- XRP surged 6% and surpassed the $107B market cap, primarily pushed by whale accumulation.

- There was key resistance at $2.00, with potential for a short-term pullback.

XRP has made waves immediately, surging 6% and surpassing the $107 billion market cap, reigniting investor curiosity and elevating questions on its future trajectory.

With this dramatic rise, many are left questioning: Is XRP on the cusp of a serious bull run, or are we merely witnessing one other fleeting value surge?

Breaking down XRP’s value surge

XRP’s newest surge, gaining 6% in each day efficiency, marks a continuation of its explosive momentum, with its market cap hovering previous $107 billion.

The dramatic uptick displays heightened buying and selling quantity and intensified investor confidence and aligns with a broader market rally and up to date authorized readability from the Ripple-SEC case, seemingly fueling bullish sentiment.

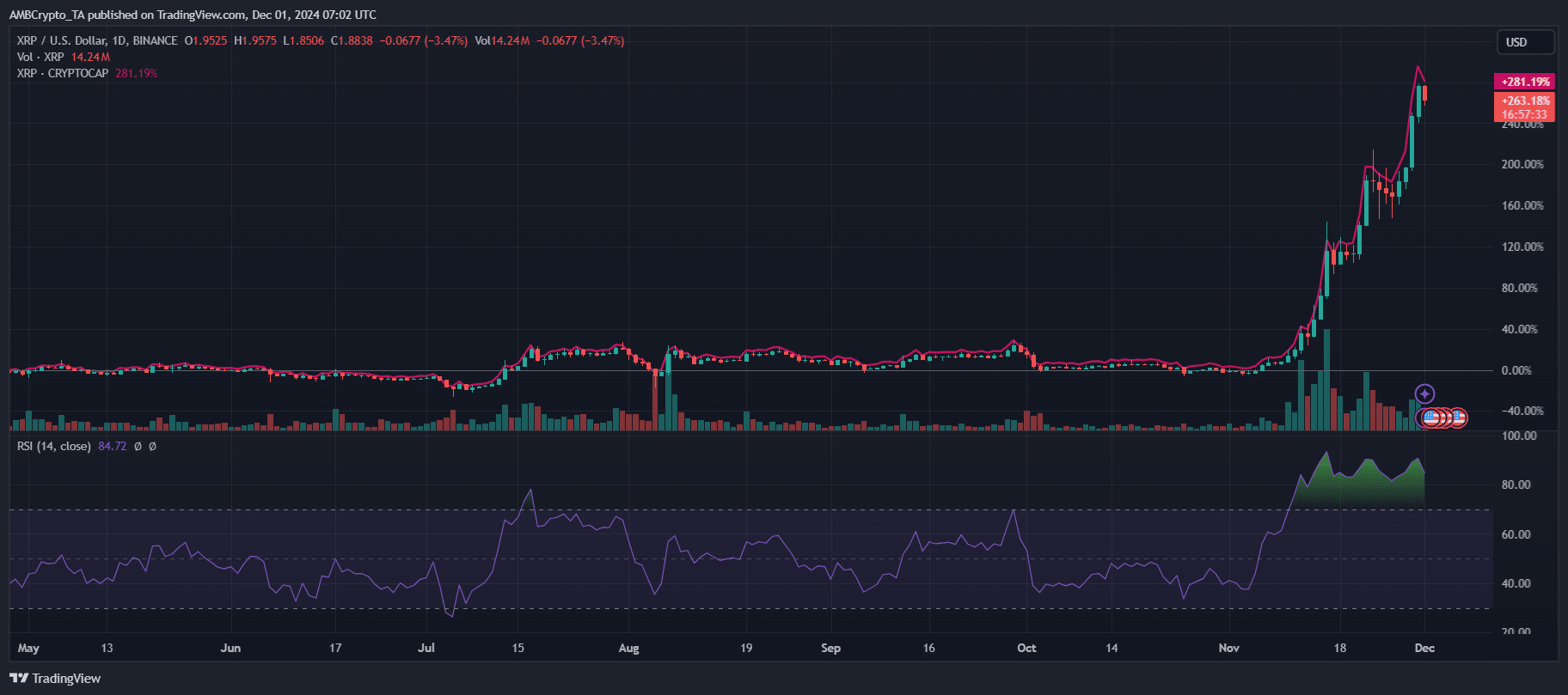

Source: TradingView

Additionally, the spike in quantity and sustained value progress above $1.85 prompt vital whale accumulation and aggressive market participation.

Technical indicators highlighted resistance close to $2.00, a important psychological and structural stage.

The query now stays whether or not XRP can maintain its upward trajectory or succumb to profit-taking amid the elevated RSI and market euphoria.

Short-term momentum or long-term rally?

Source: TradingView

The RSI of 84.49 alerts overbought situations, suggesting a possible short-term pullback as the worth exams resistance close to $2.

Despite this, the OBV has climbed to 9.85 billion, reflecting sturdy accumulation and sustained bullish curiosity.

Historically, elevated RSI ranges typically precede profit-taking, but continued OBV progress may point out that institutional patrons and whales are anchoring the rally.

Key assist lies close to $1.75, a stage that aligns with current breakout zones, whereas $2.00 stays a psychological and technical barrier.

The divergence between rising quantity and stretched momentum metrics implies a tug-of-war between bullish euphoria and consolidation dangers.

Whether XRP sustains its present trajectory hinges on its capacity to draw recent liquidity whereas navigating overextended situations.

Source: CoinMarketCap

XRP has traditionally demonstrated explosive progress throughout earlier bull runs, reminiscent of in 2017, when its worth skyrocketed by over 36,000%.

Similarly, in late 2021, XRP skilled one other vital surge, fueled by rising adoption and market hypothesis.

The present momentum exhibits placing parallels to those earlier patterns, with rising buying and selling volumes and renewed investor confidence.

However, in contrast to previous cycles, regulatory readability and adoption of XRP’s utility in cross-border funds may play a pivotal position in sustaining this rally.

Possible catalysts behind XRP’s current surge

The ongoing rally might be attributed to a number of components. Regulatory readability from Ripple’s current authorized victories has revitalized institutional confidence, whereas partnerships in cross-border fee sectors spotlight XRP’s utility.

Increased whale exercise, as indicated by rising OBV ranges, alerts vital accumulation. Broader market sentiment, buoyed by Bitcoin’s energy and altcoin rallies, has amplified bullish momentum.

Read XRP’s Price Prediction 2024–2025

Additionally, the nearing implementation of recent liquidity corridors for RippleWeb and rising traction in Asia-Pacific markets seemingly contributed to the surge.

Together, these components place XRP as a standout performer, doubtlessly paving the way in which for sustained progress in a quickly evolving market panorama.