifies the subsequent key goal for SOL lies above $249, the place a big liquidity cluster might gas a worth rally.

Source: X

However, the outlook stays unsure. Various market metrics are sending combined alerts—some pointing to additional draw back, whereas others recommend that SOL could also be primed for a rebound.

Market sees heavy promoting—Is this a retracement?

On-chain metrics revealed a surge in promoting exercise, as worth and buying and selling quantity decline. Volume has dropped by 9.75%, now sitting at $3.72 billion.

Coinglass’s Long-to-Short Liquidation mannequin indicated a bearish tilt within the derivatives market. The long-to-short ratio stood at 0.8681, effectively under 1, signaling that brief (promote) contracts considerably outnumbered lengthy (purchase) contracts.

The farther this ratio strikes under 1, the extra dominant brief positions grow to be.

Source: Coinglass

This sentiment is mirrored in liquidation knowledge over the previous 24 hours. Long positions value $6.4 million have been liquidated, in comparison with simply $348,600 briefly liquidations.

The stark disparity highlighted a market favoring draw back momentum.

Given these dynamics, SOL stays prone to additional declines, as bearish sentiment seems to outweigh any indicators of a possible restoration.

Bulls present indicators of life amid market volatility

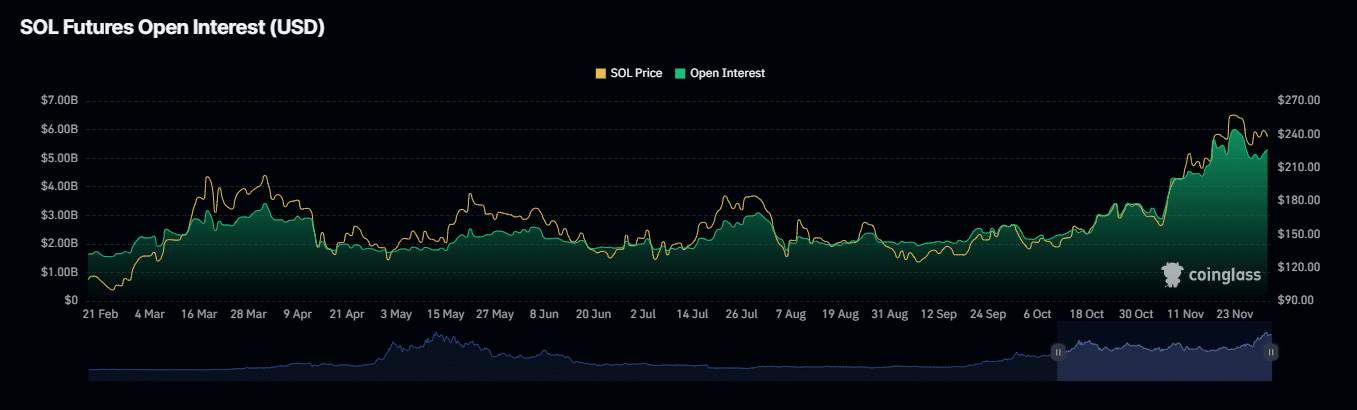

Despite current bearish sentiment, bullish exercise has surfaced, marked by a 2.89% enhance in Open Interest, bringing its complete worth to $5.28 billion.

Open Interest measures the quantity of unsettled spinoff contracts out there. An uptick usually alerts renewed dealer confidence and hints at a market primed for a rally.

Source: Coinglass

Read Solana’s [SOL] Price Prediction 2024–2025

Additionally, Exchange Netflow knowledge revealed a shift favoring bulls, with vital liquidity—primarily SOL—shifting from exchanges to personal wallets.

This outflow creates a possible provide squeeze, including upward stress to costs and growing the probability of a rally, and the drop being a retracement.