- Wormhole broke free from a descending channel, surging 11.45% with excessive buying and selling quantity.

- Mixed on-chain indicators and overbought situations recommended short-term pullback regardless of bullish momentum.

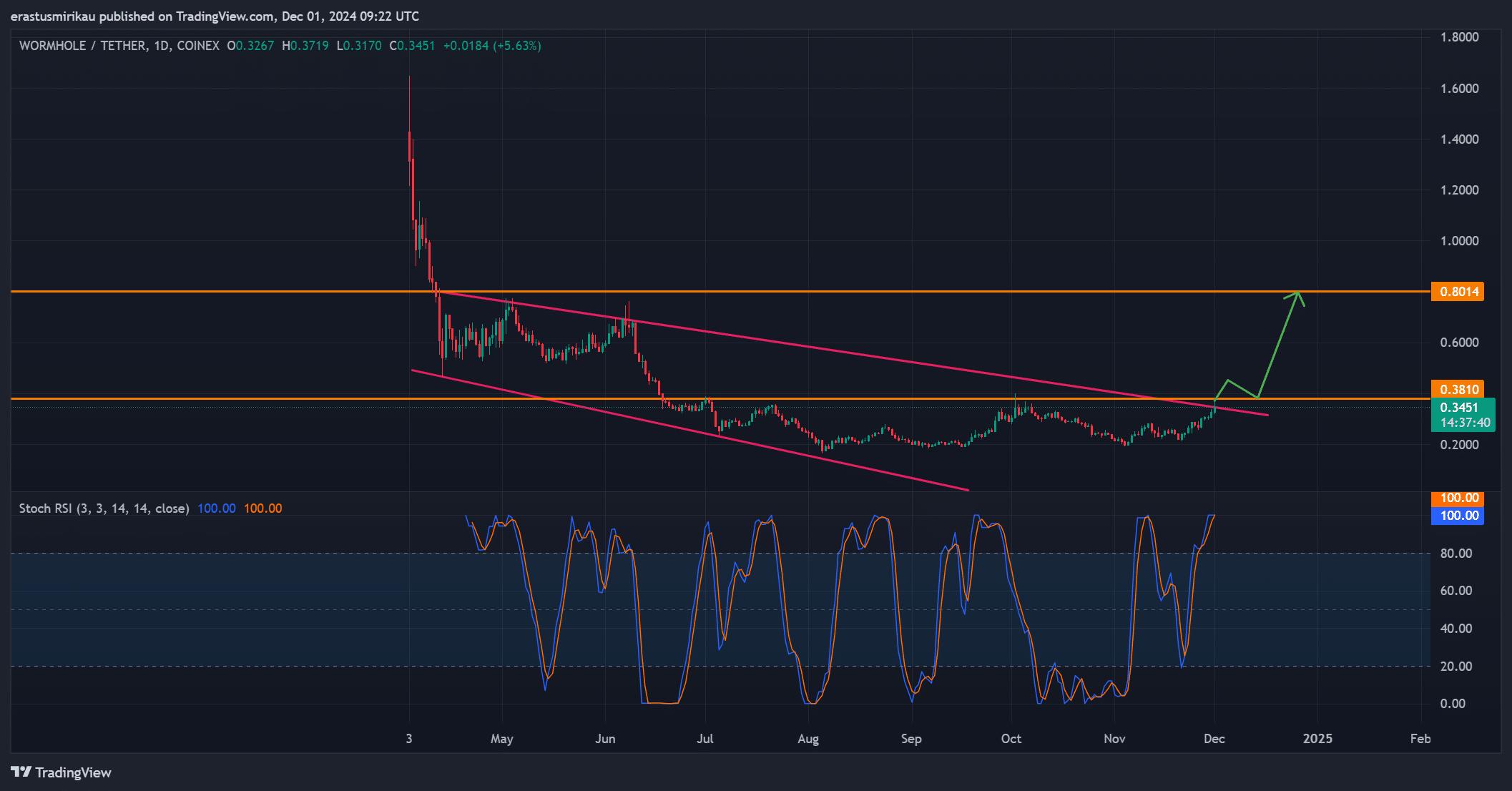

Wormhole [W] has skilled a major worth surge of 11.45% up to now 24 hours, climbing to $0.35 at press time after breaking out of its extended downtrend.

This worth motion comes after months of consolidation, because the token lastly broke free from a long-standing descending channel.

The enhance in buying and selling quantity—up 112% to $275.74M—indicated a shift in market dynamics, with merchants reacting to the breakout.

As Wormhole approaches its key resistance at $0.38, the worth motion will decide whether or not this rally could be sustained or if it faces an imminent correction.

Breakout or short-term spike?

Wormhole’s breakout from its extended descending channel is a major growth, suggesting a change in market sentiment.

The token was dealing with essential resistance at $0.38 at press time, a degree that might dictate whether or not the rally continues.

A profitable breakout above $0.38 might push W in the direction of $0.80, however the Stochastic RSI, at 100 at press time, recommended that the token was in overbought territory.

This raises issues a few potential short-term pullback earlier than any additional worth motion unfolds. Therefore, whereas the breakout is optimistic, warning is warranted.

Source: TradingView

Wormhole social quantity: Fading curiosity or short-term dip?

Wormhole’s social quantity dropped sharply, closing at 111 the day gone by however falling to 34 at press time. This decline indicators weakening public curiosity, which might restrict the upside potential.

However, the day isn’t over, and if the worth breaks by the $0.38 resistance, social engagement might choose up once more. Consequently, retail curiosity might return, probably driving new shopping for strain.

Source: Santiment

Bearish on-chain indicators level to potential promoting strain

On-chain metrics painted a blended image. Net community development has dropped 2.56%, indicating a bearish pattern in general exercise.

Additionally, the focus metric exhibits a slight decline of -0.11%, suggesting that bigger holders is perhaps promoting. Large transactions have additionally fallen by 9.90%, pointing to potential profit-taking.

However, the “Into the Money” metric stays impartial at 0.30%, that means no robust accumulation or distribution is at present occurring.

Source: IntoTheBlock

Is market confidence constructing?

One optimistic signal is the 29.04% enhance in Open Interest, which stood at $80.33M at press time. This indicated rising confidence amongst merchants that the breakout might be sustained.

Open Interest often displays market sentiment, and this rise exhibits that extra merchants are betting on Wormhole’s continued worth motion.

However, overbought situations and bearish on-chain indicators counsel that warning remains to be crucial.

Source: Coinglass

Is your portfolio inexperienced? Check out the W Profit Calculator

Conclusion: Will Wormhole’s breakout result in a sustained rally?

Wormhole’s breakout to $0.35 is promising, however important challenges stay. The $0.38 resistance is essential, and whereas Open Interest is rising, the overbought situations and bearish on-chain indicators point out a possible pullback.

Investors ought to look ahead to worth motion at $0.38 to find out if the rally will proceed or stall.